Our Federal & International Tax Group covers notable business and individual tax proposals revealed by the Biden Administration in this year’s Green Book.

- The budget proposes $2.7 trillion in business tax increases over the next 10 years, mostly from corporate and international tax increases

- Individual tax increases would fall on the shoulders of the wealthiest taxpayers while maintaining middle class tax cuts

- With Republicans in control of the House, most of the proposals will go nowhere this year but are harbingers of the future

On March 11, 2024, the Treasury Department released the General Explanations of the Administration’s Fiscal Year 2025 Revenue Proposals, known as the Green Book. The Green Book details the nearly $5 trillion in individual and corporate tax hikes that President Biden has called for in his FY 2025 budget. In addition to reaffirming previous proposals, including raising the corporate income tax rate and imposing a minimum tax on wealthy households, the 2025 Green Book includes new proposals to increase the corporate alternative minimum tax (CAMT) rate and eliminate business deductions for excess employee compensation.

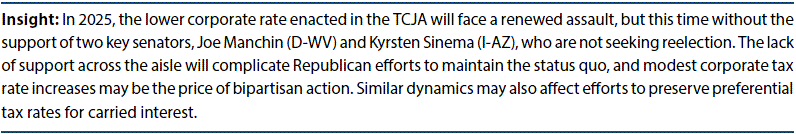

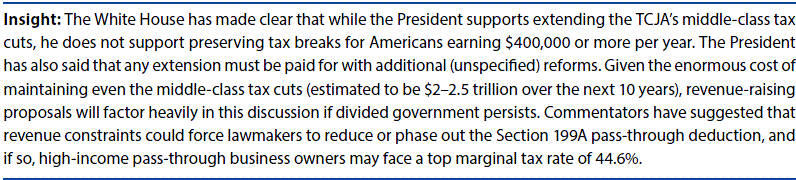

Because Republicans control the House of Representatives, no action on the Green Book proposals is currently expected. That said, because the proposals would serve as a starting point for future tax reform negotiations with Democrats, they are worth understanding better. Moreover, with parts of the Tax Cuts and Jobs Act (TCJA) set to expire at the end of 2025, Republicans may have to accept tax increases to preserve current-law benefits for families and small businesses. This means that many of the proposed revenue raisers, particularly the increased corporate rate, can no longer be dismissed as merely aspirational.

Business Tax Proposals

The President’s FY 2025 budget proposes to increase business taxes by more than $2.7 trillion over the next 10 years. The bulk of this revenue would come from corporate and international tax increases, including proposals to:

- Increase the top federal corporate tax rate to 28%.

- Raise the CAMT rate to 21%.

- Quadruple the excise tax rate on corporate stock repurchases (from 1% to 4%).

- Disallow corporate deductions for any employee compensation exceeding $1 million.

- Reform international taxation by:

- Increasing the global intangible low-taxed income rate.

- Adopting the undertaxed profits rule.

- Repealing the foreign-derived intangible income deduction.

Other business tax proposals in the FY 2025 budget include:

- Making permanent the excess business loss limitation for noncorporate taxpayers.

- Repealing deferral of gain from exchanges of like-kind real estate.

- Increasing taxes on oil and gas, including eliminating the expensing of intangible drilling costs and the use of percentage depletion for oil and gas wells.

- Extending the wash sale and other tax rules to digital assets.

- Making permanent the new markets tax credit.

Individual Tax Proposals

The President’s FY 2025 budget proposes to increase taxes on wealthy individuals by nearly $2 trillion. It would do so in part by:

- Increasing the top marginal income tax rate to 39.6%.

- Imposing a 25% minimum income tax on all taxpayers worth more than $100 million.

- Taxing capital gain at ordinary rates for households earning more than $1 million.

- Subjecting all pass-through business income of taxpayers making at least $400,000 per year to either the net investment income tax (NIIT) or Self-Employment Contributions Act tax.

- Increasing the maximum NIIT rate and additional Medicare tax rate from 3.8% to 5%.

Other individual tax proposals in the FY 2025 budget include:

- Taxing carried (profits) interests as ordinary income.

- Modifying estate and gift taxation to treat transfers of appreciated property by gift or on death as realization events for income tax purposes.

- Restricting the use of tax-favored retirement accounts by “high-income” taxpayers.

- Imposing ownership diversification requirements for small insurance company election.

Key Takeaways

While many of the Administration’s tax proposals are nonstarters for House Republicans, these proposals cannot be ignored heading into 2025. As Republicans fight to extend the sunsetting TCJA provisions, they may have to accept legislative reality and, thus, some Democratic tax increases. Gaining an early understanding of how the Green Book tax proposals may impact your business or tax planning is, therefore, essential.

Download PDF of Advisory

[View source.]