In Short

The Situation: The U.S. Environmental Protection Agency ("EPA") has proposed regulations for calculating methane emissions fees required beginning this year under the Inflation Reduction Act ("IRA"). Section 136 of the Clean Air Act (added by the IRA) requires that a fee be paid starting with emissions in 2024 for every metric ton of methane released by most oil and natural gas facilities in excess of identified thresholds. EPA has proposed regulations detailing how excess methane emissions are calculated and interpreting the statutory exemptions from the fee.

The Result: The proposed rules would implement a waste emissions charge ("WEC") assessed against facilities operating in any of nine oil and gas industry segments, reporting at least 25,000 metric tons ("mt") of carbon dioxide equivalents of greenhouse gases ("CO2e"), and exceeding established segment-specific waste emissions thresholds (subject to certain exemptions).

Looking Ahead: If finalized, these regulations will govern the WEC of up to $1,500 per metric ton of methane that parties are statutorily required to pay. The first WEC payment is due March 31, 2025.

EPA has proposed regulations implementing the methane fee program established in the IRA applicable to onshore and offshore petroleum and natural gas production facilities along with storage facilities and transmission pipelines (the "Proposed Rules"). Beginning with methane emissions in 2024, a WEC of $900 per metric ton of methane in excess of designated thresholds would apply, increasing to $1,500 per metric ton by 2026. Under the Proposed Rules, the first WEC payment for 2024 emissions will be due March 31, 2025.

The Proposed Rules expand on the statutory provisions of the IRA by providing details on the calculation of emissions subject to the fee, along with further interpretation of the statutory exemptions from the fee. This proposal is related to the August 2023 proposed rules for greenhouse gas reporting under the Greenhouse Gas Reporting Program (also referred to as Subpart W) for these industries, as those reported emissions determine whether the methane fee is applicable. The Subpart W reporting regulations by statute must be finalized by August 26, 2024. In addition, the Proposed Rules are related to the December 2023 final rule that limits emissions from new and existing oil and natural gas facilities because there is an exemption from the WEC for emissions that are in compliance with those standards.

Applicability

The Proposed Rules apply to facilities reporting more than 25,000 mt CO2e under Subpart W that operate in the following industry segments:

- Onshore petroleum and natural gas production

- Offshore petroleum and natural gas production

- Onshore petroleum and natural gas gathering and boosting

- Onshore natural gas processing

- Onshore natural gas transmission compression

- Onshore natural gas transmission pipeline

- Underground natural gas storage

- Liquified natural gas ("LNG") import and export equipment

- LNG storage

For facilities with equipment in multiple industry segments, the facility's 25,000 mt CO2e threshold is calculated as the sum of CO2e for each industry segment at the facility.

Any facilities covered by the Proposed Rules ("WEC Applicable Facilities") that exceed certain segment-specific waste emissions thresholds may be subject to the WEC. The facility's WEC-obligated party would be responsible for paying a WEC to the U.S. Treasury applicable to the methane emissions in excess of the established thresholds, as described below. A facility's "WEC-obligated party" is the reported owner or operator associated with the facility under Subpart W.

Fee Calculations

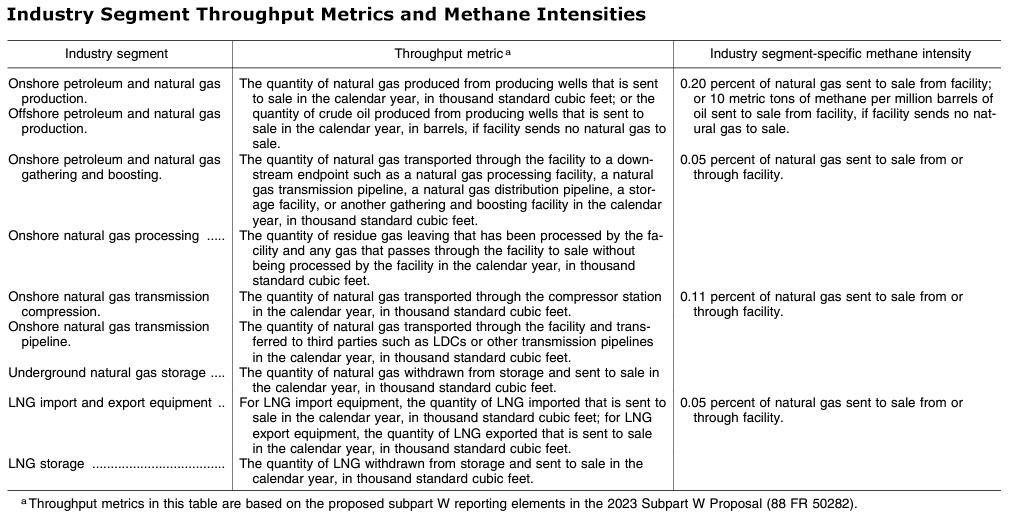

The Proposed Rules calculate the waste emissions threshold at the facility level by multiplying facility-level throughput by the industry segment-specific methane intensity thresholds as follows:

89 Fed. Reg. page 5325

The WEC is applied to the amount of facility methane emissions that exceed the waste emissions threshold, inclusive of any applicable exemptions.

First, the facility must subtract the methane emissions reported pursuant to Subpart W from the applicable waste emissions threshold.

Second, if a facility's step-one emissions calculations yield a value that exceeds the applicable threshold(s), the facility may evaluate whether an exemption applies that may reduce the facility's calculated emissions, as described below.

Third, the WEC-obligated party must conduct a netting analysis. Clean Air Act Section 136(f)(4) allows WEC Applicable Facilities under common ownership or control to net emissions from facilities exceeding the waste emissions threshold with emissions from facilities below the waste emissions threshold. The net waste emissions are equal to the sum of all methane emissions from all WEC Applicable Facilities under common ownership or control.

Finally, the net waste emissions represent the final number of metric tons of methane exceeding or below the waste emissions threshold(s). If net waste emissions are equal to or below zero, then the WEC is zero. If net waste emissions are greater than zero, the amount of methane emissions is multiplied by the annual WEC amount to yield the ultimate fee that the WEC-obligated party must pay to the U.S. Treasury.

Exemptions

Clean Air Act Section 136(f)(5)–(7) includes three exemptions from payment of the methane fee to address situations in which Congress believed it would be unreasonable to require payment: (i) when there is an "unreasonable delay" in permitting infrastructure to capture methane releases; (ii) when wells have been plugged in accordance with applicable requirements; or (iii) when methane releases occur at equipment that is in compliance with designated regulatory standards. The Proposed Rules address how EPA will interpret each of these statutory exemptions.

Under the "unreasonable delay" exemption, EPA has proposed that WEC Applicable Facilities that exceed the waste emissions threshold will not be responsible for fees resulting from flaring if the flaring: (i) is in compliance with applicable laws; and (ii) would not have occurred if a necessary permit had been granted for gathering or transmission infrastructure to mitigate the flaring. To qualify for the exemption, a designated amount of time must have passed since the application was deemed complete (likely between 30 and 42 months), and the applicant cannot be responsible for the permitting delay. Note that EPA has limited this exemption to flaring (rather than including vented emissions) even though the Section 136 language does not require this limitation.

To receive the "plugged wells" exemption, WEC Applicable Facilities must plug the well permanently so that all federal, state, and local requirements for closure are met. Although not explicitly required by the statute, only production industry and not storage wells would qualify for the exemption.

The regulatory compliance exemption will come into effect only once methane emission new source performance standards that are at least as stringent as those proposed by EPA in November 2021 are finalized and a final federal or state plan is in effect in every state with an affected facility. If a facility's methane emissions are in compliance with those standards, the facility will not be subject to the WEC. EPA is clearly interpreting this statutory exemption to incentivize states and regulated parties to finalize standards as quickly as possible so that the regulated parties can exempt methane emissions from the WEC.

Comments on the Proposed Rules are due March 11, 2024. EPA plans to hold a public hearing regarding the Proposed Rules on February 12, 2024.

Three Key Takeaways

- On January 12, 2024, EPA proposed rules to implement a methane emissions charge of up to $1,500 per metric ton of methane emissions applicable to the oil and gas sectors, with earliest payments becoming due on March 31, 2025.

- Obligated parties may be able to reduce the WEC by netting the emissions of WEC Applicable Facilities, and they should take care to evaluate any applicable exemptions.

- Obligated parties should closely monitor Subpart W reporting regulations (to be finalized by August 2024), which may directly impact how facilities calculate methane emissions and, therefore, whether they are categorized as a WEC Applicable Facility subject to the WEC.