Defining Nature and Biodiversity

“Nature” refers to the natural world and includes non-living things (such as water, air and soil) and living things (such as plants, animals (including people) and fungi). People and society, including corporates and financial institutions contribute to and are affected by nature – we have to recognise that we are embedded in nature and depend upon it for our survival. “Natural capital” can be described as the stock of renewable and non-renewable resources derived from nature (e.g. plants, animals, air, water, soils, minerals) together with nature services, being those valuable services like pollination carried out in and by nature from which business and societies benefit.

“we must fix our relationship with the natural world or destroy human prosperity, well-being and our future. And it is with this knowledge in hand that in 2021 we must seek to join up the climate and nature agendas, and arrive at an ambitious, measurable and accountable post-2020 global biodiversity framework. To secure nature is to invest in our own self-preservation.” Inger Andersen, UN Under-Secretary-General and Executive Director of the UN Environment Programme.

In the same breath as nature, we often refer to “biodiversity” but this is slightly different. It refers to the wide array of biological life on Earth. We can observe biodiversity at two levels, in the genetic variation of species in a population (think farming and the narrow range of species which are produced) and in the variety of functions that different species perform in an ecosystem. For this reason, a common metric for biodiversity is the number of species present in an ecosystem. No one knows the number of species on Earth but around 1.2 million have been described by scientists and estimates of the total number range from 8 million to 100 million species. The Kunming-Montreal Global Biodiversity Framework (GBF) states that “An average of around 25 per cent of species in assessed animal and plant groups are threatened, suggesting that around 1 million species already face extinction, many within decades, unless action is taken to reduce the intensity of drivers of biodiversity loss”. Biodiversity is important because the more biodiversity there is in an ecosystem, the more productive that ecosystem is, and the more resilient and adaptable that ecosystem is in the face of global warming and other environmental and global change.

Why do nature and biodiversity matter?

In the last few years, the focus of governments and business has been on climate change. Following the adoption of the Paris Agreement in 2015, we have seen a global drive to reduce greenhouse gas emissions to reach net zero emissions to limit the impacts of climate change, to avoid, amongst other things, increases in extreme weather which will affect food production, reduce freshwater availability, bring ecosystems to collapse and cause widespread flooding and wildfires. But we are in the middle of a twin climate-ecological crisis. Climate change and biodiversity loss are interconnected. Loss of biodiversity is a driver of climate change and restoration of biodiversity is part of the climate change solution. In December 2022, the Kunming-Montreal Global Biodiversity Framework was adopted at COP 15. The GBF aims to halt and reverse nature loss and sets out global targets to be achieved by 2030 to safeguard and ensure sustainable use of nature and “relies on action and cooperation by all levels of government and by all actors of society”1.

At this juncture, given the interconnectedness noted above, biodiversity and climate change arguably need to be tackled together, making biodiversity restoration a key part of climate change solutions and ensuring that biodiversity does not become a victim of those solutions. Poor alignment can lead to ecosystem destruction, including for example cases of deforestation to accommodate new solar farms, siting wind farms on bird migration paths, leading to the death of many birds, and disruption of aquatic ecosystems, flooding and blocked fish migration from hydropower. We risk accelerating nature’s destruction unless biodiversity and ecosystems are fully considered in development decisions around climate change solutions, including wind, solar and hydropower facilities.

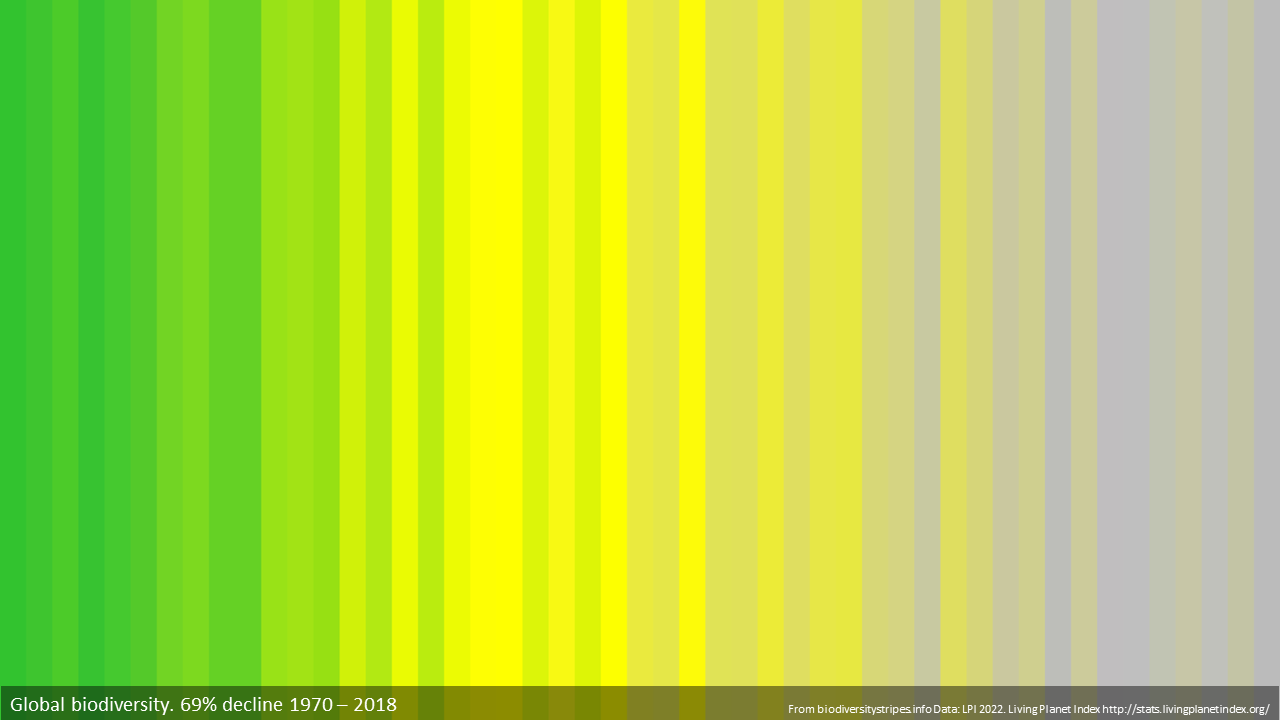

The extent of biodiversity loss is visually depicted in the “Biodiversity Stripes” below (showing global biodiversity loss between 1970 and 2018). The stripes were developed by Professor Miles Richardson et al of the University of Derby. Using data from the Living Planet Index they show an average population drop of 69% globally in mammals, birds, fish, amphibians and reptiles since 19702. In 2009, Rockström et al suggested in “A safe operating space for humanity” that biodiversity loss (based on extinction rate) is occurring at a rate not seen since the last global mass-extinction event and has already reached levels which the Earth cannot sustain without “significant erosion of ecosystem resilience”.3

So it is clear that the rate of biodiversity loss is dangerously high and businesses need to act now. But how is biodiversity loss linked to business risk? Almost all businesses have a direct or indirect link to nature. Using a simple food industry example to demonstrate this linkage – if a driver of change, such as climate change, occurs, one consequence would be strain on ecosystems which can result in a loss of a species, such as a honeybee (biodiversity loss). Honeybees (and many other types of bee and flying insects) provide nature services in the form of pollination. Decline in these species results in reduced rates of crop pollination. Agricultural and food sector businesses are consequently negatively impacted due to reduced production and even crop failures, supplies may have to be obtained from more expensive and/or distant sources, or may not be available at all. This is one example of how changes in nature impact businesses’ everyday activities. Nature-related risks are also closely connected to climate-related risks: ecosystems both emit and sequester carbon dioxide.

What is TNFD and how is it different to TCFD?

The Task Force on Climate-Related Financial Disclosures (TCFD) has been around for longer than Taskforce on Nature-related Financial Disclosures (TNFD). The TCFD provides a reporting framework for climate-related financial disclosure. It already applies in the UK and other countries, see here and here for more information and the International Sustainability Standards Board (ISSB), the sustainability accounting standard setter, confirmed that companies which apply the ISSB standards will meet the TCFD recommendations.

On 18 September 2023, the TNFD published its Final Recommendations in respect of nature-related financial disclosure. The Final Recommendations provide a framework for assessing and disclosing nature-related impacts, dependences, risks and opportunities and their interconnection and the TNFD therefore has a wider remit than the TCFD. The intention is that the TNFD provides a framework for entities to consider and disclose nature-related issues affecting their business, alongside their climate-related risk reporting. The TNFD builds on the existing structure of the TCFD, using the same categories of governance, strategy, risk management and metrics and targets for purposes of reporting on nature-related issues. It is expected that TNFD will be supported globally and the disclosure obligations will be introduced into national disclosure regimes as TCFD has been. In addition, we expect the ISSB standards and guidance to be aligned with the TNFD in due course, leading to a simpler, more streamlined approach.

Together with the Final Recommendations, the TNFD has published accompanying guides, including the following (additional information is available on their website):

How has the TNFD framework evolved from the TCFD framework?

The TNFD framework was based on TCFD framework to provide a familiar structure and to provide continuity in disclosure of climate-related risks, which will now form a part of “nature-related risks”. In the short term, as with any change in reporting standards, the TNFD will cause upheaval as entities come to terms with the wider scope of disclosures. In the long-term it provides a framework (not a standard) for businesses to assess, disclose, measure and reduce their nature-related risks.

The key differences between TCFD and TNFD include:

- Greater emphasis on the location (including identifying material locations and sensitive locations) of assets and/or activities in the TNFD in order to accommodate specific considerations arising from regional/country differences;

- The TNFD includes nature-related metrics which are holistic and much more complex than those included in TCFD; and

- Organisations will need to disclose how affected stakeholders are engaged in the assessment of, and response to, nature-related dependencies, impacts, risks and opportunities and to this end the TNFD has published Guidance on engagement with Indigenous Peoples, Local Communities and affected stakeholders.

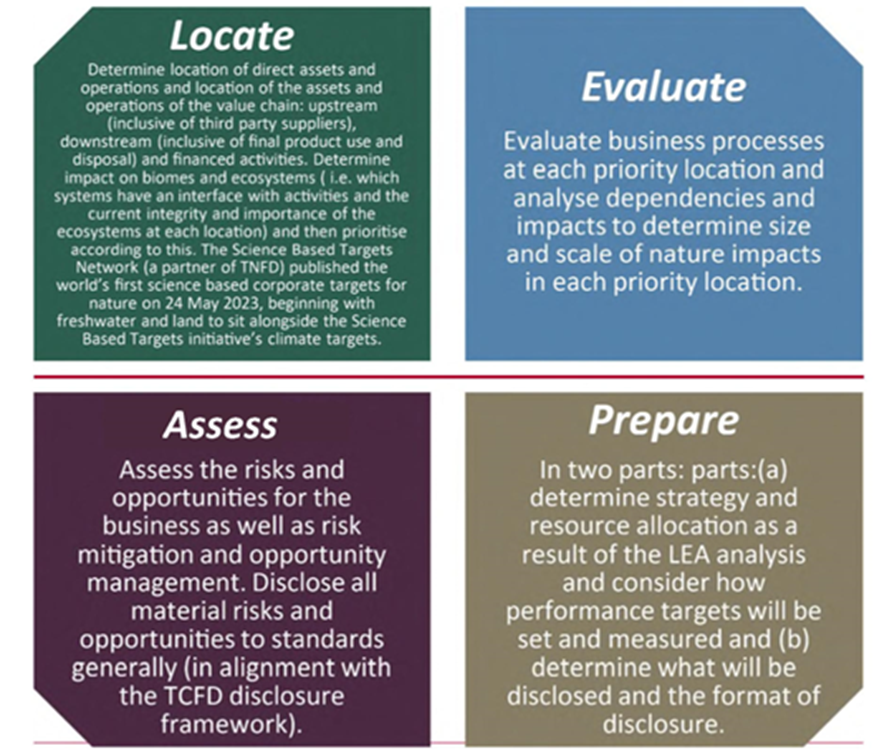

Thinking beyond climate-related risks – applying LEAP

In its Guidance on the identification and assessment of nature-related issues: The LEAP approach, the TNFD sets out steps for implementing an internal due diligence approach for scoping which nature-related issues businesses need to focus on for assessment purposes called “LEAP”: Locate, Evaluate, Assess, Prepare. The process is not mandatory and the results of pilot testing programmes demonstrate that corporates and financial institutions (FIs) may apply LEAP in very different ways. All organisations are encouraged “to use the components of LEAP in a way that best suits the needs of their business and due diligence requirements”. For example, it is noted that FIs may not find it useful to apply all of the components of LEAP and may find that they do not apply it in a linear sequence.

The TNFD continues to require examination of a subject organisation's direct operations, together with their upstream and/or downstream and/or financed impacts and dependencies where relevant, that are in priority areas. This reflects the scope 1,scope 2 and scope 3 greenhouse gas emissions associated with the TCFD.

The LEAP process recognises that for FIs the impact of nature on their own operations and supply chain will be negligible in comparison to their financed activities. They are advised to look first at their portfolios and to consider financed, facilitated and/or insurance-related activities and assets which may be most appropriate to assess by sector, geography and asset class. Such data supplied to FIs can be used to complement other sources of data such as proxy data from public and private sources, ultimately enabling FIs to produce their own aggregated reporting on a well-informed basis.

The below summarises the four steps of LEAP:

Next steps

FIs can expect TNFD-aligned reporting to become mandatory in the medium term, and similar to the process around integration of TCFD reporting, will do well to get ahead of the game. Whilst the framework is familiar and the internal process and governance pathways required to implement these types of reporting enhancements are becoming increasingly well-worn, the skills and expertise required in connection with TNFD will be different to what has gone before.

FIs will now need to ensure that they have sufficient expertise and capacity in their workforce to consider and analyse nature-related risks in line with TNFD. They will also need to build relationships and engage with upstream, downstream and financed organisations to ensure that those value and financing chain participants understand their own nature-related dependencies, and impacts as well as risks and opportunities and FIs will need to encourage them to disclose in line with TNFD. Once there is a better understanding of the dependencies, impacts, risks and opportunities, FIs can start to decide on targets and how they will measure progress.

Organisations which report under the EU Corporate Sustainability Reporting Directive will have separate obligations to make biodiversity-related disclosures. Whilst harmonisation is at the fore of people’s minds, it remains to be seen whether this will be achieved in practice.

Time is short to get to grips with these new concepts.

Looking to the United Kingdom, although recent press reports are focussing on apparent fluctuations in UK Government commitment to Net Zero standards, in private Ministers are firmly committed to ensuring that the Kunming-Montreal Global Biodiversity Framework is progressing at pace. In recent meetings with DEFRA, Ministers have been keen to ensure that Boardrooms were taking active steps to address biodiversity loss and disclose the impact on supply chains. They are also keen to invest in nature based solutions alongside conservation NGOs who are leading the way in private-civil society collaborations, see the Environment Secretary’s speech on 20 June 2023.

Please see Rewilding Hogan Lovells for information on one of our biodiversity initiatives. Some of our partners include Rewilding Europe, The Wildlife Trusts and Snowchange Cooperative. Please contact us for advice and support in respect of the implications of biodiversity and TNFD for your business.

This version has been updated to reflect the publication of the TNFD Final Recommendations published on 18 September 2023.

Our Sustainable Finance & Investment practice brings together a multidisciplinary global team to support our clients in this mission-critical area.

This note is intended to be a general guide and covers questions of law and practice. It does not constitute legal advice.

References

1 Kunming-Montreal Global Biodiversity Framework, Introductory Sections, 22 February 2023.

2 Data: LPI 2022. Living Planet Index database; 2022 https://stats.livingplanetindex.org/; Department for Environment, Food and Rural Affairs, UK. 2021. The #BiodiversityStripes website can be found at https://biodiversitystripes.info/global with a further breakdown by region. The global data includes over 30,000 populations of over 5000 species.

3 “A safe operating space for humanity”, Rockström et al, 2009, Nature, 461, 472-47.