[co-author: Siobain Quinton - Articling Student]

1. Introduction

In 2004, Alberta's Transmission Regulation established the framework for the planning and development of Alberta’s electricity transmission infrastructure. Its intent was to attract new generation, increase competition and serve expected increases in load. The regulation has remained largely unchanged since 2004. Meanwhile, the electricity system has experienced significant changes—in part due to the dramatic increase in the amount of intermittent renewable power generation facilities connecting to the grid. As a result, Alberta has embarked on a consultation process to modernize the policy framework for transmission and the broader electricity system, and released a "Green Paper" discussing potential changes on October 23, 2023. Feedback on the Green Paper is due November 30, 2023 (submit here), and is expected to inform policy changes in 2024.

In parallel, Alberta's electricity regulators are implementing various other major initiatives that are directly or indirectly connected to the issues identified in the Green Paper. Taken together, these various initiatives are likely to result in significant changes to the Alberta electricity regime in the coming year.

This blog provides an overview of these interrelated initiatives and potential changes to Alberta's transmission policy and market frameworks, including what actions interested stakeholders can take.

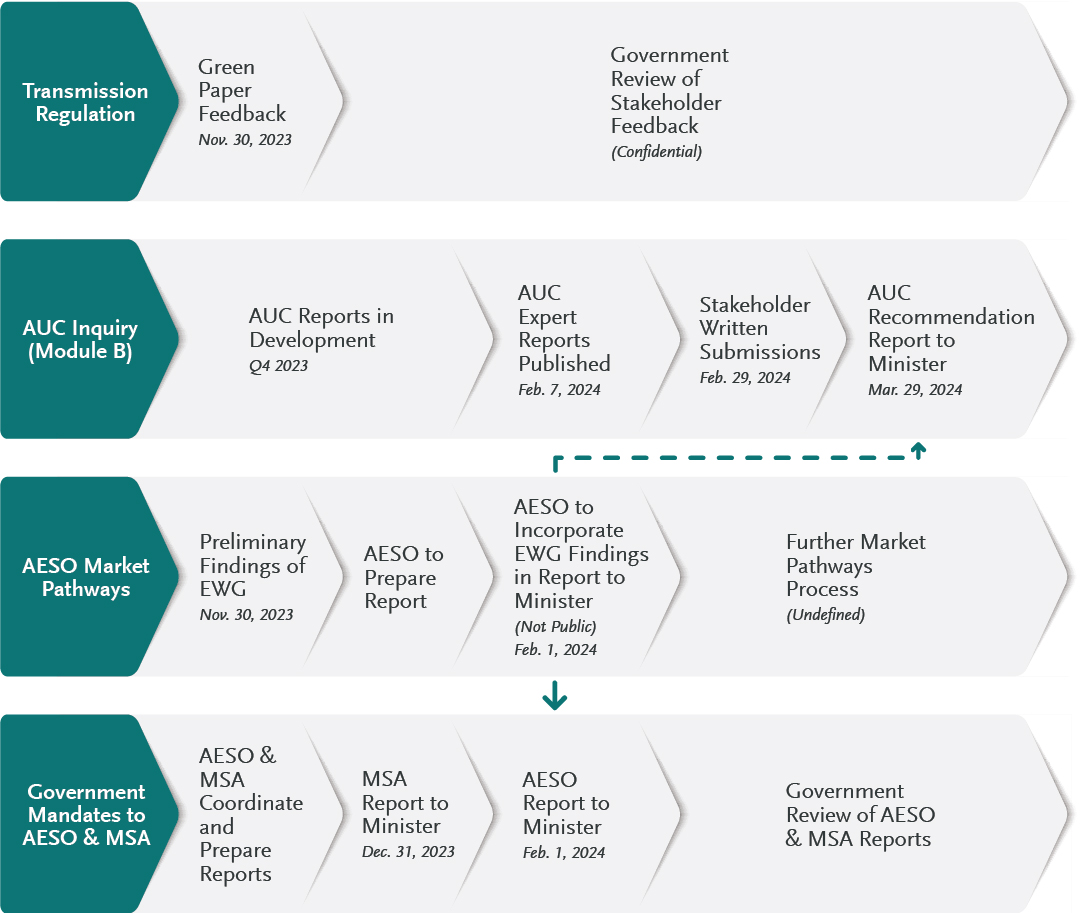

The below graphic provides an overview of the upcoming milestones in the four key initiatives discussed in this blog, all of which are oriented to informing actions by the Government of Alberta in mid-2024.

In its Green Paper, the government provided its current analysis on provincial transmission policies on discrete issues, identifying those it is likely to pursue. It also solicited feedback from stakeholders on a few significant policy issues likely to have broad impacts: the zero-congestion policy, the allocation of costs related to transmission wires and ancillary services, and intertie development. The government's stated objective is to amend transmission policies to support affordability, reliability and decarbonization.

Section 6 of the Green Paper provides an overview of the following policy initiatives that the government has engaged on since 2021, the feedback they have received on these policies, and the direction the government is expected to take on these policies:

a. Generating Unit Owner's Contribution (GUOC)

GUOC refers to the refundable payment that generators make to the Alberta Electric System Operator (AESO) at the time of connection. The purpose of the GUOC is to encourage generators to site in areas that would be most beneficial to load (in part by avoiding areas where the transmission system is already congested) and to provide the AESO with enhanced predictability regarding the timing and location of new generation connections.

In the Green Paper, Alberta proposes removing the prescribed GUOC maximum (currently $50,000 per MW of generation capacity) and minimum, and maintaining refundability.

b. Line Loss Calculation

During electricity transmission some energy is lost, usually in the form of heat. The further the electricity must travel, the greater the loss. Currently, the AESO recovers the cost of line losses from generators based on complex calculations as set out in Section 501.10 of the ISO Rules that are associated with the location of the generator on the system.

The Green Paper proposes shifting the line loss calculation methodology to a system-wide average approach, meaning loss charges would be based on a single loss factor for all generators instead of a loss factor calculated specifically for each generator.

c. Non-Wires Solutions

Non-wires solutions contemplate electricity grid solutions that use non-traditional transmission and distribution solutions to delay or avoid wire upgrades. The Transmission Regulation imposes strict limitations on the AESO's ability to use non-wires solutions to address transmission needs.

The Green Paper proposes expanded use of non-wires solutions, such as energy storage technologies, that could be procured as a service or as a regulated asset.

Section 7 of the Green Paper, titled, “Broader Policy Considerations,” sets out the following initiatives, which the government is seeking further feedback on:

a. Zero congestion

The AESO is presently tasked with planning the transmission system in a way that ensures generators have access to transmission when they need it. New generation technologies have shifted the traditional pathways and locations of electricity supply within the province and have introduced intermittent sources of generation. The Green Paper suggests the cost associated with maintaining the zero-congestion policy has increased—and will continue to increase—as a result.

Alberta is therefore examining alternative transmission frameworks and seeking feedback on changes to the zero-congestion policy. Such changes could include adjusting the transmission planning framework to introduce locational marginal pricing, or to increase the level of allowable congestion.

b. Cost Allocation, including wires and ancillary services

i. Wires

Alberta currently allocates most of the wires costs associated with new transmission builds to load. The purpose of this “load-pays” policy is to ensure that transmission costs do not dissuade investment in generation. It also acts as a signal to generators to locate in areas that minimize their costs and maximize their access to resources, which in theory, leads to downward pressure on the price of electricity. However, the Green Paper suggests that, due to changing priorities for generation investment, Alberta's transmission system is not always being used effectively. As we previously identified in our post Alberta's Pause on Renewable Projects: What We Know So Far, the issue of wires costs has been a growing area of concern for Alberta's utility regulators in recent months.

Alberta is therefore considering a shift in policy that would allocate more wires costs to generators by creating transmission rights, alternate cost-sharing frameworks as between load and generation, and/or redefining certain costs incurred during the interconnection process.

ii. Ancillary Services

To ensure Alberta's transmission system runs reliably, the AESO procures ancillary services (such as backup power supplies and voltage support). The cost of certain ancillary services has ballooned in recent years, which costs are paid for by electricity consumers.

In the name of "efficient outcomes and affordability", Alberta is considering whether the principle of "cost causation"—that is, where those parties who impose costs on the system are held responsible for paying for them—should play a role in how ancillary services costs are allocated. Such a shift in policy would likely increase costs for some generators.

c. Interties

Alberta currently has three transmission interties connecting the grid to neighbouring jurisdictions. The Transmission Regulation includes several sections on interties, including policies on development of new interties, restoration and electricity imports and exports.

To ensure interties are an effective part of Alberta's electricity system, Alberta is seeking feedback on potential amendments intended to provide clarity for existing and new interties, including ways to clarify the intertie development process.

Many policy shifts referenced in the Green Paper will, if changed, significantly impact participants in Alberta's electricity industry. The Government of Albertais requesting feedback by November 30 at 4:30 p.m. Feedback can be submitted confidentially by following this link.

Following receipt of comments, the Ministry of Affordability and Utilities has stated it will analyze responses and "determine the ideal path of action for Alberta's transmission policies." It is not clear whether further engagement or reporting will take place in response to the feedback being solicited.

As discussed in our earlier post, Update on Alberta's Renewables Pause: AUC Inquiry and Interim Requirements, the Alberta Utilities Commission (AUC) is holding an Inquiry into the ongoing economic, orderly, and efficient development of electricity generation in Alberta.

On October 24, 2023, the AUC announced the scope and format of Module B of the Inquiry, which will consider the effect of the increasing growth of renewables on generation supply mix and electricity system reliability. As the AESO is conducting related work (discussed below), the AUC stated it will take the AESO's work "into account".

Module B will center on two expert reports, commissioned by the AUC:

- The first report will inform reliability and affordability questions by assessing prior relevant studies and developing a simulation-based assessment under the current energy market structure to evaluate future system reliability and "utility bill impacts for retail customers".

- The second report will seek to identify drivers behind stakeholder perception of Alberta's power market and "review attractiveness of Alberta's market structure, views on potential market structure changes, and appetite for merchant power risk."

Next steps in Module B include:

- Independent Expert reports published: February 7, 2024

- Technical meeting for AUC experts to answer questions on reports: February 14, 2024

- Written submissions on expert reports: February 29, 2024

- AUC report to the Minister of Affordability and Utilities: March 29, 2024

The AESO is seeking to identify market pathways to address reliability issues identified in the Reliability Requirements Roadmap. Anticipating transformational changes on the grid, the AESO is attempting to identify market pathways that will inform the future evolution of Alberta's market design. To do so, the sustainability of the current market design will be evaluated and recommendations will be provided, with a focus on how to achieve reliability and affordability through competition.

Although the initiative was initially anticipated to run throughout 2024, the AESO has accelerated and altered the process amidst recent government mandates. The AESO recently assembled an Executive Working Group (EWG) to set objectives and determine viable market pathways. The EWG's background materials can be found here. Preliminary findings of the EWG will be presented at a Stakeholder Symposium on November 30, 2023 (register here). Findings of the EWG will inform the AESO's report, referenced below, to the Ministry of Affordability and Utilities, which is due by February 1, 2024. The AESO has stated it will not share its recommendations with the EWG or the broader public.

During a Market Pathways update, the AESO suggested the initiative will continue beyond February 2024, with the potential for participation by more working groups.

In parallel, the AESO is exploring competitive procurement of Fast Frequency Response (FFR) services to support immediate needs regarding the reliable operation of the grid amidst growing intermittent generation (e.g., solar and wind power) in 2024.

Changes to energy market design parameters and products, including the introduction of FFR and shifting the allocation of associated costs as between load and generation, could result in significant impacts to Alberta's electricity market participants.

In addition to the public engagement processes outlined above, the Minister of Affordability and Utilities issued letters in August 2023 directly to the AESO and Market Surveillance Administrator (MSA) requesting recommendations and advice regarding Alberta's electricity market. The two mandates are outlined below.

The Minister requested the AESO work with the MSA and study the current market framework and provide recommendations on the following by February 1, 2024:

- Market incentives that could be used to mitigate the impacts of the intermittency of supply and promote grid reliability within the province;

- Market design and legislative changes required to deliver those required market incentives affordably; and

- The current and future role and potential of different dispatchable technologies such as carbon abated natural gas power, full scale nuclear, small modular reactors, hydrogen fueled generation, hydro-electric power, and energy storage resources, in supporting this reliability objective.

As noted, the AESO's Market Pathways initiative is likely to inform this report.

In addition to the MSA's role in supporting the AESO with the above request, the Minister requested that the MSA provide advice as to whether any further legislative or regulatory reforms are required to support more effective competition in Alberta's electricity market. This advice is due to the Ministry by December 31, 2023.

The government also requested that the MSA take actions within its jurisdiction to ensure that the electricity market participants are acting in accordance with the Fair, Efficient, and Open Competition Regulation.

The Government of Alberta has signaled significant changes to transmission, generation, storage and electricity market frameworks in in the near term, with an emphasis on ensuring reliability and affordability for electricity consumers while attempting to maintain a healthy investment climate for new generation.

The government's recent prioritization of these changes has triggered several proceedings and initiatives, which are now occurring concurrently on accelerated timelines. These initiatives are occurring in tandem with other, more typical electricity regulatory functions (such as the AESO's Bulk and Regional Tariff redesign, transmission system planning and new Cluster Assessment Process), which are likely to be influenced by broad policy or legislative changes and may significantly impact certain market participants.

The initiatives discussed above are likely to take significant resources to implement, and sequencing of their implementation will be key. For instance, current uncertainty as to key parameters of the electricity framework and legislation—such as those highlighted in the Green Paper—may hamper progress on other, interrelated initiatives. Prolonged uncertainty also has the potential to impact the power generation investment climate in Alberta. We recommend stakeholders remain apprised of the key proceedings and exercise available opportunities to provide input.

As outlined, the above initiatives are scheduled to conclude with recommendations to government by February and March of 2024. While there is no firm timeline for when Alberta can expect to see transmission policy and electricity market reform, current indications suggest these matters will remain a top priority for the Alberta Government during the 2024 legislative sessions.