WHAT HAPPENED

On March 6, 2024, a divided SEC approved climate-related disclosure rules. The new rules will require disclosure of:

- Climate-related risks that have had or are reasonably likely to have a material impact on the company’s business strategy, results of operations or financial condition.

- Actual and potential material impacts of such risks.

- Material expenditures and impacts on financial estimates and assumptions from actions to mitigate or adapt to material climate-related risks.

- Board and management oversight of climate-related risks.

- Processes for identifying, assessing and managing material climate-related risks.

- Information about material climate-related targets or goals.

- For LAFs and AFs, as defined below, that are not otherwise exempted:

- After a one-year transition period, information about material Scope 1 emissions and/or Scope 2 emissions.

- After an additional transition period, an assurance report at the limited assurance level, which, for an LAF, following a second transition period, will be at the reasonable assurance level.

Compliance Dates and Accomodations

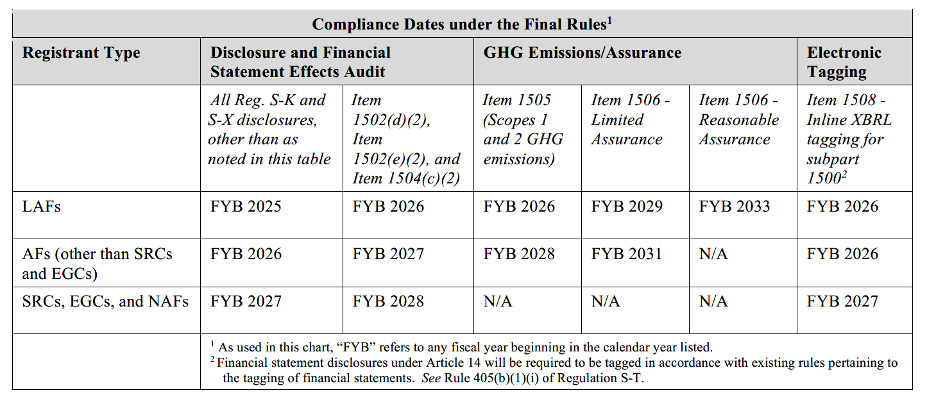

The new rules will become effective 60 days after publication in the Federal Register, with compliance phased-in based on the status of the company as a large-accelerated filer (LAF), accelerated filer (AF), non-accelerated filer (NAF), smaller reporting company (SRC) or emerging growth company (EGC):

The new rules also contain the following additional accommodations:

- As shown in the table, additional phase-in periods for disclosures pertaining to material expenditures, greenhouse gas (GHG) emissions, the assurance requirement and the electronic tagging requirement if the registrant is an LAF.

- A safe harbor from private liability for climate-related disclosures (excluding historical facts) pertaining to transition plans, scenario analysis, the use of an internal carbon price and targets and goals.

- An exemption from the GHG emissions disclosure requirement for SRCs and EGCs.

- An accommodation that allows Scope 1 and/or Scope 2 emissions disclosure, if required in an annual report, to be filed on a delayed basis as follows:

- For domestic companies, by incorporating by reference from the Form 10-Q for the second fiscal quarter in the fiscal year immediately following the year to which the GHG emissions disclosure relates, or by amending the Form 10-K no later than the 10-Q deadline.

- For foreign private issuers, by an amendment to their annual reports on Form 20-F, which will be due no later than when such disclosure would be due for a domestic registrant.

- For Securities Act or Exchange Act registration statements, as of the most recently completed fiscal year that is at least 225 days before the effective date of the registration statement.

Presentation of the Disclosures

The new rules will require companies to:

- File the climate-related disclosure in their registration statements and Exchange Act annual reports filed with the

- Provide the Regulation S-K mandated climate-related disclosures either in:

- A separate, appropriately captioned section of their registration statement or annual report or in another appropriate section of the filing, such as Risk Factors, Description of Business or Management’s Discussion and Analysis, or

- Alternatively, by incorporating such disclosure by reference from another SEC filing as long as the disclosure meets the electronic tagging requirements of the final rules.

- If required to disclose its Scopes 1 and 2 emissions, provide such disclosure:

- For a domestic filer, in (1) its annual report on Form 10-K, (2) its quarterly report on Form 10-Q for the second fiscal quarter in the fiscal year immediately following the year to which the GHG emissions metrics disclosure relates incorporated by reference into its Form 10-K or (3) an amendment to its Form 10-K filed no later than the due date for the Form 10-Q for its second fiscal quarter.

- For an FPI not filing on domestic forms, in (1) its annual report on Form 20-F or (2) an amendment to its annual report on Form 20-F, which will be due no later than 225 days after the end of the fiscal year to which the GHG emissions metrics disclosure relates.

- If filing a Securities Act or Exchange Act registration statement, as of the most recently completed fiscal year that is at least 225 days prior to the date of effectiveness of the registration statement.

- If required to disclose Scopes 1 and 2 emissions, provide such disclosure for the most recently completed fiscal year and, to the extent previously disclosed, for the historical fiscal years included in the filing.

- If required to provide an attestation report over Scope 1 and Scope 2 emissions, provide such attestation report and any related disclosures in the filing that contains the GHG emissions disclosures to which the attestation report relates.

- Provide the financial statement disclosures required under Regulation S-X for the most recently completed fiscal year, and to the extent previously disclosed or required to be disclosed, for the historical fiscal years included in the filing, in a note to the registrant’s audited financial statements.

- Electronically tag climate-related disclosures in Inline XBRL.

TAKEAWAYS

The new rules will undoubtedly face legal and political challenges, as evidenced by a lawsuit filed by ten states shortly after the SEC approved the rules. Others are likely to follow.

However, in light of the sweeping nature of the new requirements, companies should consider establishing or strengthening their policies and procedures to prepare for the new rules –recognizing that developments could alter the SEC’s compliance schedule. Steps could include:

- Developing new systems and adjust disclosure controls and procedures to ensure the accurate tracking and reporting of required disclosures, including material GHG emissions, material expenditures and material impacts on financial estimates and assumptions that directly result from climate-related mitigation or adaptation activities.

- Updating disclosure policies to establish procedures to utilize the extended safe harbor.

- Reviewing board and management oversight of climate-related risks in anticipation of required disclosures.

- Considering what level of audit committee involvement would be appropriate with respect to the selection and retention of attestation providers for climate-related disclosures, including pre-approval in cases where the existing auditor would be engaged.

- Evaluating the sufficiency of internal resources and expertise and the availability and expertise of third parties to provide training, staffing or otherwise to supplement those resources.

- Confering with the financial reporting team and external auditor on steps to implement the new financial statement disclosure requirements.

CHANGES FROM PROPOSED RULES

In response to more than 24,000 comment letters, the changes from the rules proposed in March 2022 included:

- Reducing the prescriptive rigor of certain disclosure requirements, such as climate-related risk, board oversight and risk management.

- Including a materiality threshold for certain disclosures, such as climate-related risks, scenario analyses and use of internal carbon prices.

- Eliminating a requirement to describe climate expertise for directors.

- Exempting issuers other than LAFs and AFs from Scopes 1 and 2 disclosure requirements, and phasing-in such disclosures, along with providing accommodations for attestation.

- Eliminating any requirement to provide Scope 3 disclosures.

- Reducing the financial statement disclosure requirements for severe weather events and other natural conditions and transition activities.

- Extending the PLSRA safe harbor for certain disclosures, other than historical facts, with respect to a company’s transition plan, scenario analysis, internal carbon pricing and targets and goals.

- Eliminating any requirement for a private company that is party to a business combination to provide climate-related disclosures in the S-4 or F-4.

- Eliminating any requirement to disclose material changes to climate-related disclosures in a 10-Q or, a 6-K in the case of foreign private issuers.

- Extending certain phase-in periods.

DEEPER DIVE

The new rules add a new subpart 1500 to Regulation S-K and a new Article 14 to Regulation S-X , which will require companies to provide certain climate-related disclosures in their Securities Act and Exchange Act registration statements and Exchange Act reports. The SEC believes the rules will result in more consistent, comparable and decision-useful information and, by requiring their inclusion in SEC filings, the information will be more reliable.

Climate-Related Disclosures -- Subpart 1500 of Regulation S-K

The new rules will require companies to disclose:

- Material Risks (Item 1502(a)). Climate-related risks that have had or are reasonably likely to have a material impact on the company’s business strategy, results of operations or financial condition in the short-term (next 12 months) and separately in the long-term (beyond).

- Address both physical risks, whether acute (such as hurricanes, floods, tornadoes and wildfires) or chronic (such as sustained higher temperatures, sea level rise and drought), as well as transition risks, i.e., the impacts from regulatory, technological or market changes to address mitigation or adaptation to climate-related risks.

- Description of nature, geographic location and impact of risk and extent of exposure.

- Effect on Strategy (Item 1502(b)). The actual and potential material impacts of any identified climate-related risks on the company’s strategy, business model and outlook, including, as applicable, any material impacts on a non-exclusive list of items.

- Whether the impacts of such risks have been integrated into the company’s business model or strategy, including whether and how resources are being used to mitigate climate-related risks.

- How any of the targets referenced below or in a described transition plan relate to the company’s business model or strategy.

- Mitigation or Adaptation (Item 1502(d)). If, as part of its strategy, a company has taken actions to mitigate or adapt to a material climate-related risk, a quantitative and qualitative description of material expenditures incurred and material impacts on financial estimates and assumptions that, in management’s assessment, directly result from such mitigation or adaptation.

- Transition Plans (Item 1502(e)). If a company has adopted a transition plan (i.e., a strategy and implementation plan to reduce climate-related risks) to manage a material transition risk, a description of the plan, and updated disclosures in subsequent years describing the actions taken during the year under the plan, including how such actions have impacted its business, results of operations or financial condition, and quantitative and qualitative disclosure of material expenditures incurred and material impacts on financial estimates and assumptions as a direct result of the disclosed actions.

- Scenario Analysis (Item 1502(f)). If a company uses scenario analysis and, in doing so, determines that a climate-related risk is reasonably likely to have a material impact on its business, results of operations or financial condition, certain disclosures regarding such use of scenario analysis, including a brief description of the parameters, assumptions and analytical choices used as well as expected material financial or other impacts on the company under each scenario.

- Internal Carbon Price (Item 1502(g)). If a company’s use of an internal carbon price is material to how it evaluates and manages a material climate-related risk, certain disclosures about the internal carbon price (or prices, if more than one), including price per metric ton of CO2e, and total price, including how the total price is estimated to change over the time periods referenced Any material differences among the entities use the internal carbon price and those used for calculating GFG emissions.

- Board Oversight (Item 1501(a)). Any oversight by the board of directors of climate-related risks.

- Identification of any board committee responsible for oversight.

- Description of processes by which the board or such committee is informed about such risks.

- Whether and how the board oversees progress against climate-related targets, goals or transition plan

- Management Oversight (Item 1501(b)). Any role by management in assessing and managing the company’s material climate-related risks.

- Whether and which management positions or committees are responsible for assessing and managing such risks, and their relevant expertise.

- The processes by which such positions or committees assess and manage climate-related risks.

- Whether they report information about such risks to the board.

- Risk Management (Item 1503). Any processes the company has for identifying, assessing and managing material climate-related risks and, if the company is managing those risks, whether and how any such processes are integrated into its overall risk management system or processes.

- How it identifies whether it has incurred or is reasonably likely to incur a material physical or transition risk.

- How it decides whether to mitigate, accept or adapt to the particular risk.

- How it prioritizes whether to address the climate-related risk.

- Targets and Goals (Item 1504). Specified information about a company’s climate-related targets or goals, if any, that have materially affected or are reasonably likely to materially affect its business, results of operations or financial condition.

- As applicable, scope of activities included in the target; unit of measurement; time horizon; any defined baseline time period; method of tracking progress; and plan to achieve target or goal.

- Disclosures include material expenditures and material impacts on financial estimates and assumptions as a direct result of the target or goal or actions taken to make progress toward meeting such target or goal.

- Specified information about carbon offsets or renewable energy credits or certificates (RECs) if they have been used as a material component of the company’s plan to achieve climate-related targets or goals.

- Updated disclosures in subsequent years to include description of actions taken to achieve targets or goals.

- GHG Emissions (Item 1505). For LAFs and AFs that are not otherwise exempted, information about Scope 1 emissions and/or Scope 2 emissions, if such emissions are material.

- Disclosure of any described scope of emissions expressed in the aggregate in terms of CO2e, including any constituent gas, if individually materially (e.g., disclosed as a target), disaggregated from other gases.

- Disclosure of emissions in gross terms by excluding the impact of any purchased or generated offsets.

- “Manure management systems” are excluded, as required by the 2023 Consolidated Appropriations Act.

- Description of methodology, significant inputs and significant assumptions used to calculate the disclosed GHG emissions, including organizational boundaries, i.e., entities owned or controlled by the company, and any material difference from the scope of entities reflected in its financial statements.

- Materiality of Emissions. The SEC provided guidance when evaluating the materiality of emissions:

“A registrant’s Scopes 1 and/or 2 emissions may be material because their calculation and disclosure are necessary to allow investors to understand whether those emissions are significant enough to subject the registrant to a transition risk that will or is reasonably likely to materially impact its business, results of operations, or financial condition in the short- or long-term. For example, where a registrant faces a material transition risk that has manifested as a result of a requirement to report its GHG emissions metrics under foreign or state law because such emissions are currently or are reasonably likely to be subject to additional regulatory burdens through increased taxes or financial penalties, the registrant should consider whether such emissions metrics are material under the final rules. A registrant’s GHG emissions may also be material if their calculation and disclosure are necessary to enable investors to understand whether the registrant has made progress toward achieving a target or goal or a transition plan that the registrant is required to disclose under the final rules.

“Conversely, the fact that a registrant is exposed to a material transition risk does not necessarily result in its Scope 1 and Scope 2 emissions being de facto material to the registrant. For example, a registrant could reasonably determine that it is exposed to a material transition risk for reasons other than its GHG emissions, such as a new law or regulation that restricts the sale of its products based on the technology it uses, not directly based on its emissions. Such a risk may trigger disclosure under other provisions of subpart 1500 but may not necessarily trigger disclosure of Scope 1 and Scope 2 emissions information under Item 1505.”

- Attestation of Emissions Disclosure (Item 1506). After the phase-in period, companies required to disclose Scope 1 and/or Scope 2 emissions will need to include an assurance report at the limited assurance level, which, for an LAF, following an additional transition period, will be at the reasonable assurance level.

- The SEC did not include definitions of “limited assurance” and “reasonable assurance” as it believes those terms are defined by prevailing standards and generally well understood. The report need not cover the effectiveness of internal control over GHG emissions disclosure.

- Independence; Expertise. Attestation providers must satisfy specified requirements for independence and expertise, based on their competence and capabilities.

- Attestation Standards. The report must be provided pursuant to standards established by a body or group that has followed due process procedures, including the broad distribution of the framework for public comment, and either (1) publicly available at no cost or (2) widely used for GHG emissions assurance. The SEC confirmed that the PCAOB, AICPA, IAASB and ISO standards meet these requirements.

- Pre-Approval. To the extent that the company’s auditor is engaged to provide an attestation report, the auditor would be required to comply with applicable, existing pre-approval requirements.

- Limited Assurance Not Expertized. Amended rule 436 will provide that a report by an attestation provider covering Scope 1, Scope 2 and/or voluntary Scope 3 emissions at a limited assurance level will not be considered expertised for purposes of Securities Act liability. However, amended rules will require the filing as an exhibit a letter from the attestation provider acknowledging its awareness of the use in registration statements of any of its reports which are not otherwise subject to SEC consent requirements.

- The requirement will apply on a prospective basis only with disclosure for historical periods phasing in over time. In the first year that an AF or LAF is required to provide an attestation report, such report is only required to cover the Scope 1 and/or Scope 2 emissions for its most recently completed fiscal year.

- Oversight; Disagreements. Companies must disclose whether the GHG emission attestation engagement is subject to any oversight inspection program (and, if so, which one) as well as certain information when there is a change in, and disagreement with, the attestation provider.

- Voluntary Assurance. If a company is not required to disclose its GHG emissions or to include a GHG emissions attestation report, it must nonetheless disclose certain information if it voluntarily discloses its GHG emissions in an SEC filing and voluntarily subjects those disclosures to third-party assurance.

Safe Harbor for Certain Disclosures

S-K Item 1507 provides a safe harbor for climate-related disclosures pertaining to specified sections of subpart 1500 relating to transition plans (1502(e)), scenario analysis (1502(f)), internal carbon pricing (1502(g)) and targets and goals (1504). Any information required by those sections, except for historical facts, is considered a forward-looking statement for purposes of the PSLRA, even for transactions or issuers otherwise excluded by the PSLRA.

The SEC also confirmed that the following disclosures made pursuant to any of the new rules will constitute “forward-looking statements” under the PSLRA, unless included in financial statements:

- A statement containing a projection of revenues, income (including income loss), earnings (including earnings loss) per share, capital expenditures, capital structure, or other financial items.

- A statement of the plans and objectives of management for future operations, including plans or objectives relating to the products or services of the

- A statement of future economic performance, including any such statement contained in a discussion and analysis of financial condition by the management, made pursuant to SEC rules.

- Any statement of the assumptions underlying or relating to the above statements.

- A statement containing a projection or estimate of items specified by SEC rule or Regulation.

New Article 14 of Regulation S-X

Disclosure in Note to Financial Statements. Article 14 of Regulation S-X will require that all companies (including SRCs and EGCs) disclose, in a note to the financial statements:

- Severe Weather. The capitalized costs, expenditures expensed, charges and losses incurred as a result of severe weather events and other natural conditions, such as hurricanes, tornadoes, flooding, drought, wildfires, extreme temperatures and sea level rise, subject to applicable one percent and de minimis disclosure thresholds.

- Separate disclosure of any recoveries as part of contextual information to reflect the net

- Carbon Offsets and RECs. The capitalized costs, expenditures expensed, and losses related to carbon offsets and renewable energy credits or certificates (RECs) if used as a material component of a company’s plans to achieve its disclosed climate-related targets or goals.

- No one percent threshold – only materiality.

- Beginning and ending balances on balance sheet for fiscal year.

- Estimates and Assumptions. If the estimates and assumptions a company uses to produce the financial statements were materially impacted by risks and uncertainties associated with severe weather events and other natural conditions or any disclosed climate-related targets or transition plans, a qualitative description of how the development of such estimates and assumptions was impacted.

These disclosures are required whenever a company must include both the new subpart 1500 disclosures and its audited financial statements – even if the company does not have information to report pursuant to subpart 1500.

Contextual Information. Companies must provide accompanying “contextual information” describing how each specified financial statement effect – those covered in the first two bullets -- was derived. The description should cover significant inputs and assumptions used, significant judgments made and other information needed to understand such effect and, if applicable, policy decisions made by the company to make the calculations. It should also include the accounting policy for carbon offsets and RECs for disclosures covered by the 2d bullet.

Location on Financial Statements. The capitalized costs, expenditures expensed, charges and losses represent amounts derived from transactions and recorded in the company’s books and records underlying its financial statements. The new rules require companies to disclose where on the balance sheet and income statement these amounts are presented.

Attribution Principle. The new rules require a company to attribute a cost, expenditure, charge, loss or recovery to a severe weather event or other natural condition and disclose the entire amount of the expenditure or recovery when the event or condition is a significant contributing factor in incurring the cost, expenditure, charge, loss, or recovery.

DISSENTING STATEMENTS

Commissioners Peirce and Uyeda released vigorous dissents from the new rules. Peirce, in her remarks entitled Green Regs and Spam, criticized the rules as overly prescriptive, burying investors with excessive, granular disclosures and failing to use the existing principles-based approach to climate risk, even though supported by staff disclosure review and enforcement actions. She believes the costs will be substantial, will reduce the ability of companies to address other risks, and will not outweigh the benefits. Uyeda, in his remarks entitled A Climate Regulation under the Commission’s Seal, criticized the rule as representing “the culmination of efforts by various interests to hijack and use the federal securities laws for their climate-related goals.” Both faulted the SEC for not re-proposing the rules in light of the scope of changes from the proposal and raised questions about the authority of the SEC to adopt the rules.

[View source.]