The Bureau of Ocean Energy Management (BOEM) announced on March 18, 2024, the identification of a final Wind Energy Area (WEA) of 2,000,902 acres for commercial leasing and potential development of floating wind on the Outer Continental Shelf (OCS) in the Gulf of Maine, offshore Maine, New Hampshire, and Massachusetts. This follows BOEM’s late February 2024 announcement of the identification of final WEAs for floating wind offshore Oregon and is another step toward reaching the Biden administration’s goal of 15 gigawatts (GW) of floating wind by 2040. BOEM also published its Notice of Intent (NOI) to develop an Environmental Assessment (EA) regarding potential environmental impacts associated with leasing and site assessment studies in the final Gulf of Maine WEA. Comments on the NOI are due by April 17, 2024.

In this Update, we look at the lengthy process BOEM used in identifying the final WEA in the Gulf of Maine and at the areas now excluded from offshore wind development. We also highlight unique challenges for developing floating offshore wind projects in the Gulf of Maine that will affect project feasibility assessment, planning, and timing.

Development of Offshore Wind in the Gulf of Maine

Publication of the final WEA follows decades of investment, stakeholder outreach, and research by BOEM and the states of Maine, New Hampshire, and Massachusetts in floating offshore wind. In 2003, Massachusetts convened an Ocean Management Task Force, and in 2008, Maine launched an Ocean Energy Task Force, which recognized the potential of offshore wind and identified issues needing resolution in order to support development. In 2019, after New Hampshire requested the establishment of an intergovernmental offshore wind renewable energy task force, BOEM convened the Gulf of Maine Intergovernmental Renewable Energy Task Force to identify opportunities for offshore wind development in the Gulf of Maine and to conduct stakeholder outreach.

In October 2021, Maine submitted an unsolicited application for a research lease for 9,700 acres on the OCS in the Gulf of Maine. The site would support 12 floating offshore wind turbines, generating up to 144 megawatts (MW). BOEM issued a Request for Competitive Interest in August 2022 and published its Determination of No Competitive Interest in March 2023. The Draft Environmental Assessment for the research lease was published in July 2023, and BOEM provided a Finding of Effect pursuant to Section 106 review under the National Historic Preservation Act in November 2023.

In May 2022, BOEM released the Gulf of Maine Planning Area as the starting point for the commercial lease process. In August 2022, simultaneous with publication of the Request for Competitive Interest in the research lease application, BOEM also issued a separate Request for Interest (RFI) for commercial lease planning and development in the Gulf of Maine.

Through comments received on the RFI from industry, tribes, and other interested groups; in coordination with Maine, New Hampshire, and Massachusetts; and with the National Oceanic and Atmospheric Administration’s (NOAA) National Centers for Coastal Ocean Science (NCCOS), BOEM deconflicted the original RFI area by about 27% to 9.9 million acres, resulting in the draft Call Area. In April 2023, after review of comments on the draft, BOEM published the final Call Area, which was substantially similar to the draft, with 160,000 acres removed to avoid Georges Bank, an important fishing ground, particularly for scallops. BOEM intentionally kept the Call Area broad and encompassing known conflicts to maximize the benefits of using an ecosystem spatial analysis tool developed with NCCOS. In response to the Call Area, BOEM received nominations of areas of interest from seven developers.[1]

BOEM issued the draft WEA on October 19, 2023, encompassing 3.5 million acres, dramatically reduced from the 9.7 million acres in the Call Area. The 64% reduction from the Call Area was the result of a deconfliction process with stakeholders, coordination with the neighboring states, comments received on the Call Area, and using the NCCOS ocean planning model to identify and minimize conflicts. BOEM used the same model to identify draft and final WEAs for the Gulf of Mexico, the Central Atlantic, and Oregon.[2]

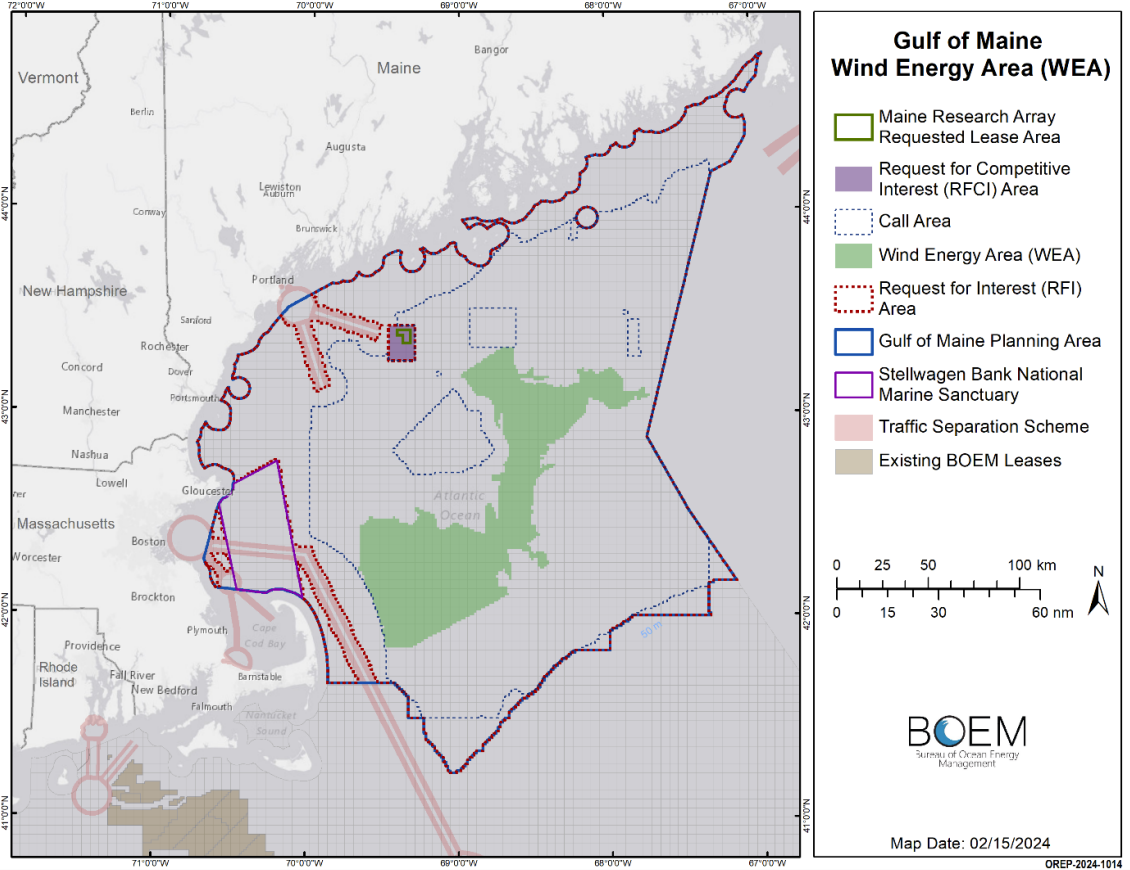

BOEM arrived at the final WEA (see Figure 1), encompassing 2 million acres (an 80% reduction from the Call Area and a 43% reduction from the draft WEA) after a series of public outreach opportunities, including over 70 external meetings, a 60-day comment period, and active coordination among the states, particularly through the intergovernmental task force.[3] BOEM’s process in the Gulf of Maine has involved significant stakeholder engagement (including tribes, ocean users, coastal communities, the fishing community, state agencies, and the general public), signaling its continued commitment to identifying and responding to stakeholder concerns early in the process.

Figure 1: Map of the Recommended Final Gulf of Maine Wind Energy Area[4]

If fully developed, the WEA could support 32 GW of energy production. According to BOEM, this exceeds the estimated regional goals for offshore wind in the Gulf of Maine—10 GW for Massachusetts and 3 GW for Maine—allowing BOEM to further deconflict the area and also support multiple lease sales in a phased approach.[5]

The location of the final WEA accounts for national security, navigation and shipping routes, commercial fishing, marine mammals, and seafloor habitat interests, among others. These are familiar considerations used in the task force, comment, and NCCOS modeling to establish the final WEA boundary. Because of the extensive outreach and comments provided, the final WEA avoids several important fishing areas and habitats, including Lobster Management Area 1 (LMA1).[6] As LMA1 is often closed to fishing to protect the North Atlantic right whale, the inclusion of LMA1 in the Call Area had garnered significant opposition from Maine fisheries and inspired the introduction of a bill in the House of Representatives to prohibit commercial offshore wind energy development within LMA1. In addition to avoiding important lobster fisheries, BOEM also concluded that the final WEA will avoid a majority of historic and present fishing grounds of tribal nations. The final WEA also excludes all North Atlantic right whale restricted areas and corridors identified by the National Marine Fisheries Service.[7]

Some spatial and environmental conflicts could remain, including potential overlap with the U.S. Coast Guard’s Maine, New Hampshire, and Massachusetts Port Access Route Study’s recommended safety fairways. While the majority of these fairways were avoided in the final WEA, there is a small overlap that BOEM will continue to coordinate with the Coast Guard on resolving. The U.S. Navy did not identify any conflicts, and the U.S. Department of Defense noted potential impacts to the North American Aerospace Defense Command radar, akin to impacts with other lease areas along the Atlantic Coast, which have been almost completely mitigated.[8]

While BOEM has finalized the WEA, further refinement of the potential lease areas may occur during the comment process for Proposed Sale Notice.

Environmental Assessment Scoping for BOEM Leasing Action

With the final WEA identified, BOEM will now prepare an EA assessing the environmental impacts of the approximately 2,000,000 acres under the National Environmental Policy Act (NEPA) before holding any lease auction.[9] The first step in that process is to solicit public and agency input on the scope of issues to be examined in the EA. The EA will consider (1) project easements and grants for subsea cable corridors associated with leasing and (2) the potential environmental impacts associated with leasing and site characterization surveys (biological, archeological, geological, and geophysical surveys and core samples) and anticipated site assessment activities. Interested parties should submit comments during the scoping period, which ends on April 17, 2024. BOEM anticipates publication of the final EA this year and a lease sale in early 2025.[10]

Issues To Watch

Project developers and interested stakeholders should consider certain unique aspects of offshore wind development in the Gulf of Maine region.[11]

- Floating versus fixed turbines. Existing offshore wind development proposed and in construction on the Atlantic Coast will utilize fixed turbines in relatively shallow waters. The majority of the continental shelf along the eastern seaboard is both wide and shallow, with depths of 165 meters, approximately 25 nautical miles from the shore. In contrast, further north in Maine, depths of over 250 meters are routinely reached at distances of no more than 10 nautical miles from the shoreline. This deeper seafloor profile precludes the fixed foundation methodology from use in the vast majority of waters in the Gulf of Maine. The water depths (approximately 120 to 277 meters) and distance from shore (approximately 20 to 80 miles) will inevitably create technical challenges not yet encountered by wind projects in the Atlantic, although they are still shallow relative to Pacific sites. Given the difference in floating structures, the environmental, fisheries, and other potential impacts from Gulf of Maine OCS wind energy development will also vary from projects currently being constructed and studied off the Atlantic Coast.

- Port infrastructure. Unlike fixed turbines, floating offshore wind turbines need to be fabricated and assembled at a port and transported by vessel to the OCS. Ports are, therefore, an essential part of the supply chain. Neighboring states in the Gulf of Maine have recognized the potential economic benefits of investing in port infrastructure and have identified promising locations. In February 2024, following lengthy stakeholder engagement and informed by the Offshore Wind Port Advisory Group and a 2021 study by the Maine Department of Transportation, Governor Janet Mills designated approximately 100 acres of a state-owned portion of Sears Island reserved for port development as Maine’s preferred site for a port facility to support the floating offshore wind industry. Maine will be seeking additional funding for the site development, which is anticipated to cost over $500 million. Massachusetts Offshore Wind Ports and Infrastructure Assessment identified the Salem Wind Port as the primary site for port development. An existing public-private partnership is already developing the facility into an offshore wind marshaling terminal. And in New Hampshire, a study from the New Hampshire Office of Offshore Wind Industry Development identified the Port of New Hampshire and the dredged area of the Piscataqua River as potentially supportive of an offshore wind manufacturing port. Developers will need to keep a close eye on the progression of these port projects across multiple states.

- Transmission infrastructure. Due to the significant distance from shore and considerable water depths, transmitting power from the final lease areas to shore will require substantial cost and risk. Construction and maintenance of floating substations, necessary to facilitate transmission, will also pose technical challenges and significant costs.[12] The National Renewable Energy Laboratory (NREL) published a tool to help calculate potential transmission costs from generation to landfall. For a fixed-turbine project located 31 miles offshore in 34 meters of water, NREL estimated electrical infrastructure would cost nearly $512 million dollars.[13] For a floating project in water roughly 10 times deeper, costs will necessarily be much greater. Projects may also be located far from shore in the Gulf of Maine, thereby necessitating the use of high-voltage direct-current offshore transmission. With environmental analysis for upland siting to be conducted in the site assessment environmental review period that follows the leasing auction, uncertainty about transmission availability and costs presents significant challenges in assessing the technical and economic feasibility of potential projects. Points of interconnection have been identified in Massachusetts, New Hampshire, and Maine where offshore wind power from the Gulf of Maine could be delivered. Independent System Operator-New England (ISO-NE), the grid operator for the six New England states, is planning for interconnection of up to 17.9 GW of offshore wind from the Gulf of Maine by 2050. Transmission solutions could be informed by efforts of the New England States Transmission Initiative, a joint initiative between Connecticut, Massachusetts, Maine, New Hampshire, Rhode Island, and Vermont, to explore the integration of offshore wind and other clean energy resources into the regional grid, including the identification and selection of a portfolio of transmission projects in partnership with transmission developers, wind energy developers, and ISO-NE.

Next Steps

Across the United States, offshore wind project developers and interested stakeholders should pay attention to how the scientific study and stakeholder processes for the region were conducted by both the states and BOEM in the Gulf of Maine. Monitoring and engaging in these early study and comment processes on potential impacts of offshore wind projects will be critical to the future feasibility of commercial offshore wind projects.

Endnotes

[1] Area Identification Memorandum at 3.

[2] BOEM first employed this model to identify Wind Energy Areas for the Gulf of Mexico in 2022. BOEM Enhances its Processes to Identify Future Offshore Wind Energy Areas (Sept. 16, 2022).

[3] Area Identification Memorandum at 3.

[4] Id. at 2.

[5] Id. at 18, 22.

[6] Id. at 19.

[7] Id.

[8] Id. at 19.

[9] Notice of Intent To Prepare an Environmental Assessment for Commercial Wind Lease Issuance, Site Characterization Activities, and Site Assessment Activities on the Atlantic Outer Continental Shelf in the Gulf of Maine Offshore the States of Maine, New Hampshire, and the Commonwealth of Massachusetts, 89 Fed. Reg. 19354 (Mar. 18, 2024).

[10] United States Department of the Interior, Bureau of Ocean Energy Management, Budget Justification and Performance Information, Fiscal Year 2025 at 23.

[11] See Musial, Walt, Suzanne MacDonald, Rebecca Fuchs, Gabriel R. Zuckerman, Scott Carron, Matt Hall, Daniel Mulas Hernando, Sriharan Sathish, and Kyle Fan. 2023. Considerations for Floating Wind Energy Development in the Gulf of Maine. Golden, CO: National Renewable Energy Laboratory. NREL/TP-5000-86550.

[12] One or more floating substations will likely be required for large commercial projects to convert array voltages at 66 or 123 kilovolts to higher voltage AC or DC power.

[13] Nakhai, Aryana Y. 2023. Electrical Infrastructure Cost Model for Marine Energy Systems. Golden, CO: National Renewable Energy Laboratory. NREL/TP-5700-87184.