On April 2, 2024, the U.S. Department of Labor (DOL) announced its final amendment to prohibited transaction class exemption 84-14 (the QPAM Exemption). The QPAM Exemption is a broad-based class exemption relied upon by many registered investment advisors (QPAMs) who manage the assets of pension plans and other employee benefit plans subject to the Employee Retirement Income Security Act of 1974, as amended (ERISA), and other “plans” described in Section 4975 of the Internal Revenue Code of 1986, as amended (collectively, Plans). Without the availability of the QPAM Exemption, many investment managers would frequently be precluded from managing the assets of a Plan unless another administrative or class exemption were available. The amendment takes effect on June 17, 2024.

The final amendment modifies the QPAM Exemption as follows:

- For the first time, investment managers will be required to notify the DOL if relying on the QPAM Exemption.

- The notice must be given within 90 days of reliance on the QPAM Exemption. If such notice is not timely given, there is an automatic 90-day cure period where notice may be provided along with an explanation as to why the notice was not previously given.

- For managers currently relying on the QPAM exemption, notice would have to be provided to the DOL by September 14, 2024.

- In the preamble to the final amendment, the DOL stated its intention to compile a list of investment managers relying upon the QPAM Exemption on its publicly available website. We can only presume that the intent of this notice is to enhance the ability of the DOL to audit managers regarding ERISA compliance and help the plaintiff’s bar identify potential defendants.

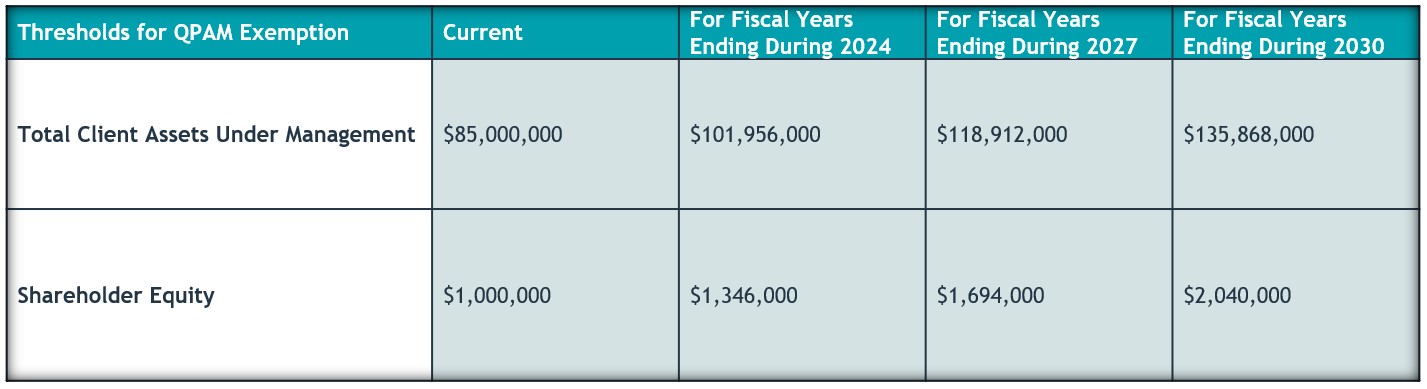

- For registered investment advisers, the final amendment incrementally increases:

These new limits will be annually adjusted for inflation. The QPAM Exemption will not be available to managers failing to meet the amended thresholds.

- The final amendment provides that, for the QPAM Exemption to apply to a transaction, the “terms of the transaction, commitments, and investment of fund assets, and any associated negotiations” be based on the QPAM’s “own independent exercise of fiduciary judgment” and that no relief will be provided if the transaction has been, “in whole or in part,” planned, negotiated or initiated by a party in interest to a Plan investor. This requirement could be problematic in circumstances or jurisdictions where an entity other than the QPAM is assigned some responsibility for a transaction in which the QPAM Exemption is intended to apply.

- Unlike the current QPAM Exemption, the final amendment requires that a manager maintain and make available for examination records necessary to determine whether the conditions of the QPAM Exemption have been met for a period of six years from the date of a covered transaction.

-

We note that these records must be available to the DOL, the Internal Revenue Service and other state or federal regulators, as well as (subject to exceptions for “privileged trade secrets” and “privileged commercial or financial information”) Plan fiduciaries, contributing employers, unions having members covered by the Plan and Plan participants and beneficiaries.

- For managers who use the QPAM Exemption only when their funds are deemed to hold “plan assets,” this recordkeeping requirement could be particularly burdensome.

- An investment manager is precluded from relying on the exemption for 10 years following the Criminal Conviction of the manager, its affiliates or 5% or more owners or any of the foregoing participating in Prohibited Misconduct (each as discussed below). The final amendment retains the list of disqualifying crimes included in the current QPAM Exemption and clarifies that convictions by foreign courts (other than those of “foreign adversaries” of the United States) of substantially equivalent non-U.S. laws would also lead to disqualification (the conviction of any such crime or similar laws, a Criminal Conviction). In addition, the final amendment would extend disqualification to (i) entering into a non-prosecution or deferred prosecution agreement with a U.S. federal or state prosecutor’s office or regulatory agency that, if successfully prosecuted, would have constituted one of the enumerated crimes, (ii) engaging in a systematic pattern or practice of conduct that violates the conditions of the QPAM Exemption, (iii) intentionally engaging in conduct that violates the conditions of the QPAM Exemption or (iv) providing materially misleading information to the DOL, certain other U.S. regulatory agencies, or a state regulator or attorney general in connection with the conditions of the QPAM Exemption (any circumstances described in (i) – (iv), Prohibited Misconduct). The final exemption provides that “participating in” Prohibited Misconduct would include not only active participation, but also knowing approval of the conduct or knowledge of the conduct without taking active steps (such as reporting to appropriate compliance personnel) to prohibit such conduct.

- Criminal Conviction includes the following crimes: any felony involving abuse or misuse of such person’s Plan position or employment, or position or employment with a labor organization; any felony arising out of the conduct of the business of a broker, dealer, investment adviser, bank, insurance company or fiduciary; income tax evasion; any felony involving the larceny, theft, robbery, extortion, forgery, counterfeiting, fraudulent concealment, embezzlement, fraudulent conversion, or misappropriation of funds or securities; conspiracy or attempt to commit any such crimes or a crime in which any of the foregoing crimes is an element; or any crime that is identified or described in Section 411 of ERISA.

- We note that entering into a non-prosecution or deferred prosecution agreement with a foreign government will not constitute disqualifying conduct (as would have been the case in the proposed amendment) if the manager provides notice to the DOL within 30 days.

- For larger institutions with diverse affiliate relationships, the expanded scope of these provisions may needlessly disrupt their ability to continue to manage ERISA “plan assets” or otherwise continue to serve as a QPAM.

- If a manager is subject to a Criminal Conviction or Prohibited Misconduct, the final amendment provides for a one-year transition period during which the QPAM Exemption will continue to apply, subject to certain conditions which could result in liability to the manager far in excess of any liability imposed by the statutory provisions of ERISA. Among the conditions are that the manager provide notice of the Criminal Conviction or Prohibited Misconduct to the DOL and each of its client plans stating that, during the transition period, the manager:

- Agrees not to restrict the ability of the Plan to withdraw from the arrangement (e.g., no gates, slow-pay, etc.). For certain illiquid strategies, this may be virtually impossible to comply with in practice.

- Will not impose any fees or penalties on a Plan in connection with terminating or withdrawing from an investment fund managed by the QPAM except for reasonable fees disclosed in advance that are specifically designed to prevent abusive investment practices or ensure equitable treatment of all investors in the fund.

- Agrees to indemnity and hold harmless, and promptly restore actual losses to the Plan for any damages that directly result to them from a violation of applicable laws, a breach of contract or any claim arising out of the conduct that is the subject of a Criminal Conviction or Prohibited Conduct. Under ERISA, such a manager is generally only subject to liability for a breach of its fiduciary duties. The scope of the liability in the final QPAM Exemption potentially exceeds the statutory requirements.

- Will not employ or knowingly engage any individual that participated in the conduct that is the subject of the Criminal Conviction or participating in Prohibited Misconduct.

- The provisions above will require managers to amend various agreements that they may have in place to address these conditions. However, unlike the proposed amendment to the QPAM Exemption, these amendments need not be made until a Criminal Conviction or Prohibited Misconduct has occurred.