Global political and business leaders have purported ambitious climate-focused goals for the decades ahead, such as eliminating landfill waste by 2030, transitioning to 100% renewable energy use by 2035, and achieving net-zero carbon neutrality by 2050. To reach these goals, ESG (Environmental Social and Governance) assets are expected to represent “more than a third of the $140.5 trillion in projected total assets under management” at over $50 trillion by 2025.

Costs of inaction on climate issues to the U.S. economy are estimated at over $14 trillion by 2070 – failure to act on climate issues will have major impacts on our economy and society. The U.S. Securities and Exchange Commission (SEC) has set monitoring Climate Risk and ESG reporting as a priority due to the importance of climate risks to investors.

Corporations have historically been able to stealthily circumvent accountability. With the actions of empowered and informed whistleblowers, misconduct can be exposed. Whistleblowers play a vital role in bringing violations to light, as they possess inside information about whether a registrant’s disclosures of climate-related risks accurately reflect the registrant’s conduct.

The United States’ strong whistleblower laws, including the Dodd-Frank Act (DFA) and False Claims Act (FCA), provide opportunities for whistleblowers to come forward with information about ESG violations such as price gouging and misreporting and other forms of fraud damaging the environment.

The SEC Whistleblower Program

In 2010, the Dodd-Frank Act established the SEC Whistleblower Program which offers monetary awards and anti-retaliation protection to whistleblowers reporting securities law violations.

Qualified whistleblowers may be eligible for rewards ranging between 15 and 30 percent of what the Commission recovers from an enforcement action or sanction. Since its establishment in 2010, the program has recovered over $6.3 billion in sanctions from fraudsters and awarded close to $1.9 billion to whistleblowers.

The SEC Climate and ESG Task Force was launched on March 4, 2021. Focused on identifying climate misconduct and pursuing enforcement actions against companies that violate securities law, their work is bolstered by whistleblower tips, referrals, and complaints.

Some examples of ESG violations include companies involved in illegal pollution, failure to disclose environmental risks, or violation of environmental regulations. A whistleblower could report a company knowingly releasing toxic chemicals into a nearby water source.

Companies that commit financial fraud, misrepresent financial information, or engage in other governance violations may be reported under the whistleblower program. For example, a whistleblower could report a company that falsely represents its ESG practices to attract investment or appear to meet a regulatory standard. This is known as greenwashing.

Greenwashing is a deceptive marketing strategy that projects a false impression of a company’s ESG performance, by overstating, exaggerating, or misrepresenting their commitment to values. This gives investors and stakeholders the impression that the company is more sustainable and responsible than it is.

The SEC settled charges of $25 million against DWS Investment Management Americas Inc. in two enforcement actions related to alleged anti-money laundering violations and other misstatements regarding its ESG investment process, greenwashing their methods.

The SEC alleges that DWS “made materially misleading statements about its controls for incorporating ESG factors into research and investment recommendations for ESG integrated products, including certain actively managed mutual funds and separately managed accounts.”

Sanjay Wadhwa, Deputy Director of the SEC’s Division of Enforcement, and head of its Climate and ESG Task Force stated that “Here, DWS advertised that ESG was in its ‘DNA,’ but, as the SEC’s order finds, its investment professionals failed to follow the ESG investment processes that it marketed.”

The Financial Times reports that the investigation was prompted by a whistleblower complaint from DWS’s former head of ESG, Desiree Fixler. Following the SEC’s announcement, Fixler told the paper that “‘Greenwashing is harmful — to investors, communities, and overall financial stability.’”

The SEC’s Pending Climate Risk Disclosure Rules

In March of 2022, the SEC proposed rules which would make climate-related disclosures mandatory for public companies. The new rules would require companies, funds, and advisors to share their ESG strategies, risks, impact, and oversight methodology with investors, making it more difficult for companies to engage in greenwashing. The rules also amend the “Names Rule” so that funds with names suggesting a focus on ESG are obligated to direct 80% of their investments to companies that satisfy those characteristics.

If the proposed rule changes are adopted, they would make the failure to disclose climate risks a securities law violation. This means that individuals with knowledge of undisclosed climate risks could qualify for awards and protection under the SEC Whistleblower Program.

In any new disclosure requirements established by the SEC, whistleblowers will play a key role in ensuring that corporations’ statements are not false or misleading. In strengthening the ESG disclosures required by corporations, global whistleblowers have an increased ability to protect the climate, environment, and human rights.

Whistleblower attorneys Stephen M. Kohn and Mary Jane Wilmoth of Kohn, Kohn & Colapinto provided recommendations back in 2021 on how the SEC can best utilize its whistleblower program to combat climate change. They encourage “direct reporting to the SEC, use the whistleblower program to enforce climate-related risks, exercise discretion to implement the whistleblower program to have the maximum impact on climate-related crimes/violations, prioritize FCPA (Foreign Corrupt Practices Act) cases that impact climate, and fully implement the ‘related action’ rule.”

False Claims Act

The False Claims Act’s qui tam provisions permit private citizens with knowledge of fraud, corporate or individual, against the government to bring forth a lawsuit on behalf of the United States and are eligible to receive shares between 15 and 30% of the government’s recovery.

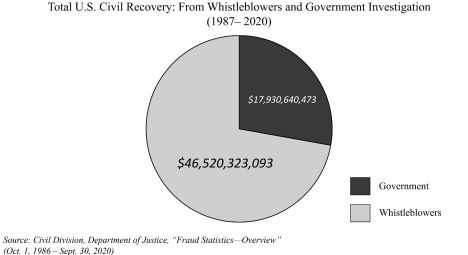

Whistleblowers have spearheaded the majority of civil recoveries through the FCA.

Whistleblowers can use the FCA to report environmental fraud, as seen in the case of Alex Chepurko.

Whistleblower Alex Chepurko

Alex Cherpuko was a financial trader at Caravan Trader when he realized that along with their producer, the company was pretending to manufacture new biofuel to qualify for millions in tax credits when they were selling unused biofuels from sources that already cashed in their tax credits.

Represented by whistleblower law firm Kohn, Kohn & Colapinto, Chepurko filed three separate whistleblower claims: as an anonymous whistleblower under the SEC Dodd-Frank Act whistleblower reward law, as one of the involved companies was publicly traded. Because the fraudsters were profiting from an environmental tax credit program, Chepurko filed confidentially under IRS tax evasion whistleblower law. The third case was filed in federal court “under seal” under the False Claims Act qui tam law. The False Claims Act covers false claims made to the Federal Government, including the Environmental Protection Agency’s alternative fuel program.

Chepurko’s whistleblowing ended the scam and collected millions of dollars in fines and penalties, shutting down the companies involved. Ringleaders were convicted criminally and received long jail sentences in U.S. ex rel. Chepurko v. e-biofuels, LLP, et al., the court ordered the defendants to pay the United States $69.6 million. Chepurko was entitled to a reward of between 25-30% of whatever the Government could collect on the judgment. Under the False Claims Act, taxpayers do not pay any of the whistleblower rewards. All proceeds paid to whistleblowers come directly from the fines and penalties obtained from the wrongdoers.

Conclusion

Whistleblowers play a vital role in exposing ESG greenwashing, as they are positioned to reveal information about unethical or illegal practices within organizations. By using corporate whistleblower award laws, individuals can hold these fraudulent organizations accountable while being protected from retaliation and qualifying for monetary awards.