Our Antitrust and Mergers & Acquisitions Groups analyze this year’s Hart–Scott–Rodino Act adjustments and the Federal Trade Commission’s plans for a potential government shutdown.

- The thresholds, representing a 7.3% increase over last year, go into effect on March 6

- The FTC will not handle pre-merger notification filings during a government shutdown

- Major changes to the HSR rules are on the way

On January 22, 2024, the Federal Trade Commission (FTC) announced the annual adjustment of the jurisdictional thresholds for pre-merger notification filings under the Hart–Scott–Rodino Antitrust Improvements Act of 1976 (HSR Act). The revisions account for changes in the U.S. gross national product and constitute an increase of approximately 7.3%. The FTC also published annual inflation adjustments for civil penalties for failure to file an HSR Act filing, as well as thresholds for Section 8 of the Clayton Act. In addition to these routine revisions, the FTC published an updated shutdown plan that may significantly impact the ability of dealmakers to submit HSR Act filings in the event of a government shutdown. And proposed changes to the HSR Act rules and form await final publication and an implementation date.

HSR Act Pre-Merger Notification Thresholds Revised

The HSR Act requires companies contemplating mergers or acquisitions of voting securities or assets that meet or exceed certain monetary thresholds to file notification forms with the FTC and the U.S. Department of Justice Antitrust Division (DOJ) and to wait a designated period (generally 30 days) before consummating the contemplated transaction. The new thresholds were published in the Federal Register on February 5, 2024 and will go into effect for transactions closing on or after March 6, 2024. For those transactions, companies will generally need to comply with the HSR Act pre-merger notification and waiting period requirements if either of the following is true:

- The size of the transaction is more than $119.5 million (up from $111.4 million) and the parties to the deal meet minimum “size of person” criteria (generally one party to the transaction must have total assets or annual net sales of $239 million or more and the other party must have total assets or net sales of at least $23.9 million); or

- The size of the transaction (as defined by the HSR Act and applicable regulations) is more than $478 million (up from $445.5 million) regardless of size-of-person criteria.

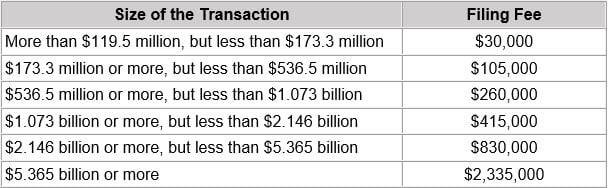

The FTC has also announced changes to the various thresholds that determine the amount of the required filing fees submitted with an HSR filing, a system that was expanded under legislation effective in 2023 and is being indexed for the first time based on the percentage increase in the Consumer Price Index. The new schedule effective March 6, 2024 is:

These requirements are subject to various exemptions and exceptions, and it is important to consult with experienced antitrust counsel to determine whether a filing is required. We note that the agencies have continued their suspension of the discretionary practice of granting “early termination” of the HSR Act waiting period for transactions that do not raise antitrust concerns that has been in effect since March 2020.

“Interlocking Directorates” Thresholds

Section 8 of the Clayton Act prohibits, with certain exceptions, one person from serving as a director or officer of two competing corporations. Under the FTC’s revised Section 8 thresholds, which became effective upon publication in the Federal Register on January 22, 2024, and increased by approximately 7.3%, a person may not serve as a director or officer of two competing corporations if each corporation has capital, surplus, and undivided profits aggregating more than $48,559,000, unless one or more of the corporations has competitive sales under $4,855,900 or other exceptions apply. Additionally, in a major shift to enforcement of Section 8 of the Clayton Act, the FTC has indicated that it interprets the statute to apply to non-corporate entities as well.

Inflation-Adjusted Civil Penalty Amounts

On January 11, 2024, the FTC also announced adjustments to various maximum civil penalty levels for certain laws it enforces. The action was required by the Federal Civil Penalties Inflation Adjustment Act Improvements Act of 2015, which significantly increased penalty levels in 2016 and required annual indexing of those levels for inflation. Of most interest, the maximum civil monetary penalty for violations of the HSR Act and Section 5 of the FTC Act (concerning unfair methods of competition and unfair or deceptive acts or practices) increased by approximately 3.2% from $50,120 to $51,744 per day of noncompliance. The new maximum civil penalties became effective upon publication in the Federal Register on January 10, 2024.

Updated Shutdown Plan Impact on HSR Act Filings

On January 23, 2024, the FTC published an updated shutdown plan, which details how the FTC will be impacted by a potential lapse in federal appropriations. Under the new plan, the FTC announced that the commission’s Premerger Notification Office, which handles HSR Act filings for the FTC and DOJ, will be closed during a government shutdown and that the FTC will not receive, accept, or process pre-merger notification filings under the HSR Act or respond to questions or requests for information or advice from outside parties. This marks a significant change from prior versions of the shutdown plan, which historically treated the acceptance and processing of HSR Act filings as an essential activity that continued during a shutdown. There remains considerable uncertainty whether a lapse in federal appropriations may occur in the near future. Additionally, it is not clear whether the FTC shutdown would commence immediately upon a formal lapse of funding. In the past, the FTC has often had a reserve of funding that allowed it to continue to operate for days or weeks after a formal lapse in funding.

Major Changes to HSR Rules Forthcoming

In June 2023, the FTC and DOJ proposed rules to amend the HSR form and its instructions. The proposed changes would be the most significant changes to the form in 45 years and would significantly increase the time and burden required to prepare HSR filings. The new HSR form would require the merging parties to submit narrative responses discussing horizontal overlaps and non-horizonal relationships, such as supply relationships, in response to a new “competition analysis” section. This section would also require the parties to identify and provide contact information for top customers, explain the rationale behind the transaction, and disclose the timeline for the deal. The new form would also require the submission of draft documents related to the transaction and ordinary course documents. The comment period on the pending proposed revisions to the HSR form and instructions ended on September 27, 2023. However, the agencies have yet to publish the final revised HSR form and instructions, which, if substantially similar to those published in June 2023, would represent a marked shift in practice.

Download PDF of Advisory

[View source.]