The Biologics Price Competition and Innovation Act (BPCIA) was enacted as part of the Affordable Care Act (colloquially called "Obamacare," Public Law 111-148) (see "House Passes Health Care Reform Bill -- Biosimilar Regulatory Pathway Makes Cut, Pay-for-Delay Ban Does Not"). It gave the U.S. for the first time a pathway for FDA approval of alternatives to biologic drugs (termed "biosimilars" because the complexity of these molecules precludes the atom-for-atom identity of small molecule generic drugs), codified at 42 U.S.C. § 351(k), as well as provisions for resolving patent disputes between innovator biologic drug companies (termed "reference product sponsors" in the Act) and biosimilar applicants (codified at 42 U.S.C. § 351(l)).

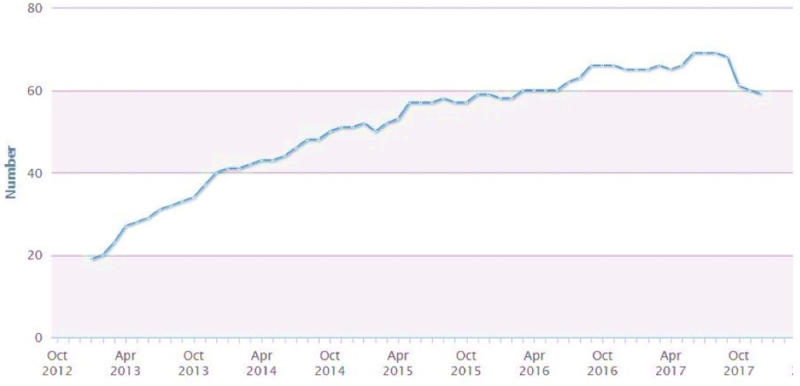

Nine years later, after promulgation of several Guidances by the FDA regarding how it will (and has) implemented the biosimilar pathway, it is reasonable to review what the BPCIA hath wrought. While the litigation provisions have been the source of some controversy (and arguably have played out in ways not envisioned when the Act was passed), the biosimilar pathway has been somewhat successful in bringing a first generation of biosimilar drugs to market. For example, as of December 2017 there were 59 biosimilar products enrolled in the FDA's Biosimilar Development Program:

And as of June 2018, 24 biosimilar applications have been filed and eleven biosimilar drugs have received FDA approval.

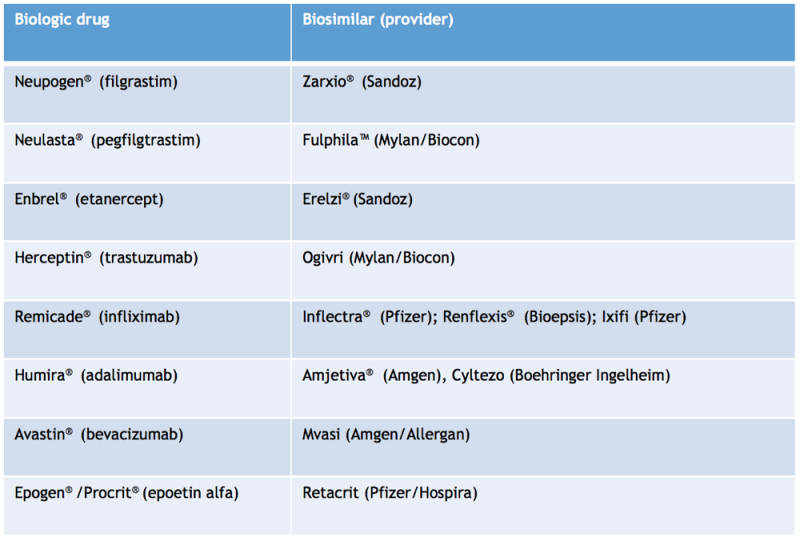

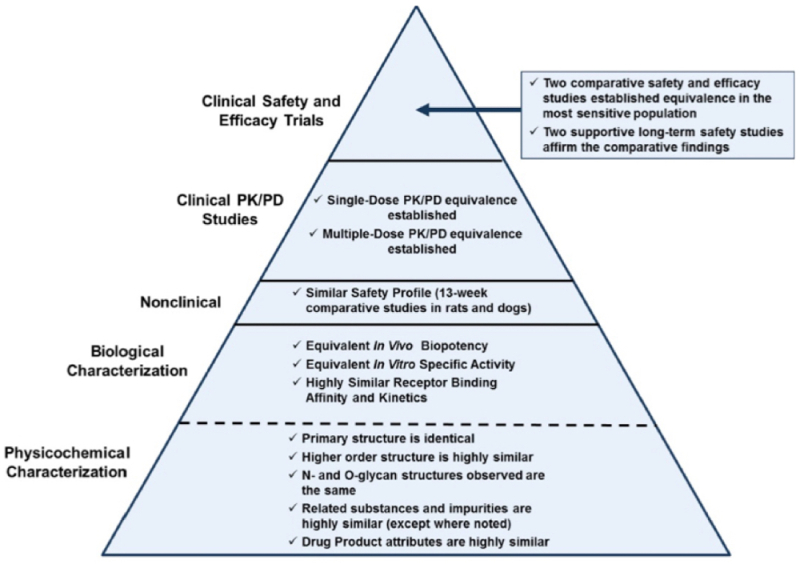

FDA approval of these drugs has been relatively rapid, typically taking 10-20 months from FDA acceptance to approval. There have been some outliers; Pfizer/Hospira's Retacrit® (a biosimilar of Epogen®/Procrit®) was under FDA review for 42 months. Most (but not all) of these FDA-approved biosimilars have also been approved in Europe (some quite a while ago, paradoxically including Retacrit® which was approved in Europe in 2007). The FDA decided early in its implementation process that it would accept clinical and other comparative data previously submitted to European regulators, supplemented by so-called "bridging studies," in the FDA approval process. Such studies were submitted for Sandoz's Zarxio® (filgrastim-sndz) and Erelzi® (etanercept-szzs) biosimilars, for example. Several products (Amgen's Amjetiva® (adalimumab-atto), Pfizer/Celltrion's Inflectra® (infliximab-dyyb), and Merck/Samsung Bioepsis's Renflexis® (infliximab-abda)) were supported by double-blind clinical studies comparing the biosimilar to EU-licensed and RPS-sourced biologic drugs.

The prolonged regulatory saga for Retacrit® illustrates the extent to which the FDA can require a biosimilar applicant to satisfy its purity, safety, and efficacy standards for a biosimilar product:

Mere approval is not sufficient, of course; many but not all of these drugs are on the market in competition with the reference biologic drug. These include Zarxio® (filgrastim-sndz) (in competition with Amgen's Neupogen®), which launched in September 2015, and Inflectra® (infliximab-dyyb) (in competition with J&J/Janssen's Remicade®), which launched in November 2016; each of these biosimilars are sold at a 15% discount from the reference biologic drug price. Renflexis® (infliximab-abda) (another Remicade® competitor) launched at risk (i.e., while patent litigation was on-going) at a 35% discount, and Amjetiva® (adalimumab-atto) is scheduled to enter the market in competition with AbbVie's Humira® in January 2023 as the result of a settlement agreement between the parties. Several other approved biosimilars are not yet on the market, however; these include Boehringer Ingelheim's Humira® biosimilar, Cyltezo® (adalimumab-abdm); Amgen/Allergan's Avastin® biosimilar, Mvasi (bevacizumab-awwb) (Amgen/Allergan); and Mylan/Biocon's Herceptin® biosimilar, Ogivri (trastuzumab-dkst), despite a global licensing agreement with Genentech entered into on March 31, 2017; and Hospira's Epogen® biosimilar, Retacrit® (epoetin alfa-epbx). In addition, Pfixer has decided not to enter the marketplace with its Remicade® biosimilar, Ixifi, which would also compete with Pfizer's other Remicade® biosimilar, Inflectra®.

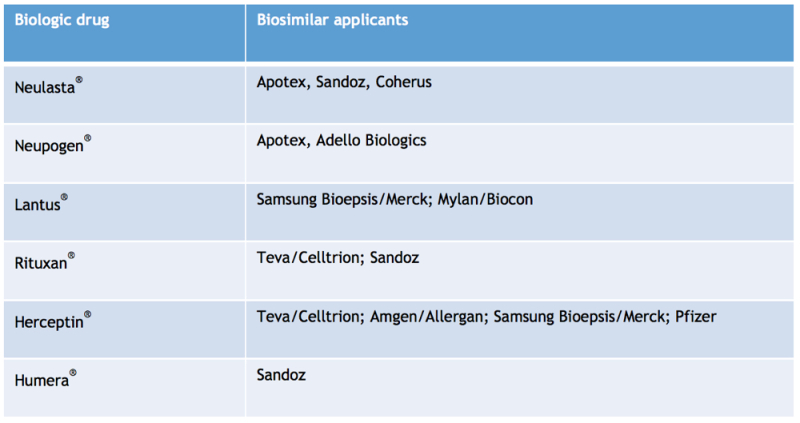

Fourteen biosimilar (§ 351(k)) applications are currently pending:

These applications have encountered more challenges on their approval pathways; several of them have received Complete Response Letters from the FDA (indicating that the agency will not approve the application under 21 C.F.R. §§ 314.125 or 314.127), and many have been pending longer than the 10-20 month average experienced by the already-approved biosimilars.

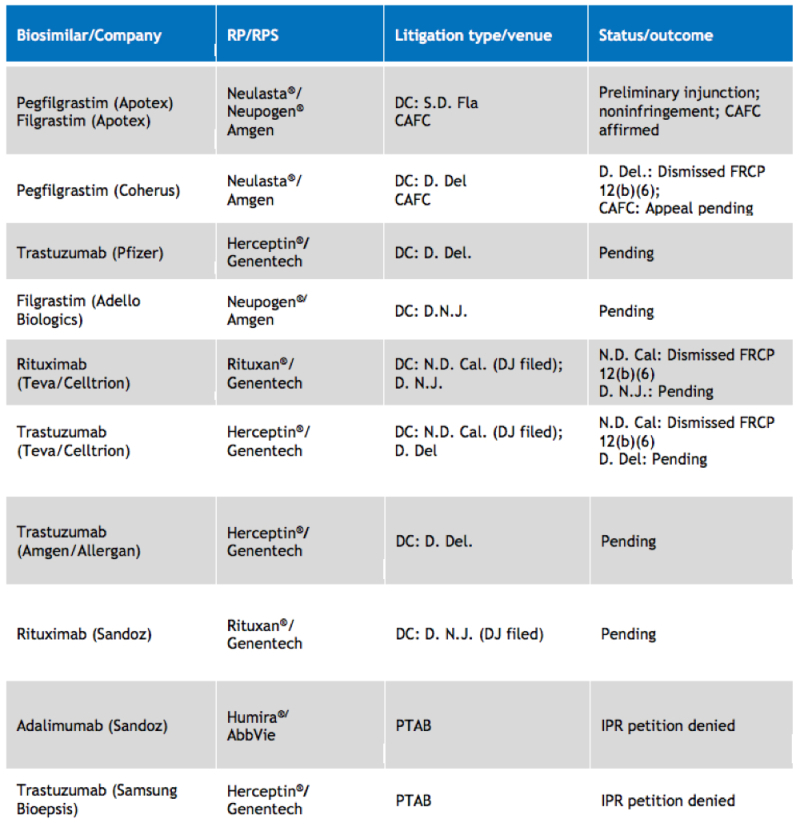

Biosimilar litigation is also proceeding and provides a reason that some of the approved biosimilars are not yet on the market (including Erelzi®, Cyltezo®, Mvasi, and Mylan/Biocon's Neulasta® biosimilar, Fulphila™). Consistent with expectations during passage of the BPCIA, there is also active litigation involving reference product sponsors and biosimilar applicants:

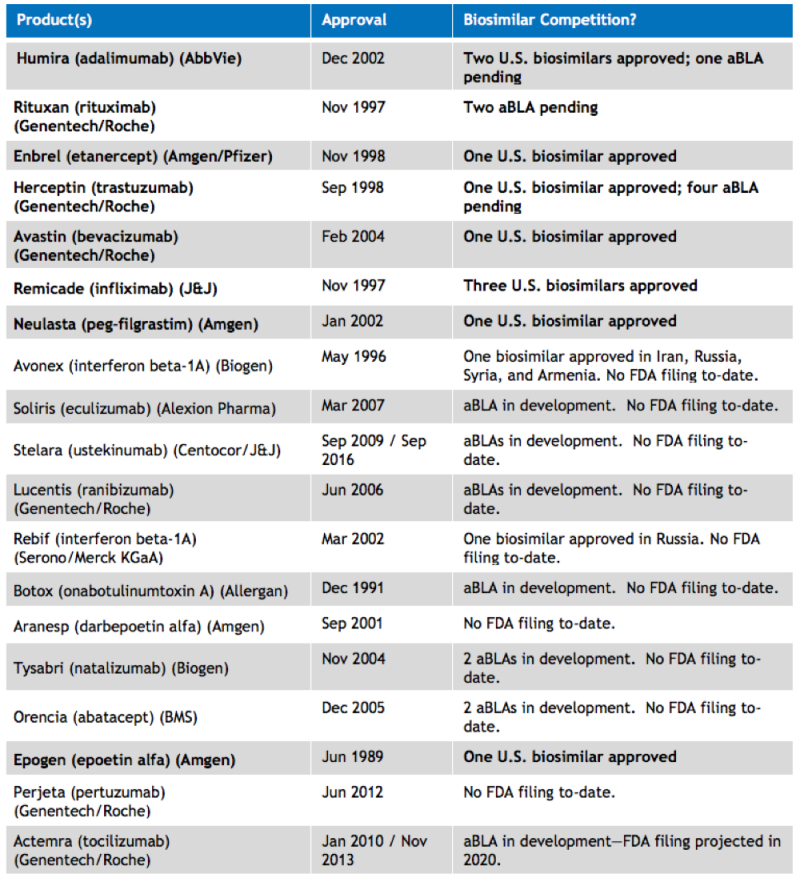

So far, approved biosimilars and pending biosimilar applications have been concentrated amongst the top U.S. biologic drugs, but there are several such drugs that are among these top drugs and have no prospective biosimilar competitors:

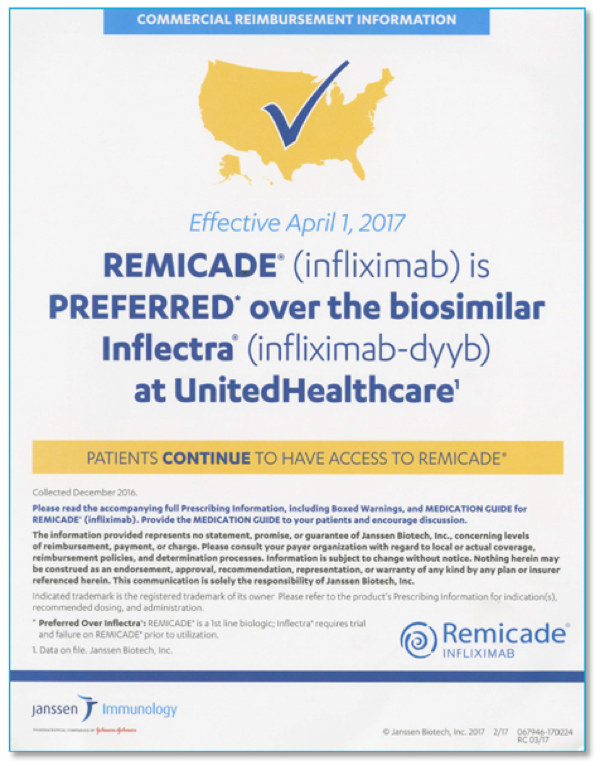

Finally, it must be recognized that other considerations can and have arisen, particularly antitrust concerns. Pfizer filed suit against Johnson & Johnson and Janssen Biotech for antitrust violations related to alleged anticompetitive activities surrounding competition between Remicade® and Inflectra®. Pfizer alleged that the defendants engaged in "improper exclusionary tactics," including exclusionary contracts, coercive rebate policies with insurers, hospitals, clinics ("fail first" restrictions), exclusionary rebates, bundling, and coverage restrictions. This advertisement hasn't helped:

Pfizer's four-count complaint alleged Sherman Act Section 2 violations for monopolization and attempted monopolization; Clayton Act violations for entering into exclusive contracts; and Sherman Act Section 1 violations for entering into agreement in restraint of trade. Pfizer has asked the court for $150 million in damages, attorneys' fees, costs, and an injunction. J&J/Janssen has responded with a motion to dismiss under Fed. R. Civ. Pro. 12(b)(6) based in pleadings deficiencies under Ashcroft v. Iqbal and Bell Atlantic Corp. v. Twombly. Substantively, defendants allege that Pfizer did not show antitrust injury or anticompetitive behavior, and that their actions were just robust capitalist competition. The motion has been pending since November 2017, and the court has stayed discovery while considering the motion.

Within the last year, the number of approved biosimilars in the U.S. has more than doubled, and with the number of pending biosimilar applications it is likely that this trend will continue. One aspect of the BPCIA has not yet come to pass, a designation of any biosimilar as being interchangeable. The FDA released draft Guidance directed to the standards it is considering for awarding an interchangeability designation in January 2017 (see Considerations in Demonstrating Interchangeability with a Reference Product); a Final Guidance is expected in 2019.

*Adapted from a talk given at the American Conference Institute's 9th Annual Conference on Biosimilars, held in New York, New York on June 25-27, 2018.