[author: Carlos E. Juarez]*

In its Annual Report (the “Report”), the Securities and Exchange Commission’s Office of the Advocate for Small Business Capital Formation (OASB) provides data on the reliance by private and public companies on exempt offerings to raise capital. Based on data provided by the SEC’s Division of Economic and Risk Analysis, between July 1, 2022 and June 30, 2023, companies raised approximately $4.2 trillion in private and exempt offerings. The Report breaks down the data based on the exemption relied upon by the companies. For example, companies raised $169 billion in Rule 506(c) offerings, $2.7 trillion in Rule 506(b) private placements, and $258 million in Rule 504 limited offerings. Companies raised $352 million through Regulation Crowdfunding. Companies raised $1.3 trillion in all other exempt offerings, including Regulation S and Rule 144A offerings. Of course, these numbers do not account for amounts raised in Section 4(a)(2) offerings.

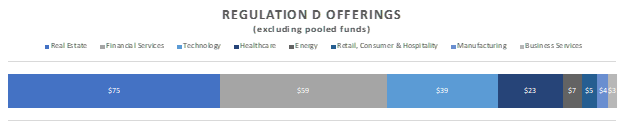

The Report breaks down offerings based on the issuer’s sector, with companies in the real estate, financial services, tech and healthcare sectors accounting for the most significant activity. Pooled funds accounted for the majority of funds raised in reliance on Regulation D, with over $1.5 trillion raised in the first half of 2023.

Source: Sec. & Exch. Comm’n

US public and private companies raised $834 billion in private and exempt offerings, with Rule 506(b) offerings accounting for 32% of all private offerings.

Source: Sec. & Exch. Comm’n

For early-stage companies, seed stage activity has declined significantly with $6.6 billion raised in seed rounds in the first half of 2023, compared to $14 billion in same time period in the prior year. Growth companies accessing private VC funding has also dropped. In the first half of 2023, companies raised $86 billion in venture investments in 6,514 offerings, representing a 46% decline compared to the first half of 2022. Companies raised $20 billion in Series A and B rounds, while Series C+ rounds raised $59 billion in the same period. In the second quarter of 2023, 19% of deals were down rounds. This is a 52% increase year-over-year. The Report also highlights an increase in the median time between a seed stage offering and a Series A raise, from 14 months in 2014 to 25 months in 2023. The below illustrates the average time between rounds.

Source: Sec. & Exch. Comm’n

Read the OASB Report and more about exempt offering alternatives.

*J.D. Candidate

[View source.]