APMA set a record for executed advance pricing agreements (APAs), but high processing times and a hefty pending APA inventory continued to challenge APMA in 2023. Our Federal & International Tax Group evaluates trends gleaned from the 2023 annual report.

- We commend APMA for improving its output of executed APAs, but challenges remain due in part to factors outside APMA’s control

- APMA is reviewing Rev. Proc. 2015-41, the main source of APA guidance; updated APA procedures are expected in 2024

- Updated APA procedures may address pre-APA submission conferences, tools available to companies to address transfer pricing risks, APA submission requirements, and APA case processing

On March 26, 2024, the IRS issued its Announcement and Report Concerning Advance Pricing Agreements (APA Report), which presents the key results of the IRS’s Advance Pricing and Mutual Agreement Program (APMA). The APA Report provides general information about the program's operation, including staffing, and statistical information about the numbers of APA applications received and resolved during the year, including countries involved, demographics of companies involved, industries covered, and transfer pricing methods (TPMs) employed.

Much of the data in the APA Report represents a snapshot in time, and like prior years, the APA Report does not provide data for categories involving fewer than three APAs. Despite these caveats, we can identify important trends based on such data and our experience advising companies pursuing and executing APAs. Please see our advisory for 2022 for a comparison of trends then and now.Note: The IRS did not provide any data for new unilaterals for 2022.

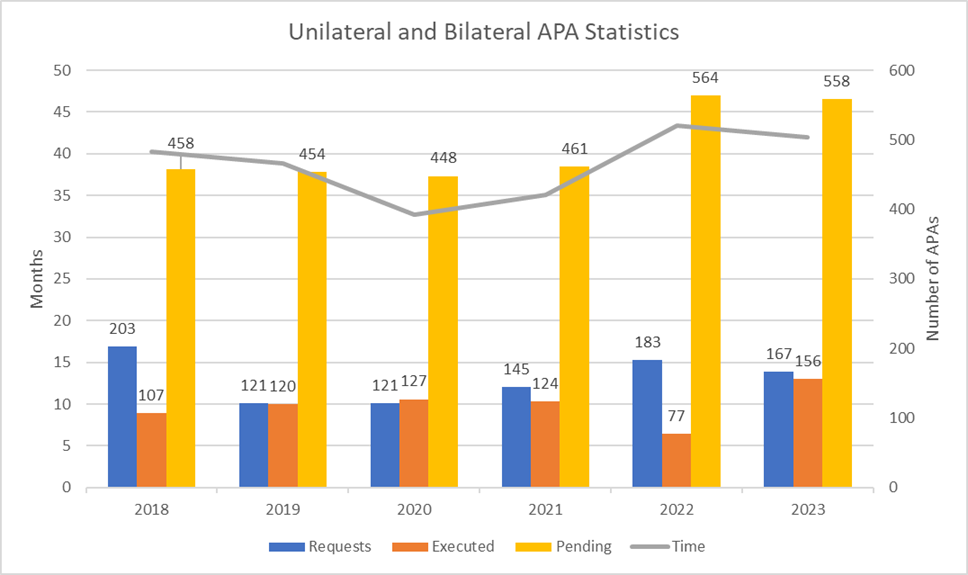

First, APMA should be congratulated for executing a record number of APAs during 2023—a reassuring twofold rebound from 2022 when executed APAs fell alarmingly to a level not seen since 2011. Second, APMA’s personnel resources increased by 17%, with a new manager and team of team leaders and economists added to each of APMA’s three geographic groups. Third, some processing times improved slightly since 2022, but the overall processing times still exceed or are near historically high levels—more than four years are required to execute a new bilateral APA. Fourth, taxpayer demand for APAs is still strong with 2023 applications at the fourth highest level in history but down about 9% from 2022. Finally, APMA’s inventory of pending APAs remains at an elevated level.

Although the APA Report data has its limitations, some of the trendlines over the years may point to issues that APMA should address and strategies that companies should consider if they are evaluating or negotiating an APA. Before diving into the details, here are some high-level observations.

It is worth noting that, in April 2023, the IRS issued new guidance to the IRS’s Treaty and Transfer Pricing Operations employees on the IRS’s review of APA prefiling memoranda and APA requests from taxpayers. The IRS indicated that it issued the guidance to ensure that both taxpayer and IRS resources are used as effectively as possible and stated that the guidance is not intended to decrease the number of APA requests that APMA accepts. Instead, the guidance is intended to improve APMA’s handling of cases through the early identification of potential roadblocks to a successful APA and to recommend alternative paths to address issues in certain cases. We have successfully maneuvered through these procedures to ensure access to APMA for companies that value the certainty that APAs provide.

Although APMA faced headwinds during 2022 and 2023, in our experience such challenges are due, in part, to factors outside APMA’s control, such as the impact of the COVID-19 pandemic on the ability to have face-to-face negotiations with treaty partners. Also, certain treaty partners were severely limited in their ability to work on APAs during the pandemic. Finally, actions and positions taken by treaty partners can affect case processing times, particularly a treaty partner that seeks to gain as large a share of revenue as possible on an unprincipled basis. Reaching a mutually acceptable agreement requires that all tax authorities take meaningful steps to reach an agreement.

As companies continue to navigate how APAs can best address those years impacted by COVID-19, supply chain issues, sanctions, inflation, and other unexpected events, as well as post-COVID-19 years, our experience indicates that companies with robust TPMs that effectively address arm’s-length returns for nonroutine intangibles, COVID-19, and other issues should see their APAs progress more efficiently than APAs with TPMs that arguably require significant modifications. Addressing these issues does not imply a one-size-fits-all approach, and each company’s situation needs to be evaluated carefully, according to APMA. In addition, companies need to show how they were affected and propose meaningful solutions.

Finally, the data clearly shows that APMA has needed (and is now receiving) additional resources to address increased demands. Throughout our advocacy for companies during the APA process, however, APMA has been available to discuss and has been dedicated to addressing various questions and issues and advancing cases toward completion.

APMA Operations and Staffing

Demand for APAs remained steady in 2023 at near historically high levels, and hopefully, the increase in APMA personnel will assist in handling the high demand on an efficient basis. The total number of APMA employees increased from 97 professionals at the end of 2022 to 114 professionals at the end of 2023. At the end of 2023, APMA had 70 team leaders (significantly increased from 59 in 2022), 29 economists (increased from 26 in 2022), 12 managers (up from 9 in 2022), and three assistant directors (unchanged). Each assistant director now oversees four managers who lead teams composed of both team leaders and economists. Finally, APMA’s leadership remained the same from 2022, which adds stability to the program.

Rev. Proc. 2015-41 continued to serve as the main source of IRS guidance for the APA process during 2023, along with the guidance mentioned above, and we expect to see an update to Rev. Proc. 2015-41 during this calendar year. Comments submitted by various stakeholders, including the American Bar Association Tax Section, identify areas in which improvements can be made to the procedures. Although not discussed in the APA Report, based on public comments it appears that updated APA procedures may address pre-APA submission conferences, various tools available to companies to address transfer pricing risks (e.g., International Compliance Assurance Program), APA submission requirements, APA case processing, and other issues.

APA Demand and Output

Slight decreases in processing times and number of pending APAs, but still too high

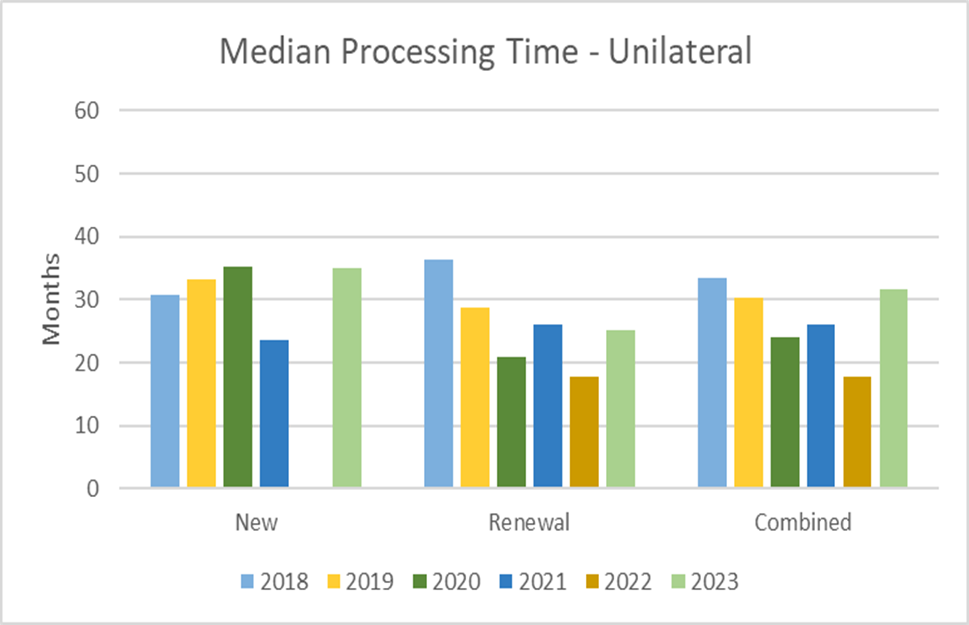

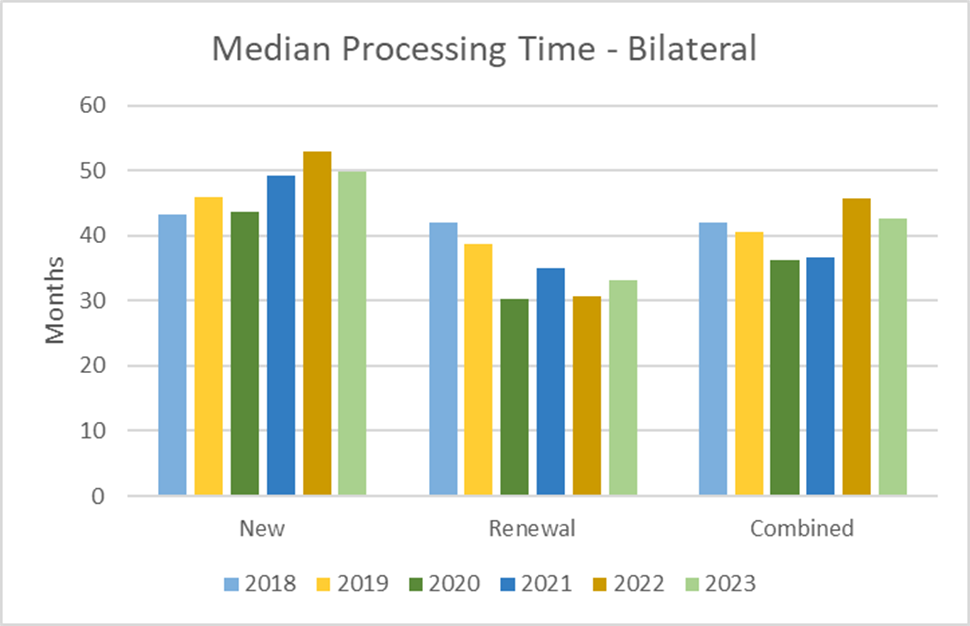

The median time required to complete an APA decreased slightly to 42 months in 2023 (down from 43 months in 2022), and new bilateral APAs showed the most improvement, with a three-month decrease in processing time. In comparison, renewal bilateral APAs required 10% more time to resolve in 2023 than in 2022. Overall, processing times are still too lengthy from a historical perspective, and only APAs executed in 2022 took longer to resolve.

As indicated, the data reflects a snapshot in time for cases resolved during 2023, and the mix of older and newer cases resolved in 2023 affects the processing times. However, the high processing times and continued large pending APA inventory mean that APMA continues to face challenges. Of course, some of these challenges arise from treaty partners and, in some cases, their unwillingness to engage in principled negotiations to reach mutually acceptable resolutions. There are steps that companies can take to move cases to resolution, and our experience indicates that careful legal and economic analysis, preparation, management, and responsiveness throughout the APA process are critical.

Note: The IRS did not provide any data for new unilaterals for 2022.

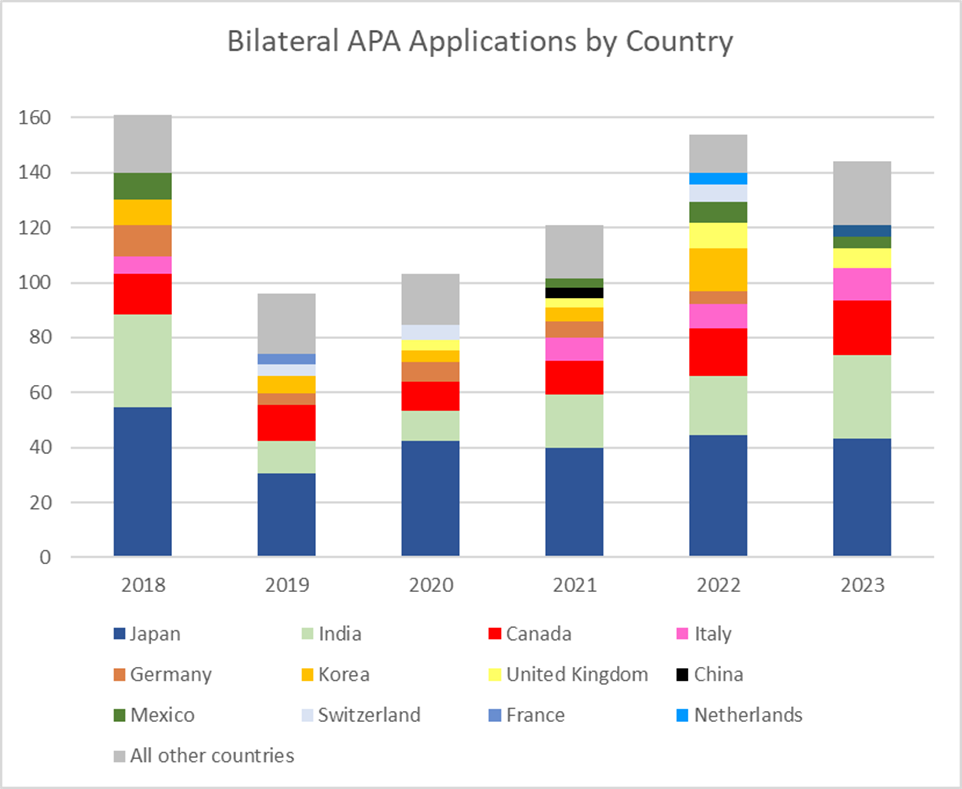

The number of pending APAs also remained elevated in 2023 (558), decreasing by only six APAs compared with 2022. At the end of 2023, the pending APAs consisted of 44 unilateral, 480 bilateral, and 34 multilateral APAs. Over the past 10 years, the number of pending bilateral APAs has trended higher and shows no signs of improvement. As mentioned, the additional resources and upfront screening process may reduce the inventory. APMA would need approximately 3.5 years to work through its existing inventory (assuming no new APA requests are accepted). Japan (25%), India (23%), and Canada (13%) constituted the majority of the pending bilateral APAs, consistent with past years.

New applications: continued strong APA demand

In 2023, 167 APA applications were filed, a decrease of 9% from 2022. This was the second-highest number of APA applications filed since at least 2010 in any year in which impending filing fee increases did not influence demand (impending fee increases influenced filings in 2010, 2015, and 2018). Demand for APAs continues to be strong, and therefore, additional resources for APMA are warranted.

The country-by-country breakdown of bilateral filings remained fairly consistent. In line with previous years, the number of bilateral filings involving Japan, India, and Canada cumulatively represented 65% of all bilateral filings in 2023. Bilateral filings involving Italy represented 8% of all bilateral filings in 2023, while filings involving Korea dropped below the level for reporting.

Increased number of APAs executed

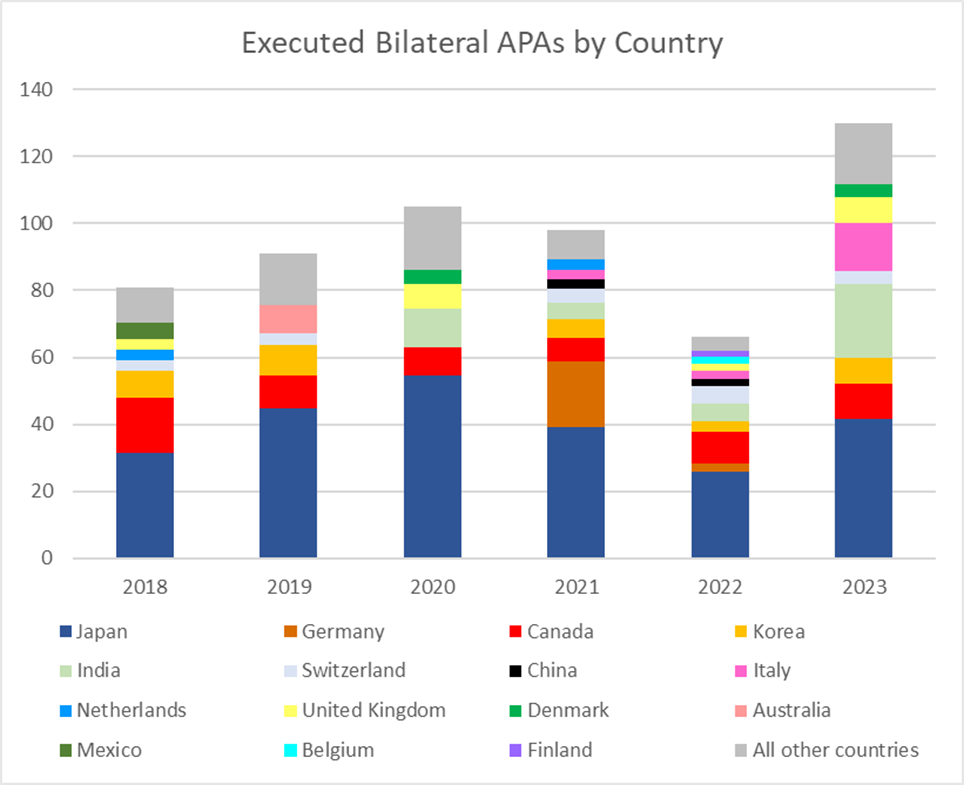

The IRS performed well in executing APAs—a twofold increase from 2022 to 156 executed APAs. However, continuing at this elevated level of executed APAs will not be sufficient for a well-functioning APA program because it would not keep up with demand. Also, the percentage of executed APAs that were renewal bilateral APAs decreased again, to 38%, while bilateral APAs (both new and renewal) make up almost 80% of pending APAs. The percentage of executed APAs that were bilateral decreased slightly to 83%, and two multilateral APAs were executed in 2023, which is consistent with past years (between zero and three multilateral APAs have been executed annually in the last 10 years).

U.S.-Japan bilateral APAs continued to constitute the largest percentage of bilateral APAs that the program processed (32%), followed by India (17%), Italy (11%), and Canada (8%). The large number of bilateral APAs executed involving Japan can be attributed to the long history of the APA programs in the United States and Japan. The increase in U.S.-Italy APAs reflects, in part, the well-functioning treaty partner relationship. Overall, APMA has invested in building relationships and trust with treaty partners, which is critical to being able to agree on approaches to streamline analyses (e.g., standard benchmarking) and focus resources on more complex issues.

APMA continues to develop more substantial and regular APA discussions and negotiations with a broader range of countries, as indicated by the reportable APAs with a large number of countries, which is a positive development for the overall APA process and companies desiring to resolve transfer pricing issues through APAs. It is our understanding that the increased use of videoconferencing technology by APMA and other tax authorities has helped facilitate more frequent formal and informal negotiations, although in-person negotiations are necessary to make progress on more complex issues.

Withdrawn APA requests

Thirteen APA applications were withdrawn in 2023, which was higher than prior years (six APA applications were withdrawn in 2022 and 2021). In 2023, for the eleventh consecutive year, no APAs were revoked or canceled.

U.S. vs. non-U.S. parent companies

Similar to past years, the majority of APAs involved non-U.S. parent companies: 56% of the executed APAs for 2023 were for non-U.S. parent companies and their U.S. subsidiaries, while 37% involved U.S. parent companies and their non-U.S. subsidiaries and 6% involved sister companies. The ongoing appeal of the APMA program to non-U.S. parent companies, particularly Japanese parent companies, could be due to, among other things, the IRS’s continued focus on transfer pricing involving non-U.S. parent companies, non-U.S. parent companies’ desire for transfer pricing certainty, or an increase in audit activity in other countries for which resolution through a bilateral APA with the United States may be preferred.

Industries represented

Most of the APAs executed in 2023 involved the manufacturing (31%) and wholesale/retail trade (30%) industries. The other industries specifically identified in the APA Report were services (17%); finance, insurance, and real estate (12%); and management (6%). Within the manufacturing industry, the largest proportion of APAs executed involved transportation (31%), followed by chemical (19%) and computer and electronic products (17%). Within the wholesale/retail trade industry, a majority of the APAs executed involved merchant wholesalers of durable goods (53%), merchant wholesalers of nondurable goods (21%), and clothing and clothing accessories stores (11%). To some extent, the year-over-year industry breakdown is random, providing a snapshot of a particular 12-month period.

TPMs applied

For 2023, the comparable profits method/transactional net margin method (CPM/TNMM) continued to be the most commonly applied TPM for tangible and intangible property transactions (applied to 80% of such transactions). Of the profit level indicators (PLI) used when the CPM/TNMM is employed, the operating margin (defined as operating profit divided by net sales) was applied 60% of the time. As in past years, the CPM/TNMM was applied in 86% of the APAs with intercompany service transactions, and the most commonly selected PLI with the CPM/TNMM was the operating margin, used 48% of the time. Based on our experience, increased focus by APMA and other tax authorities on nonroutine intangibles, including marketing intangibles, may lead to a shift in the types of TPMs deployed going forward.

APA terms

Rev. Proc. 2015-41 instructs taxpayers to request a term of at least five prospective years, and taxpayers may also request that the APA be “rolled back” to cover one or more earlier taxable years. APA term lengths, including rollback years, averaged six years in 2023, unchanged from 2022. The largest number of APAs were executed with five-year terms (49%), and 88% had terms of five or more years. In 2023, the longest APA term was 14 years. A substantial number of the APAs with terms of greater than five years were submitted as a request for a five-year term, and the additional years were agreed to between the taxpayer and the IRS (or between the IRS and the foreign government, upon the taxpayer’s request, in the case of a bilateral APA) to ensure, for example, a reasonable amount of prospectivity in the APA term. Of the APAs executed in 2023, 19% included rollback years.

Companies with APA terms spanning years before and after the effective date of the Tax Cuts and Jobs Act of 2017 should take into account any implications from APMA’s prior announcement addressing “telescoping” and other related topics.

FX adjustments

APMA does not have a set policy for adjustments to company financials to account for currency fluctuations. As in past years, the APA Report notes: “In appropriate cases, APAs may provide specific approaches for dealing with risks, including currency risk, such as adjustment mechanisms and/or critical assumptions.” Over the years of the APA program, FX adjustment mechanisms have been proposed by companies and by governments, and when the fluctuations are extreme, or when a currency has weakened significantly, this can be taken into account in a bilateral APA.

Observations and Conclusions

APMA made strides in 2023 in improving certain aspects of its operations that are reflected in the APA Report data, and we hope that these trends and other improvements continue for the long game—in 2024 and later years. We commend APMA for devoting the necessary resources to build positive working relationships and trust with treaty partners, identifying avenues for streamlining APAs, and focusing on more complex issues. With the additional resources available to APMA and continued efforts with treaty partners, it would not be unreasonable to assume that the 2024 data will show additional improvements.

Of course, certain unfavorable datapoints for 2023 involve factors outside APMA’s control, such as COVID-19 pandemic impacts, delays in processing APAs by other tax authorities, and reluctance by some tax authorities to negotiate in good faith to reach a mutually acceptable agreement. Our experience advising companies on APAs since the beginning of the IRS’s APA program indicates that careful strategic planning, legal and economic analysis, management, and responsiveness are important steps to most efficiently obtain an APA.

APAs are a critical tool for companies and tax authorities to address and resolve transfer pricing and ancillary issues on a principled, effective, and efficient basis. The additional investments that the IRS is making in APMA are critical to its success, and other tax authorities should similarly invest in their APA operations. It will be important to evaluate how these IRS investments in APMA contribute to a more effective APA process, particularly given the increased demand for APAs anticipated due to the OECD BEPS Pillars One and Two and more aggressive transfer pricing audits by non-U.S. tax authorities.

[View source.]