On March 6, 2024, the Securities and Exchange Commission (SEC) finalized its long-awaited climate disclosure rules on a party-line 3-2 vote. The new rules have been significantly watered down from the SEC’s March 21, 2022 proposal,1 but when implemented would still impose significant disclosure requirements on publicly traded companies. In the final rule, the SEC instituted a materiality threshold for reporting and jettisoned its unpopular and unwieldy proposal to require companies to report their Scope 3 (or value chain-related) greenhouse gas (GHG) emissions. Large publicly traded companies, however, will still be required to disclose their Scope 1 (direct) and Scope 2 (energy-related) GHG emissions, as long as those emissions are material, and all publicly traded companies will need to disclose information regarding material climate-related risks and associated risk management and oversight. Following issuance, the SEC rules were promptly challenged both by states, corporations, and trade associations, who argue that the regulations are too stringent, and by environmental groups, who argue the regulations do not go far enough.

Below is a summary of the key requirements of the final rule and how the rule may impact your SEC reporting.

Summary of Disclosure Requirements

The final rules will require the following disclosures:

- Registrants will be required to disclose any climate-related risks (including physical risks and transitional risks) that have had or are reasonably likely to have a material impact on the registrant.

- Registrants will also need to disclose any actual or potential material impacts of the identified climate-related risks on their strategy, business model, and outlook. These material impacts could include impacts to the registrant’s operations, its products, its suppliers or its customers, and expenditures necessary to mitigate or adapt to climate-related risks.

- If, as part of its strategy, a registrant has undertaken activities to mitigate or adapt to a material climate-related risk, the registrant must provide a quantitative and qualitative description of material expenditures incurred and material impacts on financial estimates and assumptions that directly result from such mitigation or adaptation activities.

- If a registrant has undertaken activities to mitigate or adapt to a material climate-related risk, including the use of transition plans, scenario analysis, or internal carbon prices, it must disclose information related to these activities.

- Registrants must disclose any oversight by the board of directors of climate-related risks and any role by management in assessing and managing the material climate-related risks. Where there is board oversight, these disclosures would include identification of relevant board committees/subcommittees involved in the oversight, the process through which the board is apprised of climate-related risks, and whether and how the board is overseeing progress toward climate-related goals and implementation of any applicable transition plan.

- Registrants must disclose any processes used to identify, assess, and manage material climate-related risks and if the registrant is managing those risks, whether and how any such processes are integrated into the registrant’s overall risk management system.

- If the registrant has climate-related targets or goals that have materially affected or are reasonably likely to materially affect the registrant’s business, operations, or financial condition, the registrant must disclose any material expenditures and material impacts on financial estimates and assumptions that are a direct result of the target or goal or actions taken to make progress toward meeting such target or goal. This disclosure requirement would apply to both public and internal targets and goals that are material to the registrant but would not apply to interim goals, which would typically be included in a “final goal.”

- If the registrant has set climate-related targets or goals that have or will likely have a material impact, the registrant must disclose information regarding how it intends to meet those targets or goals and provide annual reports on the progress made, including specific actions taken during the reporting year, to achieve the targets and goals.

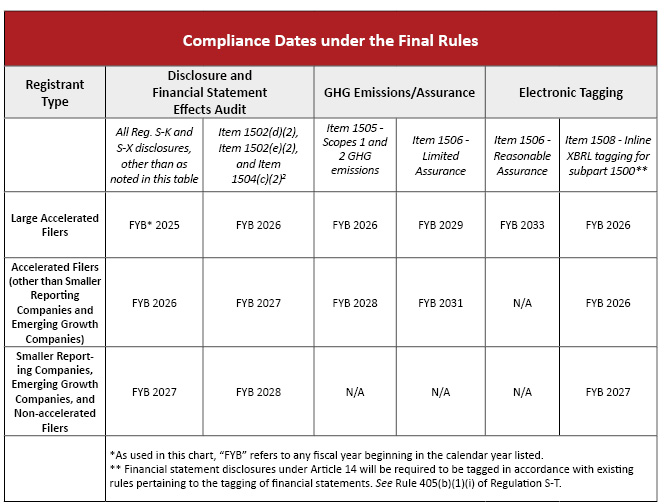

- Large accelerated filers (LAFs) and accelerated filers (AFs), unless exempted, must report their Scope 1 and/or Scope 2 GHG emissions, if material, and provide information on how those emissions were calculated. Materiality determinations will be based on company-specific quantitative and qualitative factors. To address concerns that registrants would not be able to measure and report GHG emissions by the deadline for submittal of their Form 10-K reports, the final rules allow LAFs and AFs to report their GHG emissions for the most recently completed fiscal year to be reported in the Form 10-Q for the second quarter of the next fiscal year (which the 10-K would incorporate by reference) or in an amendment to the Form 10-K due at the same time as the second quarter Form 10-Q.

- LAFs and AFs that are required to disclose their GHG emissions must provide an assurance report from a qualified, independent provider at the limited assurance level starting in fiscal year 2029 for LAFs and fiscal year 2031 for AFs. LAFs are further required to provide attestation at a reasonable assurance level beginning in fiscal year 2033.

Registrants are also required to provide the following information in notes to their financial statements:

- Capitalized costs, expenditures expensed, charges, and losses incurred as a result of severe weather events and other natural conditions, such as hurricanes, tornadoes, flooding, drought, wildfires, extreme temperatures, and sea level rise, subject to applicable one percent and de minimis disclosure thresholds;

- Capitalized costs, expenditures expensed, and losses related to carbon offsets and renewable energy credits or certificates (RECs) if used as a material component of a registrant’s plans to achieve its disclosed climate-related targets or goals.

- If the estimates and assumptions used by a registrant to produce the financial statements were materially impacted by risks and uncertainties associated with severe weather events, other natural conditions or any disclosed climate-related targets or transition plans, the registrant must qualitatively describe how the estimates and assumptions were impacted.

The final rules will go into effect 60 days after publication in the Federal Register and will include a phased-in compliance period for all registrants with the LAFs subject to the earliest deadlines. Below is a table setting forth the disclosure deadlines applicable to each type of registrant.

Under the final rules, the “safe harbor” protections of the Private Securities Litigation Reform Act of 1995 for forward-looking statements apply to disclosures related to transition plans, scenario analysis, the use of an internal carbon price, and targets and goals. These protections do not apply to historical facts, including material expenditures actually incurred for carbon offsets and/or RECs.

What’s Next for Your Company?

After reviewing and considering the 24,000+ comments letters that it received on the proposed rule, the SEC made numerous changes to these final regulations to ease the reporting burden on registrants and focus the required disclosures on information that would be material to investors. The final rule, however, will still result in a significant amount of additional work for public companies of all sizes as they consider the extent of their disclosure obligations in relation to climate concerns.

Almost immediately upon issuance, the SEC regulations were challenged. On March 21, all pending challenges were consolidated into a single multi-district litigation in the Eighth Circuit Court of Appeals.

It is uncertain if this pending litigation will be resolved before the largest public companies are required to make their first disclosures. Therefore, all registrants, but especially LAFs that have disclosure obligations beginning in fiscal year 2025, should review their processes and systems that track and evaluate climate-related risks, goals, and targets to ensure that they are collecting and evaluating the types of information that may be subject to disclosure. In some instances, registrants may need to establish a framework to assess climate-related matters if they were not previously doing so.

Complicating matters, public companies may also be subject to other mandatory climate reporting requirements, including those in the European Union and California,1 which are not based upon the same “materiality” standards in the SEC climate-related disclosure rule, and which may be implemented on a different time frame. There is no express preemption of any state law in the final SEC rule, and the question of whether there is an implied preemption would need to be determined in a judicial proceeding. Given the potential applicability of international and/or state requirements, registrants should develop a strategy to ensure consistency when meeting different climate disclosure requirements, with an eye to the fact that less robust reporting may be required to meet the SEC disclosure rules.

END NOTES

1 Our discussion of the California climate-related disclosure laws can be found here.

2 Items 1502(d)(2), 1502(e)(2) and 1504(c)(2) require a registrant to provide the following

quantitative and qualitative disclosures respectively:

- Material expenditures incurred and material impacts on financial estimates and assumptions that, in management’s assessment, directly result from activities to mitigate or adapt to the climate-related risks disclosed.

- Material expenditures incurred and material impacts on financial estimates and assumptions as a direct result of the registrant’s transition plan, if one has been disclosed; and

- Any material expenditures and material impacts on financial estimates and assumptions as a direct result of the target or goal or the actions taken to make progress toward meeting the target or goal.

3 Our discussion of the March 21, 2022 proposal can be found at here.