The new failure to prevent fraud offence and new ‘senior manager’ attribution test for corporate criminal liability contained in the Economic Crime and Transparency Act 2023 are relevant to private equity firms for two key reasons:

- There is an increased risk of criminal enforcement against a large portfolio company (PC) whose employees, agents etc commit fraud in order to benefit the PC. Much like ABAC due diligence, PE firms will want to build anti-fraud risk mapping and controls into their standard due diligence checks if they are not already doing so. The Fund itself could also be held criminally liable for misconduct at the PC level. Regardless of size threshold, a PC could also be prosecuted for a substantive fraud or other economic crime offence if a ‘senior manager’ of the portfolio company was involved.

- PE firms will also want to check that their own compliance policies are sufficient to manage risk of fraud being committed for their benefit or to benefit their clients.

More detail

The new ‘failure to prevent fraud’ offence in s199 Economic Crime and Corporate Transparency Act 2023 will apply where a company (or partnership) fails to prevent an associated party (AP) from committing a fraud-type offence with the intention of benefitting the company/partnership or its clients. The fraud offences are broad – and include fraud by false representation, fraud by abuse of position, fraud by failing to disclose information (which can include conflicts of interest situations), cheating the revenue, false accounting, fraudulent trading etc. More here.

The new offence will only apply to an entity or group of a certain size: more than 250 employees, over GBP18m assets; over GBP36million turnover. The criteria can be fulfilled at individual entity or group level. A parent undertaking of a group (comprising parent and subsidiaries) can be caught by the new offence provided the group fulfils the size threshold. The offence catches UK and non-UK businesses but is particularly relevant where an element of the fraud occurs in the UK or where there is a loss or gain in the UK. The new offence is likely to come into force mid to late 2024.

As to risk 1 above:

- a PC that meets this size threshold would be in scope of the new failure to prevent fraud offence. Any fraud by an associated party of the PC to benefit the PC or its clients/customers could lead to liability for the PC for failing to prevent fraud, unless the PC can show it had reasonable procedures in place. The fraud risk for the PC depends on the PC’s business model.

- regardless of size, a PC could also be prosecuted for a substantive fraud offence if a ‘senior manager’ of the portfolio company was involved. The changes to the ‘identification doctrine’ contained in the Act mean that a broader range of employees can trigger corporate criminal liability – it is no longer the ‘directing mind and will’; it also now includes senior managers. This change comes into force on 26 December 2023.

- PE firms will want to build analysis of risk mapping for fraud/economic crime within potential PC, and outbound anti-fraud controls/prevention procedures if they are not already doing so.

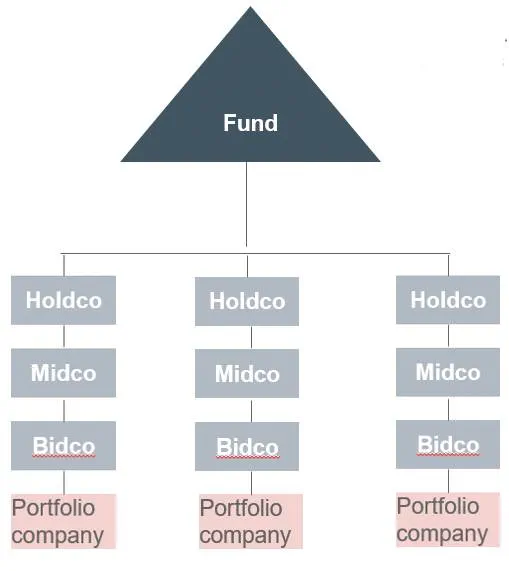

- in addition, a parent undertaking (wherever incorporated) can be liable for a failure to prevent fraud by a subsidiary where the fraud is intended to benefit the parent company or customers. In the diagram below, there is a possibility of liability for the Fund for fraud at PC level which is intended to benefit the Fund, directly or indirectly, even though the natural (and most likely) target for the prosecution would be the PC. An example might be where a PC makes misleading statements in order to gain investment, win a contract / make sales. If there are senior people at the PC who have an interest in the performance of the Fund – by way of investment performance or carried interest, then it is very likely that their decisions are being made to benefit the Fund. If the Fund doesn’t have adequate procedures in place to prevent fraud, it could be liable for failure to prevent fraud by the PC.

Note: the definition of ‘parent undertaking’ is taken from s1162

Companies Act 2006 (s205 ECCTA). In a private equity structure, the ‘group’ as per below includes the parent undertaking (here the Fund) plus all wholly owned subsidiaries, including subsidiaries of subsidiaries (s1162(2) and (5) Companies Act 2006).

The new failure to prevent fraud offence and new ‘senior manager’ attribution test for corporate criminal liability contained in the Economic Crime and Transparency Act 2023 are relevant to private equity firms for two key reasons:

The General Partner holds the legal title to the investments made by the Fund on behalf of the Limited Partners,

As to risk 2 above, the new offence would catch, for example, dishonest asset valuations by employees / agents at the PE firm which benefit the firm, for example if there are improper valuation issues or misrepresenting investment strategy or credentials (for example, on ESG) to win investment.

Firms will want to make sure their internal compliance policies and training are up to date.