Regulations recently coming into effect under the Corporate Transparency Act (CTA) may impose new beneficial ownership reporting obligations on clean energy tax equity partnerships and joint ventures. The rules now require reporting companies to disclose certain personal information of each “beneficial owner” to the Financial Crimes Enforcement Network (FinCen). The regulatory language and available guidance raise a number of questions in the context of these equity investment structures.

Given the complexity of these issues and the new reporting deadlines—90 days from formation for entities formed in 2024 and January 1, 2025 for pre-2024 entities—it is important that members of the renewable energy community turn their attention to these issues now and proactively determine their reporting requirements.

What Is the CTA and What Has Changed?

The US Congress enacted the CTA on January 1, 2021 as part of the 2021 National Defense Authorization Act. The CTA directs FinCen to establish a national registry of beneficial ownership information (BOI) for the beneficial owners of most entities created or registered to do business in the United States.

FinCen published a Final Rule on September 30, 2022 that established BOI reporting requirements pursuant to the CTA. The Final Rule became effective January 1, 2024.

Who Must Report?

The Final Rule applies to “reporting companies,” which are bifurcated between domestic reporting companies and foreign reporting companies. A domestic reporting company is defined as any entity that is

- a corporation;

- a limited liability company (LLC); or

- created by the filing of a document with a secretary of state or any similar office under the law of a state or American Indian tribe, which would include limited partnerships that file with the secretary of state.

A foreign reporting company is defined as any entity that is

- a corporation, LLC, or other entity;

- formed under the law of a foreign country; and

- registered to do business in any state or tribal jurisdiction by the filing of a document with a secretary of state or any similar office under the law of a state or American Indian tribe.

Certain types of entities are granted exceptions from the BOI reporting requirements, including “large operating companies” that (1) employ more than 20 full-time employees in the United States, (2) have an operating presence at a physical office within the United States, and (3) filed a federal income tax or information return in the United States for the previous year demonstrating more than $5 million in gross receipts or sales, excluding gross receipts or sales from sources outside of the United States.

Many sponsors and investors in the renewable energy industry may satisfy these requirements at an entity level up the corporate chain. Likewise, there are a number of exempt entity categories—e.g., banks, depository institution holding companies, Exchange Act registered entities—that could potentially apply to investors.

Most relevant for tax equity partnerships, the rule provides that subsidiaries “whose ownership interests are controlled or wholly owned, directly or indirectly,” by certain other types of exempt entities (including the exemptions listed above) are also exempt. The subsidiary exemption may cover certain tax equity partnerships and joint venture entities, but it may not apply to other types of subsidiaries such as certain subsidiaries owned by funds that qualify as “pooled investment vehicles.”[1]

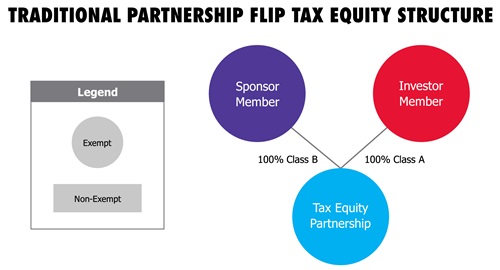

Will a Tax Equity Partnership or Joint Venture Entity Qualify for the Subsidiary Exemption if Both Members Are Exempt?

The CTA and Final Rule both stipulate (and FinCen guidance confirms) that the subsidiary exemption will apply to an entity whose ownership interests are owned or controlled “by 1 or more” exempt entities. 31 USC § 5336(a)(11)(B)(xxii); see also 31 CFR § 1010.380(c)(2)(xxii); FinCen’s Small Entity Compliance Guide (FinCen Compliance Guide), Section 4.2, at 39. In the example above, the Tax Equity Partnership would be exempt since all of its owners are themselves exempt entities.

What Happens if One of the Owners Is Not Exempt?

Under recent guidance from FinCen, “[i]f an exempt entity controls some but not all of the ownership interests of the subsidiary, the subsidiary does not qualify. To qualify, a subsidiary’s ownership interests must be fully, 100 percent owned or controlled by an exempt entity.”[2] Based on this guidance, partnership or joint venture entities at least partially controlled by any non-exempt entity would not qualify under the subsidiary exemption regardless of the ownership percentage held by the non-exempt member.

FinCen’s available guidance leaves open an issue of whether an owner can “control” the ownership interests of a different person such that a non-exempt owner that does not exercise control over its ownership interests would not violate the exception. Future FinCen policy could clarify what would constitute “control” of an ownership interest in this context.

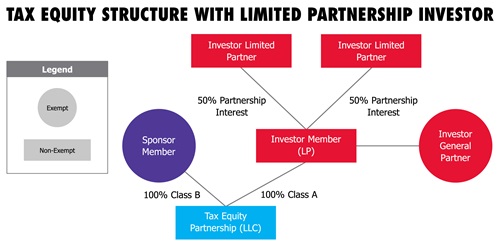

Note that certain investor members of a tax equity partnership may themselves be partnerships. In order for that upper-tier partnership entity to qualify for the subsidiary exemption, it would also need to have owners that are each themselves exempt entities.

What Are the Reporting Obligations for Non-Exempt Entities?

If no exemption applies, the regulation requires reporting companies to file an initial report by the applicable deadline referenced above, based on the effective date of the company’s creation or registration. See FinCen BOI FAQs.

In accordance with the regulation, companies are required to disclose in the initial report certain personal information about the reporting company and each beneficial owner.

Specifically, reporting companies must provide their (1) full name, (2) any trade name or “doing business as” name, (3) complete current US address, (4) state, tribal, or foreign jurisdiction of formation, (5) state or tribal jurisdiction of first registration (for foreign reporting companies only), and (6) Internal Revenue Service Taxpayer Identification Number (including an Employer Identification Number).

Similarly, each beneficial owner is required to disclose their (1) full legal name, (2) date of birth, (3) complete current address, and (4) unique identifying number and issuing jurisdiction from, and image of, either a US passport, state driver’s license, or identification document issued by a state, local government, or tribe. Reporting companies already existing or registered prior to January 1, 2024 do not need to report their company applicants.

The reporting company must submit an updated report to FinCen when there are changes to previously reported information concerning the reporting company or its beneficial owners. For example, any changes in beneficial owners, such as a change in the chief executive officer or a change to a beneficial owner’s name or address, must be reported to FinCen within 30 calendar days after the change occurs.

Who Must a Non-Exempt Entity Report As a ‘Beneficial Owner’?

The term “beneficial owner” includes any individuals who exercise “substantial control” over the reporting company or who own or control at least a 25% “ownership interest” in the reporting company.

As a general rule, FinCen requires identification of actual individuals as beneficial owners rather than intermediate entities or holding companies in the corporate chain. However, when reporting beneficial ownership based on the 25% ownership interest test, intermediate entity names may be reported instead of individuals if the intermediate entity is an exempt entity or if the beneficial owners of the reporting company and intermediate entity are the same. This special rule does not apply to beneficial ownership through substantial control, so it will still be necessary to identify any individuals who exercise substantial control.

“Substantial control” is defined broadly and includes a catchall term encompassing “any other form of substantial control.” Examples include any individual that (1) serves as a senior officer of the reporting company; (2) has authority over appointment or removal of any senior officer or members of the board; (3) directs, determines, or has substantial influence over important decisions made by the reporting company; or (4) has direct or indirect exercise of substantial control through board representation, ownership of a majority of the voting power, rights associated with a financing arrangement, or control over one or more intermediary entities that exercise substantial control over a reporting company.

Similarly, the term “ownership interest” is defined broadly to encompass not just an equity interest but also other forms of ownership interest. These include (1) any equity, stock, or similar instrument; (2) any capital or profit interest in an entity; (3) any instrument convertible to equity or stock interest; (4) any option or privilege to buy or sell any of the foregoing interest without an obligation to do so; or (5) any other instrument, contract, arrangement, understanding, relationship, or mechanism used to establish ownership.

The following illustration demonstrates how complex the determination of beneficial ownership may be in a renewable energy investment structure involving both limited liability companies and limited partnerships.

In this example, ownership and substantial control may be difficult to determine or may reside with individuals up the corporate chain. The Tax Equity Partnership, Sponsor Member, and Investor Member may not have any individual managers or officers, and there could be several individuals who exercise substantial control at various holding and equity ownership levels.

Determining who owns at least 25% of the “ownership interests” in the Tax Equity Partnership could be complicated by the unique allocations of cash, income, losses, and tax benefits of the partnership flip structure. In many cases these will change over the course of the partnership based on the passage of time and/or the returns received by the Investor Member.

While the agency has issued some illustrative guidance in the FinCen Compliance Guide, the term “ownership interest” remains susceptible to multiple possible interpretations in this context. Further, if the Investor Limited Partners are determined to own at least 25% ownership interests, then sponsors would need to trace the ownership of these limited partners up the chain. Similar and additional considerations would apply if the Investor Member were formed as a limited liability company and when a corporation is placed somewhere in the partnership structure.

The questions raised in the illustration above demonstrate the potential benefits of qualifying a tax equity partnership or other joint venture entity under the subsidiary exemption.

Where Can I Obtain More Information?

Morgan Lewis’s Corporate Transparency Act Task Force is monitoring the latest regulatory developments, and our lawyers are actively providing guidance to members of the renewable energy community and clients across several industries facing new reporting obligations. Additional resources with respect to the CTA and BOI reporting can be found on the Task Force landing page. Please contact us for additional information.

[1] For more information on fund reporting, see our LawFlash US Corporate Transparency Act: Impact on Private Funds and Venture Capital Funds.

[2] See FinCen’s Beneficial Ownership Information Reporting Frequently Asked Questions, L. 3. (the FinCen BOI FAQs).

[View source.]