[co-author: Yingshi Pan]

As ESG regulation in Asia develops at an increasing pace, Latham lawyers give an update on noteworthy developments across the region covering the second half of the year.

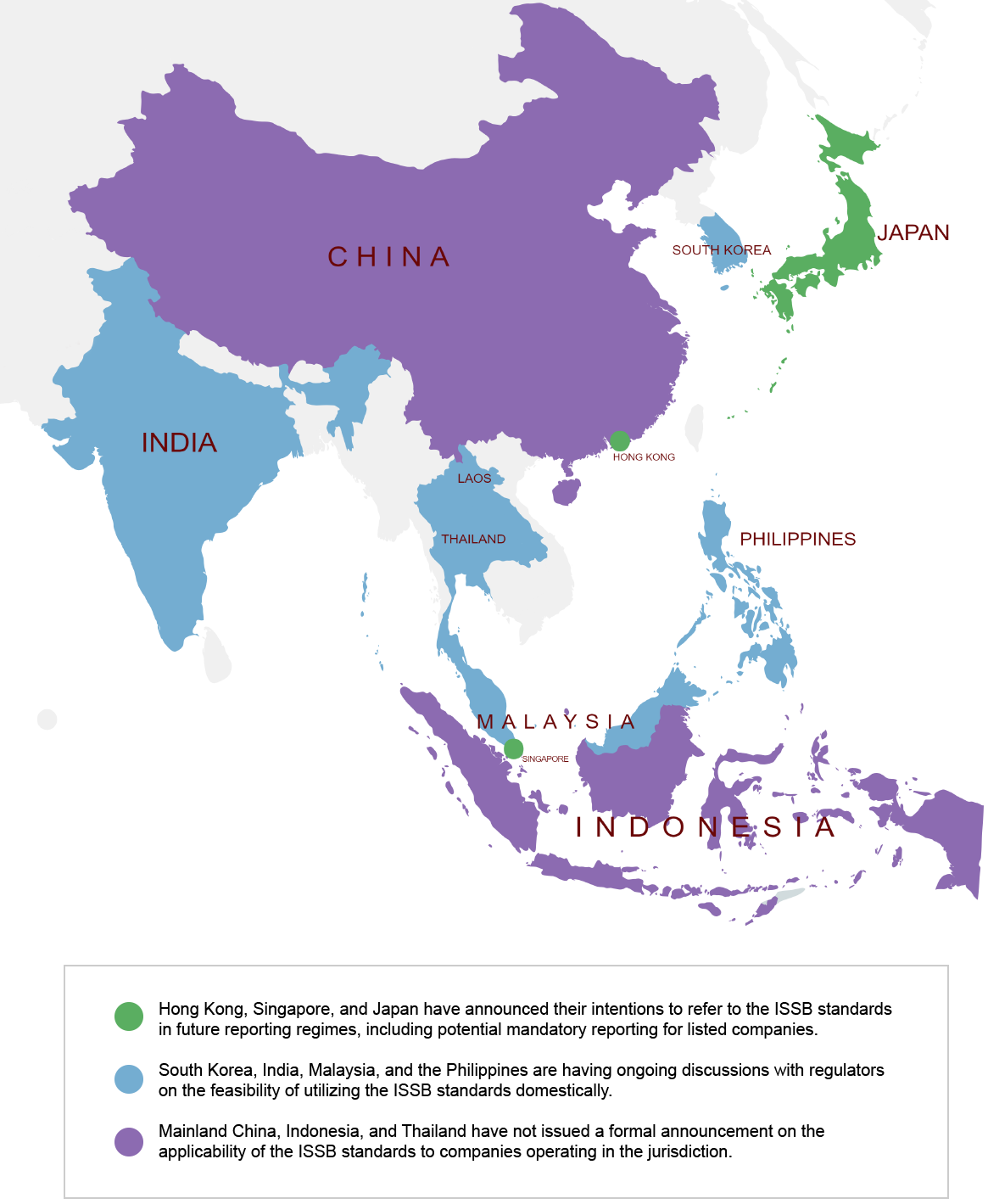

ISSB Status Update

In June 2023, the International Sustainability Standards Board (ISSB) released its inaugural sustainability disclosure standards, published by the International Financial Reporting Standards (IFRS). The ISSB standards are designed to facilitate the disclosure of sustainability-related information alongside companies’ financial information.

The ISSB standards are also expected to significantly influence sustainability reporting requirements in many jurisdictions — and may even become mandatory. A number of regulators across Asia have expressed their support for the standards, with some announcing their intentions to utilize the standards going forward.

How Different Jurisdictions Are Responding to the ISSB Standards*

*As of November 2023. Created with MapChart.

- Hong Kong — As discussed in the Hong Kong section below, the Green and Sustainable Finance Cross-Agency Steering Group has announced a roadmap for planned alignment with the ISSB standards. In addition, the Hong Kong Exchanges and Clearing Limited (HKEX) is exploring ISSB-aligned reporting for issuers.

- Singapore — The Accounting and Corporate Regulatory Authority and Singapore Exchange Regulation launched a public consultation in July 2023 on recommendations that would require listed issuers to report ISSB-aligned, climate-related disclosures starting from financial year 2025, with large non-listed companies to follow suit in financial year 2027.

- Japan — The Financial Services Agency publicized a press release issued by the IFRS Foundation Monitoring Board welcoming the finalization of the ISSB standards. Japan plans to issue its draft sustainability disclosure standards, which will be consistent with the ISSB’s framework, by March 31, 2024, and to finalize these standards by March 31, 2025. These disclosure rules are expected to apply to all listed companies in Japan.

- South Korea — The Korea Accounting Institute and the Korea Sustainability Standards Board are assessing the feasibility of adopting the ISSB standards domestically. As discussed in the South Korea section below, the Financial Services Commission (FSC) recently delayed the implementation of ESG disclosure rules for listed issuers. The FSC is expected to largely draw upon the ISSB standards, having previously committed to align with major international standards.

- India — The Institute of Chartered Accountants of India (ICAI) is actively considering global reporting developments and has already converged to the IFRS. The ICAI, along with other regulators, is expected to vet the ISSB requirements for local applicability before deciding on implementation for corporates in India.

- Malaysia — The Deputy Chief Executive of the Securities Commission Malaysia stated during a session on the ISSB exposure drafts that “discussions on the proposed standards are already underway between the Securities Commission, Bank Negara Malaysia, Bursa Malaysia and the MASB [Malaysian Accounting Standards Board].”

- Philippines — The Financial and Sustainability Reporting Standards Council (FSRSC) established the Philippine Sustainability Reporting Committee (PSRC) in 2022. The PSRC’s main purpose is to evaluate the ISSB standards for local use, and then issue local interpretations and guidance.

- Mainland China — The People’s Republic of China (PRC) has not made any announcements regarding potential ISSB implementation, although market participants have noted that the standards are likely to serve as a benchmark for the PRC’s ESG disclosure standards in the future.

- Indonesia — The Institute of Indonesia Chartered Accountants has shared its support for the ISSB standards in a comment letter but has made no formal announcement on potential implementation.

- Thailand — Thailand has not made any announcements regarding potential implementation of the ISSB standards.

Considering the positive feedback from a number of regulators across the region, the voluntary ISSB standards may continue to be integrated into local sustainability requirements in various jurisdictions.

For more information on the ISSB standards, see this Latham Client Alert.

HONG KONG

SEHK Postpones Implementation of Enhanced Climate Disclosure Under Listing Rules

The SEHK announced in November 2023 that the implementation date of the Listing Rules amendments on the enhanced climate-related disclosures will be postponed to January 1, 2025, having previously been planned for January 1, 2024. When finalizing the Listing Rule amendments, the HKEX intends to consider the recommended approaches on the scaling and phasing-in of requirements available under the ISSB adoption guide, which is expected to be released by the ISSB before the end of 2023.

In April 2023, the Stock Exchange of Hong Kong (SEHK) published a consultation paper seeking market feedback on proposals to enhance climate-related disclosures under its ESG framework, with a proposed implementation date of January 1, 2024. The consultation period ended in July 2023, but the consultation conclusion is yet to be released.

For more information on the proposed enhanced ESG disclosures, see the August 2023 edition of this newsletter.

For further details, see the consultation update.

Steering Group Announces Priorities to Strengthen Hong Kong’s Sustainable Finance Ecosystem

The Green and Sustainable Finance Cross-Agency Steering Group (Steering Group) announced in August 2023 its key priorities to further promote and consolidate Hong Kong’s role as a leading sustainable finance hub.

Such priorities include:

- establishing world-class regulation through alignment with the ISSB standards;

- boosting Hong Kong’s vibrancy and competitiveness through capacity building, data enhancement, and technology innovation of the finance ecosystem to support net zero transition across the economy; and

- growing dynamic, trusted markets with diverse products to mobilize capital at a larger scale to support the net zero transition.

To achieve this, the Steering Group will provide support to non-listed companies and small- and medium-sized enterprises (SMEs) in their sustainability planning and reporting, as well as their broader usage of available data sources and tools. It will also explore opportunities for public-private partnerships to promote the development of technology-driven solutions.

According to reports, a dedicated workstream would explore ways to further support financial institutions and corporates in their transition planning and reporting. Meanwhile, the Steering Group is extending its efforts to build Hong Kong into an international carbon market to connect opportunities across the mainland, other parts of Asia, and the rest of the world.

For further details, see the Hong Kong Monetary Authority’s press release.

MAINLAND CHINA

China Relaunches Its Carbon Credits Program

On October 19, 2023, the Ministry of Ecology and Environment and the State Administration for Market Regulation jointly released the trial Measure for the Administration of Voluntary Emission Reduction Trading (the New Measure).

The New Measure came into effect on the same date of its formal release. It replaced the previous set of rules and became the governing law of China’s carbon credits program (known as the CCER scheme), which had been suspended for over six years.

Together with the national emissions trading scheme launched two years ago, the CCER scheme represents China’s continuing efforts to adopt market-based mechanisms for achieving its climate commitments (peaking emissions before 2030 and reaching carbon neutrality before 2060).

For more information, see this Latham blog post.

SASAC Publishes Guidance on ESG Disclosure for SASAC-Owned Public Companies

As of June 2023, a total of 1,738 A-share listed companies have independently disclosed ESG or social responsibility reports, according to the “ESG Action Report of Chinese Listed Companies (2022-2023),” which was jointly published by the National Business Daily and the Central University of Finance and Economics. Among those reports, over 50% of the listed state-owned enterprises (SOEs) at central and local levels had made ESG-related disclosure.

In July 2023, the General Office of the State-owned Assets Supervision and Administration Commission (SASAC) issued the “Notice on Research on the Preparation of ESG Special Reports of Listed Companies Controlled by Central Enterprises” to central SOEs and local state-owned assets supervision and administration bureaus, so as to provide more guidance on ESG disclosure by SOEs. The notice includes guidance to SOEs on KPI selections and ESG report templates.

At the second Sustainable Investment and Financing and Free Trade Port Construction Forum in September 2023, the Deputy Director of the Listing Department of the China Securities Regulatory Commission (CSRC) indicated that the CSRC is dedicated to building up the policy structure and related practices of sustainable development disclosure of listed companies. Given what the CSRC sees as the general conditions of China, the CSRC says it plans to start with voluntary disclosure by the listed companies, which should conform with certain minimum regulatory requirements.

How Could the EU’s Carbon Border Adjustment Mechanism Impact China?

The EU’s Carbon Border Adjustment Mechanism (CBAM), part of the “Fit for 55” package, aims to reduce greenhouse gas emissions by 55% by 2030. The CBAM will enable the EU to impose a carbon border tax on specific imports, with the aim of ensuring that the price of carbon imports is equivalent to the carbon price of domestic production. The introduction of the CBAM will therefore directly impact businesses trading into the EU in the sectors covered by the CBAM, including cement, iron and steel, aluminum, fertilizers, electricity, and hydrogen.

The CBAM aims to put a fair price on the carbon emitted during the production of certain carbon-intensive goods entering the EU, and also to encourage cleaner industrial production in non-EU countries. As a major exporter to the EU, China will be significantly impacted by the CBAM. The introduction of the CBAM will potentially encourage the Chinese government to implement policies requiring industries to match EU standards. Following the transitional phase, the scheme will enter a full implementation phase from January 1, 2026.

From an immediate trade perspective, the CBAM may not have a significant impact on Chinese goods, with exports of CBAM-covered products accounting for a minimal proportion of total exports to the EU. However, the implementation will impact export-oriented manufactures. The CBAM covers both direct and indirect emissions, so manufacturers will, for example, need to consider methods to improve energy efficiency and use lower-carbon fuels. To further prepare for the implementation of the CBAM, affected industries may need to enhance their capabilities for managing carbon-related affairs to remain competitive.

For more information on the CBAM and the transitional phase of requirements, which runs until December 31, 2025, see this Latham blog post.

SOUTH KOREA

A number of recent publications and updates cover a range of sustainability topics.

ESG Disclosures

Implementation of ESG Disclosure Rules Postponed

In October 2023, the Financial Services Commission (FSC) announced that South Korea will postpone the implementation of ESG disclosure rules for listed firms from 2025 to 2026 or later, aiming to grant a sufficient preparatory window to domestic companies.

The FSC’s decision to defer the implementation beyond 2026 is underpinned by a commitment to align with international standards; specifically, the FSC is expected to draw upon the ISSB standards.

Corporate Governance

FSC Publishes Revised Guidelines on Corporate Governance Disclosure

In October 2023, the FSC announced the “Revision of Corporate Governance Report Guidelines.” This revision follows the gradual expansion of the scope of corporate governance disclosures, first introduced by the Korea Exchange in 2017. According to the FSC, the revised guidelines “incorporate the needs of market participants, demands from companies for revisions, and reorganization of the reporting system.” The guidelines will improve disclosures in a number of areas, including dividends, shareholder communications, board diversity, and remuneration.

Social Topics

Proposed Bill on Human Rights and Environmental Protection for Corporate Sustainable Management

On September 1, 2023, the Democratic Party of South Korea proposed a Bill on Human Rights and Environmental Protection for Sustainable Business Management in order to oblige companies to conduct annual human rights and environmental due diligence on their supply chains.

The proposal cites recent legislative developments in the EU as evidence of an “international movement” to introduce non-financial performance indicators into management to promote the aim of corporate social responsibility and sustainability. The Bill is still at an early stage, and market participants will likely closely monitor the progress of the proposed legislation.

Greenwashing

Ministry of Environment Publishes Guidelines on Green Advertising

In October 2023, the Department of Green Industry Innovation published guidelines covering green advertising, with the aim of ensuring that companies display or advertise their “green” activities correctly.

Financial Supervisory Service Publishes Disclosure Standards for ESG Funds

In October 2023, the Financial Supervisory Service released disclosure standards for ESG funds. The standards require funds that include “ESG” in the fund name, or ESG in their investment objectives in strategies, to disclose information aimed to improve transparency for investors and reduce the risk of greenwashing by asset managers. The standards apply to both existing and new funds and are expected to be implemented from February 2024.

INDIA

India’s Pioneering Regulation of ESG Ratings Providers

In January 2022, India’s market regulator, the Securities and Exchange Board of India (SEBI), was the first organization to launch a consultation to formerly regulate ESG ratings. This initial consultation began three months after the International Organization of Securities Commissions (IOSCO) published a report and set of recommendations in relation to ESG ratings providers, which urged regulators to focus more attention on these entities. For more information on the initial consultation, see this Latham blog post.

Following the consultation, in July 2023, SEBI introduced a framework for regulating ESG ratings providers (ERPs). The framework will require ERPs to seek registration with SEBI prior to commencing business. Further, ERPs must establish an adequate framework to ensure transparency, and openly publish ratings methodology on their website.

As ESG issues have become an increasingly prominent aspect of investment decisions, the role of providers of ESG ratings and scoring services has grown in importance. India has become one of the few jurisdictions to regulate ERPs.

This development follows ongoing discourse over the impact and importance of ESG ratings, with regulators and politicians focusing on the accuracy and potential for conflicts of interest (among other issues), and aiming to pave the way for further potential regulation seeking to mitigate issues of greenwashing through improved transparency.

SINGAPORE

MAS Launches Singapore-Asia Taxonomy for Sustainable Finance

On December 3, 2023, the Monetary Authority of Singapore (MAS) unveiled the Singapore-Asia Taxonomy for Sustainable Finance (Taxonomy) at the United Nations COP28 climate conference in Dubai. The Taxonomy sets out detailed thresholds and criteria for defining green and transition activities that contribute to climate change mitigation across eight focus sectors: energy, industrial, carbon capture and sequestration, agriculture and forestry, construction and real estate, waste and circular economy, information and communications technology, and transportation.

The Taxonomy utilizes a “transition” category, acknowledging the unique challenges and needs of Asia’s shift toward a net zero economy amid economic growth and increasing energy demands. This initiative is designed to mitigate the risk of greenwashing and ensure that financed activities are on a credible path to net zero emissions.

The Taxonomy also provides a hybrid framework to phase out coal-fired power plants at both a facility and entity level, which MAS considers a “critical part of the energy transition in the Asia-Pacific region, where coal accounts for almost 60% of power generation.”

The Taxonomy builds upon feedback received from the previous rounds of consultation. For details of the final consultation, see this Latham blog post. MAS has noted that the Taxonomy will be reviewed periodically to keep pace with emerging science and technology improvements.

MAS and McKinsey Publish Working Paper on Transition Planning for Coal-Fired Power Plants

In September 2023, MAS and McKinsey & Company jointly published a working paper setting out how high-integrity carbon credits can be utilized as a complementary financing instrument to accelerate and scale the early retirement of coal-fired power plants (CFPPs). The paper explores the conditions for generating such carbon credits, and identifies what is needed to develop a high-integrity credit market.

The paper acknowledges that the managed phase-out of CFPPs is critical for Asia’s energy transition and that the phase-out must take place alongside the development of clean energy sources. In the absence of mandatory managed phase-out requirements, stakeholders of CFPPs have little motivation to shorten their existing power purchase agreements (PPAs). Notwithstanding existing efforts to finance the early retirement of CFPPs, the large and young fleet of CFPPs in Asia means that additional financing mechanisms are needed to improve the economic viability of such transactions and to access significant private capital at scale.

To address this, the paper explores the use of high-integrity carbon credits to reduce the economic gap for early retirement of CFPPs. It considers the possible generation of “transition credits,” arising from the emissions reduced through retiring a CFPP early and replacing it with cleaner energy sources. The paper identifies that the key elements of this approach are:

- Quantifying the economic gap: To retire a CFPP early, quantifying the economic gap as well as the financing needed is important for the viability of the transaction. For example, the economic gap to retire a CFPP with a 1 gigawatt (GW) capacity five years earlier will be US$70 million per GW. The financing in this example is estimated at US$310 million per GW.

- Leveraging transition credits: The revenues from the sale of transition credits could reduce the economic gap from retiring a CFPP early. These credits must be of high integrity, which includes alignment to the Core Carbon Principles set out by the Integrity Council for the Voluntary Carbon Market. The paper does not attempt to develop a new carbon credit methodology for the early phase-out of CFPPs. It makes clear that such a methodology should include commitments by the host jurisdiction not to build new CFPPs, and provide for the accurate measurement and monitoring of actual emissions reduced.

- Mitigating key transaction risks: The long-term horizon of such transactions creates risks and uncertainties, as transition credits will only be issued much later, when the emissions reductions are verified. A combination of different undertakings could enable greater market adoption of this new form of credits. These include the relevant government’s agreement to enforce CFPP closures, or insurance solutions to mitigate political risk that could lead to delays in the generation of carbon credits.

- Just transition: Decision-makers must assess and implement measures to mitigate potential harm to livelihoods and communities arising from the early retirement of CFPPs. This includes accounting for such costs in the financing of early CFPP retirement.

MAS and McKinsey have also proposed a template that provides detailed steps and sample tools for market participants to assess and execute such transactions. This includes a cashflow model to compute the economic gap that could potentially be covered by transition credits and a list of standardized documents required to execute such a transaction.

MAS is inviting interested parties to join a coalition of partners to further validate this transaction approach and identify suitable CFPPs to pilot integrating transition credits into the early retirement of CFPPs. This builds upon the extensive engagements that have been carried out with industry practitioners across the carbon credit, energy financing, and project development space.

MAS Issues Three Consultation Papers on Transition Planning for Financial Institutions

In October 2023, MAS issued three consultation papers setting out proposed updated guidelines for the three categories of financial institution — insurers, banks, and asset managers. The proposed guidelines establish MAS’s expectations for these financial institutions to have a sound transition planning process to enable effective climate change mitigation and adaptation measures by their customers in the global transition to a net zero economy. MAS’s expectations extend across areas such as governance, strategy, risk management, and disclosure.

In terms of implementation, MAS proposes to provide a transition period of 12 months after each of the guidelines are issued, so that the financial institutions can assess and implement their respective guidelines as appropriate.

- Insurers: The proposed Guidelines on Transition Planning for all insurers (Guidelines (Insurers)) are intended to supplement the Guidelines on Environment Risk Management for Insurers with additional granularity in relation to insurers’ transition planning processes. The Guidelines (Insurers) also set out proposed expectations across governance and strategy, risk management, underwriting, investment, and disclosures.

- Banks: The proposed Guidelines on Transition Planning for all banks, merchant banks, and finance companies (Guidelines (Banks)) are intended to supplement the Guidelines on Environment Risk Management for Banks with additional granularity in relation to banks’ transition planning processes. The Guidelines (Banks) set out proposed expectations across governance and strategy, risk management, and disclosures.

- Asset managers: The proposed Guidelines on Transition Planning for all fund management companies and real estate investment trust managers (Guidelines (Asset Managers)) are intended to supplement the Guidelines on Environment Risk Management for Asset Managers with additional granularity in relation to asset managers’ transition planning processes. The Guidelines (Asset Managers) set out proposed expectations across governance and strategy, portfolio management, engagement and stewardship, and disclosures.

JAPAN

Japanese Ministries Publish Guidance on Financed Emissions

The Financial Services Authority; the Ministry of Economy, Trade and Industry; and the Ministry of the Environment published a paper titled “Addressing the Challenges of Financed Emissions” to achieve carbon neutrality by 2050.

The paper acknowledges that international targets for financial institutions to reduce their emissions to net zero, including emissions of their borrowers/investees, may cause fundraising issues for companies in sectors that face major challenges in transitioning to net zero (so-called “hard-to-abate” sectors). Financial institutions may be reluctant to provide services to these sectors, since doing so would increase their financed emissions.

The paper proposes the following solutions to this problem:

- New calculation methods and disclosure of financed emissions

- Use of multiple metrics instead of only focusing on financed emissions

The second category is further divided into two sub-categories:

- “Efforts on Real-Economy Transition”: Indicators related to initiatives that promote the decarbonization of the real economy. This includes metrics that represent the positive impact of the fundraiser’s products and services to the decarbonization of the real economy, and metrics that represent the contributions of the fundraiser’s own decarbonization efforts.

- “Execution Capability for Decarbonization-Related Measures”: Indicators representing the progress and level of execution of a financial institution’s decarbonization plan. Possible examples include those related to execution on its strategy, engagement, and governance.

The paper acknowledges that the challenges associated with financed emissions vary between new finance and assessing existing portfolio alignment, as well as between asset owners, asset managers, insurance companies, or banks, or between the policies of each financial institution on decarbonization.

The paper concludes that calculation methods and key considerations for financed emissions require further discussion to address these challenges, and such discussions are expected to be led by the Partnership for Carbon Accounting Financials and/or other private initiatives related to financed emissions. For the use of multiple indicators other than financed emissions, specific options must be explored in various private initiatives to ensure the appropriate evaluation of financial institutions’ contributions to new decarbonization investments.

CONCLUSION

Regulators across the Asia-Pacific region are playing a leading role in developing and fine-tuning ESG reporting requirements and standards. This year has been particularly active, with regulators pushing through frameworks and collaborative efforts with stakeholders.

However, challenges remain. While countries are actively moving toward a sustainable investment landscape, the turning point has not yet arrived in establishing a fully integrated global roadmap. This year we have seen the impact of international developments, including the ISSB standards as well as the EU’s Corporate Sustainability Reporting Directive and Corporate Sustainability Due Diligence Directive, in shaping and influencing future regulatory developments across the region. We will closely monitor how this plays out in the coming year.