This past year saw a continued trend in building supply chain resiliency, as this topic has grown increasingly important following Covid-19, the conflict in Ukraine, shifting landscape on tariffs, forced labor concerns and a number of other factors. Increasingly, supply chains are having to respond to policy concerns requiring shifting production away from China, either through onshoring or friend shoring as a means of strengthening US national and economic security interests.

In November, the White House convened the inaugural meeting of the White House Council on Supply Chain Resilience, acknowledging that protecting America’s supply chains is critical to national and economic security and publishing 30 new actions to strengthen America’s supply chains. This announcement came on the heels of a busy year regarding U.S.-China specific supply chain developments, which we explore below.

Below, we outline a number of the most significant legal developments in this space.

House Select Committee on the CCP

The House Select Committee on the Chinese Communist Party (CCP), formed on January 11, 2023, launched a number of investigations into various U.S. and Chinese companies over the course of the year. The Committee’s concerns stretched across a variety of industries, from fashion and batteries to seafood.

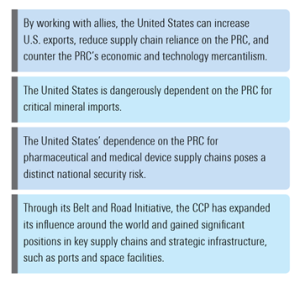

On December 12, 2023, the House Committee released a three-pronged plan, entitled “Reset, Prevent, Build: A Strategy to Win America’s Economic Competition with the Chinese Communist Party.” As part of this plan, the House Committee underlined the need to reduce supply chain reliance on China, particularly in the areas of technology, pharmaceuticals and medical devices.

Key findings from the report include the following:

UFLPA Enforcement Actions

2023 marked the first full year of implementation for The Uyghur Forced Labor Prevention Act (UFLPA), providing industry with important insights into enforcement trends and priorities. The UFLPA establishes a rebuttable presumption that the importation of any goods, wares, articles, and merchandise mined, produced, or manufactured wholly or in part in the Xinjiang Uyghur Autonomous Region (XUAR) of the People’s Republic of China, or produced by entities on the UFLPA Entity List, is prohibited by Section 307 of the Tariff Act of 1930 and that such goods, wares, articles, and merchandise are not entitled to entry to the US. Our previous post discussing 2023 developments related to the UFLPA can be found here.

Entities which appear on the UFLPA Entity List may be listed for a variety of reasons, including allegedly sourcing from Xinjiang or participating in the Xinjiang “poverty reduction” scheme. Importantly, this means that not all listed entities are operating in or are headquartered in the XUAR.

In its first year, US Customs and Border Patrol (CBP) reportedly stopped approximately 4,000 shipments pursuant to the UFLPA, totaling almost 1.5 billion in value. The majority of these shipments were electronics; industrial and manufacturing materials; and apparel, footwear, and textiles. As there is no de minimis exception in the UFLPA, many of the goods detained did not originate directly from China but were believed to incorporate components originating from Xinjiang. For example, imports from Malaysia constituted approximately 58% of the total value of shipments stopped in 2023.

In June 2023, the Forced Labor Enforcement Task Force (FLETF), the interagency organization which assists in the implementation of the UFLPA, published updated guidance related to UFLPA enforcement. In this guidance, it noted a number of sectors identified by non-governmental organizations as high risk of being tainted by forced labor, including red dates and other agricultural products, vinyl products and downstream products, aluminum and downstream products, steel and downstream products, lead-acid and lithium-ion batteries, copper and downstream products, electronics, and tires and other automobile components.

Manufacturing

While the most prominent manufacturing update related to Chinese supply chains came in the form of new semiconductor controls (explored in our prior post here), the U.S. government took a number of additional steps which may also impact the manufacturing sector.

As the U.S. has increased its efforts to combat China’s civil-military fusion strategy, a number of Chinese and third country companies have been added to the Entity List in order to restrict their access to U.S. technology.

Throughout the year, the U.S. added a number of Chinese companies to the Entity List. Most commonly, Chinese entities were added for conspiracies to ship U.S. origin technology to Iran or Russia, particularly as it relates to Russia’s unmanned aerial vehicle (UAV) program.

As restrictions in the U.S. have tightened, we have also seen the Chinese government implement controls impacting U.S. supply chains. For example, in 2023, China imposed a number of controls on certain key minerals. PRC the Ministry of Commerce (MOFCOM) and General Administration for Customs of China (GACC) jointly issued new export control measures on graphite in July and similar controls on gallium and germanium in October.

June Amendment to ICTS Rule

On June 16, 2023, the Commerce Department issued a final rule to implement Executive Order (EO) 14034, titled Protecting Americans’ Sensitive Data From Foreign Adversaries. This rule amended the previously issued “Securing the Information and Communications Technology Supply Chain” regulations (the “ICTS rule”). EO 14034 mandated the Secretary of Commerce to assess the risks associated with “connected software applications” and take appropriate measures as outlined in the existing ICTS rule and EO 13873, Securing the Information and Communications Technology and Services Supply Chain, which led to the creation of the ICTS rule.

The ICTS rule grants the Commerce Department the authority to limit or regulate transactions related to information and communications technology or services (ICTS) associated with “foreign adversaries” presenting an “undue or unacceptable risk” to US national security. The June 16 rule amends the ICTS rule, providing clarity on Commerce’s jurisdiction over transactions involving software, including “connected software applications.” It also outlines the criteria Commerce will consider when assessing such transactions, which are the following:

- Ownership, control, or management by persons that support a foreign adversary’s military, intelligence, or proliferation activities.

- Use of the connected software application to conduct surveillance that enables espionage, including through a foreign adversary’s access to sensitive or confidential government or business information, or sensitive personal data.

- Ownership, control, or management of connected software applications by persons subject to the jurisdiction or direction of a foreign adversary.

- Ownership, control, or management of connected software applications by persons involved in malicious cyber activities.

- Whether there is regular, thorough, and reliable third-party auditing of connected software applications.

- The scope and sensitivity of the data collected.

- The number and sensitivity of the users with access to the connected software application.

- The extent to which identified risks have been or can be mitigated using measures that can be verified by independent third parties.

USTR Extension on Section 301 China Tariff Product Exclusions

In 2018, the U.S. Trade Representative (USTR) imposed tariffs on Chinese imports due to unfair practices related to technology transfer, intellectual property, and innovation. Over the years USTR has allowed a small proportion of imports to be excluded from tariffs based on a process of notice and comment from industry. In May 2022, USTR undertook a statutory four-year review of the section 301 tariffs. As part of this process USTR solicited comments from both domestic industry as well as importers on the continued relevance of maintaining the tariffs on a huge swath of American imports.

On December 26, 2023, the USTR announced a limited extension of a small group of exclusions covering 429 products pertaining to COVID related products and other previously reinstated exclusions until May 31, 2024. These exclusions will shield specified products from additional duties on Chinese imports for another five months. Concurrently, the USTR will review these 429 exclusions to determine if they warrant another extension beyond the May 31, 2024 date. The comments period opened on January 22, 2024, and closed on February 21, 2024.

In January 2024, Ambassador Katherine Tai informed the House Select Committee on the CCP that the four-year review is expected to conclude in the coming months, despite the initial expectation of completion in the fall of 2023.

[View source.]