On October 10, the Securities and Exchange Commission (SEC or the Commission) adopted comprehensive changes to Regulation D-G, which governs beneficial ownership reporting under Section 13(d) of the Securities Exchange Act of 1934 (Exchange Act).

Among other things, the rule amendments: (i) accelerate deadlines for filing initial Schedule 13D and Schedule13G reports (reducing the filing window for many initial Schedule 13D and 13Gs from 10 calendar days to five business days, while also requiring certain filings historically triggered on the basis of year-end positions to be made on the basis of quarter-end positions), (ii) accelerate the deadline for filing amendments to Schedule 13Ds from "promptly" following a material change in the information previously reported to two business days following a material change in the information reported; (iii) require Schedule 13G amendments to be filed to report "material" changes on a quarterly basis (rather than the current regime, which requires annual amendments to report any change in beneficial ownership as of calendar year end); (iv) modify the deadlines for filing Schedule 13G amendments after a filer's beneficial ownership surpasses 10 percent of the class; (v) mandate that Schedule 13D and 13G filings be made using a structured, machine-readable data language; and (v) extend the filing "cut-off" time within a given business day by which Schedules 13D and 13G may be filed from 5:30 p.m. to 10:00 p.m. ET).

The SEC declined to adopt proposed amendments to Rule 13d-3 with respect to beneficial ownership of certain derivative securities and Rule 13d-5 with respect to group formation. However, as discussed below, the adopting release included important guidance in these areas.

Compliance with the modified filing deadlines and the structured data requirement for Schedules 13D and 13G will not be required until September 30, 2024, and December 18, 2024, respectively. The SEC's guidance relating to group formation and cash-settled derivatives will be effective immediately upon publication in the Federal Register. Otherwise, the amendments will become effective ninety days after publication in the Federal Register (with such effective date likely no earlier than January 2024).

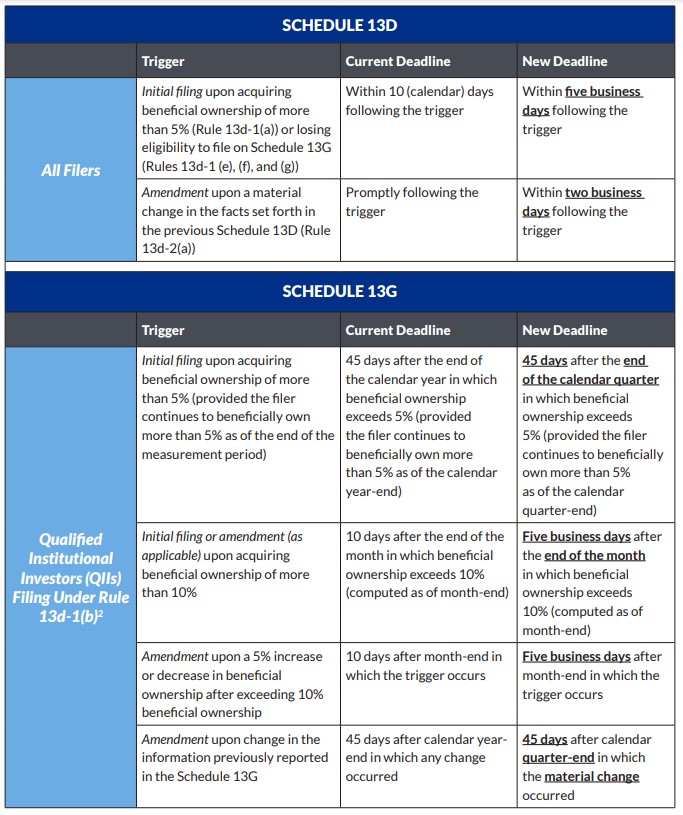

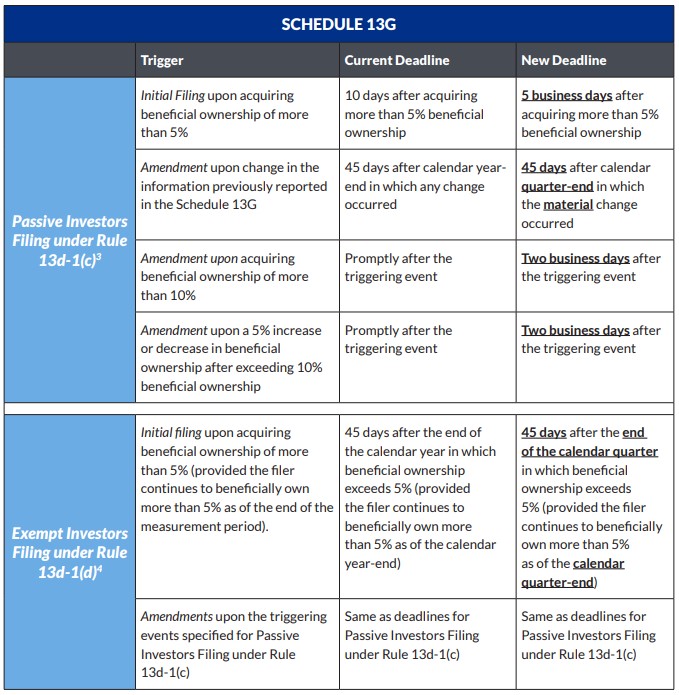

A more detailed discussion of the foregoing amendments and SEC guidance follows. For a tabular summary of current and new deadlines for submitting Schedule 13D and Schedule 13G filings, as well as amendments to such filings, please see the Quick Reference Guide at the end of this advisory.

Accelerated Filing Deadlines for Schedule 13Ds and 13Gs

The rule amendments:

- require investors to make initial Schedule 13D filings under Rule 13d-1(a) within five business days (rather than 10 calendar days) after the date on which a person acquires beneficial ownership of more than 5 percent of the outstanding shares of a covered equity security;

- accelerate the filing deadline for an initial Schedule 13D required under Rule 13d-1(e), (f) or (g) to be filed by certain persons who cease to be eligible to continue reporting on Schedule 13G to five business days (rather than 10 calendar days) after the event that triggers their ineligibility to use Schedule 13D (e.g., a passive investor filing on Schedule 13G develops plans to change or influence control of the issuer or acquires beneficial ownership of at least 20 percent of the class of equity securities; an institutional investor relying on Rule 13d-1(b) that has not yet filed a Schedule 13G ceases to hold the applicable securities in the ordinary course of its business; or an exempt investor filing on Schedule 13G in reliance upon Rule 13d-1(d) acquires more than 2 percent of the covered class during a 12-month period);

- require that an amendment to Schedule 13D be filed within two business days (rather than "promptly") following a material change in the information disclosed in the Schedule 13D;

- require a passive investor relying on Rule 13d-1(c) to make an initial Schedule 13G filing within five business days (rather than 10 calendar days) after the date on which the investor acquires beneficial ownership of more than 5 percent of the outstanding shares of a covered equity security;

- accelerate the deadline for certain qualified institutional investors (QIIs) and exempt investors (i.e., investors that beneficially own in excess of 5 percent of a covered class but have not made an acquisition of beneficial ownership subject to Section 13(d), such as pre-IPO investors who have not acquired more than 2 percent of a covered class within a 12-month period) filing a Schedule 13G in reliance upon Rule 13d-1(b) or 13d-1(d) to 45 calendar days after the end of the calendar quarter (rather than the end of the calendar year) in which beneficial ownership first exceeds 5 percent of a covered class;

- mandate QIIs to make initial Schedule 13G filings under Rule 13d-1(b) within five business days (rather than 10 calendar days) after month-end in which beneficial ownership exceeds 10 percent;

- require all Schedule 13G filers to disclose material changes (rather than any change) no later than 45 calendar days after the end of each calendar quarter (rather than calendar year);

- mandate QIIs to amend their Schedule 13G filings within five business days (rather than 10 calendar days) after the end of the month in which they cross the 10 percent beneficial ownership threshold or experience a 5 percent increase or decrease in beneficial ownership; and

- require all passive investors to amend their Schedule 13G filings within two business days (as opposed to "promptly") after acquiring more than 10 percent beneficial ownership or a 5 percent increase or decrease in beneficial ownership.

EDGAR Filing Deadlines and XML

To aid compliance with the accelerated filing deadlines, the Commission extended the EDGAR filing cut-off deadlines in Regulation S-T for Schedules 13D and 13G from 5:30 p.m. to 10:00 p.m. ET.

In addition, all filers must comply with a new XML structured data requirement for disclosures reported on Schedules 13D and 13G, with the exception of exhibits, beginning December 18, 2024.

Treatment of Certain Cash-Settled Derivatives

In an effort to "eliminate any ambiguity regarding the scope of the disclosure obligations of Item 6 of Schedule 13D as to derivative securities," the SEC also adopted amendments to Item 6 of Schedule 13D (which requires the disclosure of any contracts, arrangements, understandings, or relationships relating to the issuer's securities) to clarify that beneficial owners required to report on Schedule 13D must disclose any interests in derivatives securities, including cash-settled derivatives, that use the covered equity security as a reference security.

The SEC did not, however, adopt proposed amendments to Rule 13d-3 that would have changed the standards for determining beneficial ownership to provide that a person who holds cash-settled derivative securities in respect of a covered class of equity would be deemed to beneficially own the reference securities (as if the person held the reference securities directly). Rather, the SEC reaffirmed the application of prior guidance regarding the beneficial ownership of security-based swaps to cash-settled derivatives.[1]

Consistent with prior guidance regarding security-based swaps, the adopting release clarifies that a holder of a cash-settled derivative may be deemed to beneficially own the reference equity security if the cash-settled derivative (i) provides such holder with voting or investment power over the reference security, (ii) the derivative is part of a plan or scheme to evade Section 13(d) or 13(g) reporting requirements, or (iii) such holder has the right to acquire beneficial ownership of the equity security within 60 days or with the purpose or effect of changing or influencing the control of the issuer of such covered class. Although this guidance does not provide a "bright line" test for determining whether a holder of a cash-settled derivative must include the reference securities when calculating its beneficial ownership of a covered class of equity securities, it does provide a framework for what is ultimately a "facts and circumstances" analysis. Further, in contrast to the proposed rule, the guidance retains flexibility for holders looking to achieve economic exposure to a covered class of equity, without necessarily becoming the beneficial owner of the covered equity security.

Guidance on Section 13(d) and 13(g) Group Formation

The Commission declined to amend Rule 13d-5 under the Exchange Act as proposed (i.e., to provide that two or more persons who "act as" a group for purposes of acquiring, holding or disposing of securities will be treated as a group for purposes of Section 13(d), and to remove references to "an agreement" between two or more persons acting as a group). The SEC opted instead to provide guidance for determining when a Section 13(d) or 13(g) "group" has been formed in certain circumstances. Specifically, the SEC confirmed its view that the formation of a "group" of two or more persons does not solely depend on the entry into an express agreement; rather, concerted actions and informal agreements for the purpose of acquiring, holding or disposing of securities of an issuer suffice.

The Commission's guidance also stipulated that a person who shares information about an upcoming Schedule 13D filing, to the extent this information is not yet public and is communicated with the purpose of causing another person to make purchases of the same class of securities and a recipient of such information who subsequently purchases the issuer's securities based on this information will potentially be deemed to have formed a group for Section 13(d) purposes.

In order to avoid chilling communications among stockholders, the adopting release included several Q&As intended to demonstrate circumstances where shareholder engagement activities that involve a free exchange of ideas and views among shareholders or between shareholders and the issue's management (and do not have the purpose or effect of changing or influencing control of an issuer) will not result in the formation of a group. The Q&As suggest that shareholder discussions that do not commit to a course of action, joint engagement of management that does not include attempts to convince the board of directors to change its existing membership, and joint submissions of non-binding shareholder proposals will not, without more, result in the formation of a "group" for a Section 13(d) purpose. As such, shareholders seeking to engage with other shareholders or members of an issuer's management team may do so without necessarily triggering Schedule 13D reporting obligations but would be well served to consider the intent and purpose of any such communications in order to evaluate any potential implications under Section 13(d).

Section 16 Implications

Although the rule amendments do not directly modify the rules promulgated under Section 16 of the Exchange Act, the SEC's guidance could affect whether a person would be deemed to beneficially own, or to be a member of a group that beneficially owns, more than 10 percent of a covered equity security and, therefore such person's status as a statutory "insider" for Section 16 purposes. In particular, given the Commission's guidance, any person that holds cash-settled derivative securities will need to evaluate whether the reference securities must be included in the number of a covered class beneficially owned by such person and, if so, determine whether the number of reference securities, together with any other shares of the covered class beneficially owned by the person, exceeds 10 percent of the covered class (in which case, the person would be subject to short-swing trading liability and reporting provisions under Section 16).

Quick Reference Guide

Deadlines for Schedule13D and Schedule 13G Filings

[1] See Beneficial Ownership Reporting Requirements and Security-Based Swaps, Release No. 34-64628 (June 8, 2011) [76 FR 34579 (June 14, 2011)].

[2] Rule 13d-1(b) permits specified institutional investors, including registered broker dealers, banks, insurance companies, registered investment companies, investment advisers and certain other institutions, to report on Schedule 13G (rather than Schedule 13D) if the investor acquired the covered securities in the ordinary course of business and not with the purpose nor with the effect of changing or influencing the control of the issuer, nor in connection with or as a participant in any transaction having such purpose or effect.

[3] Rule 13d-1(c) permits an investor that do not qualify as QIIs to file on Schedule 13G so long as (i) the investor (and any group of which it is a member) beneficially owns less than twenty percent (20 percent) of the covered class and (ii) the securities were not acquired with any purpose, or with the effect, of changing or influencing the control of the issuer, or in connection with or as a participant in any transaction having that purpose or effect.

[4] The term "Exempt Investors" refers to persons beneficially owning more than 5 percent of a covered class of equity securities, but who have not made an acquisition of beneficial ownership subject to Schedule 13(d) (e.g., certain pre-IPO investors that do not acquire securities following an exchange act registration, or acquire no more than 2 percent of the covered class within a 12-month period).