During TransPerfect Legal’s third annual Antitrust Clearance and Merger Enforcement conference, a panel of leading antitrust attorneys shared their strategies for overcoming the challenges presented by multijurisdictional merger control filings and clearance proceedings. The expert panel included Teisha Johnson, Partner at Baker McKenzie LLP; Lindsey Champlin, Partner at Latham & Watkins LLP; John Davis, Senior Counsel at Crowell & Moring LLP; and Santiago Roca Arribas, Special Legal Consultant at Clifford Chance LLP.

This blog post summarizes highlights from the session to help you overcome potential hurdles in the multijurisdictional merger control process.

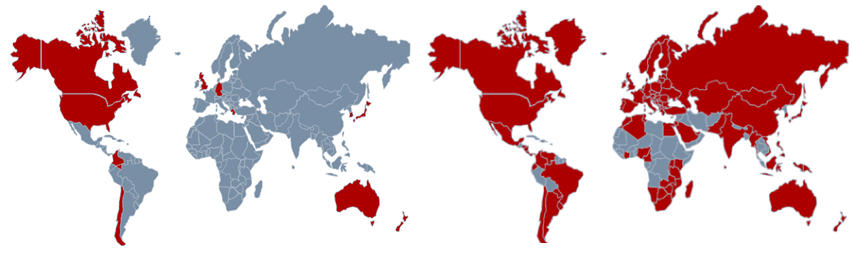

Global Merger Control Has Exploded Over the Last 40 Years

Over the past four decades, the international landscape for merger control has dramatically expanded. Whereas in the 1980s, when only a select few jurisdictions such as the United States, the UK, and Canada required regulatory approval of large M&A deals, today's merging parties must navigate a labyrinthine regulatory environment with over 140 merger control regimes worldwide.

Parallel Processes in Global Merger Control

To make matters even more complicated, the merger review processes aren’t uniform from one jurisdiction to the next. They range from mandatory, pre-closing regimes like those in the US and the European Commission to those like the UK's voluntary and non-suspensory system or Indonesia’s post-closing filing requirement. In pre-closing regimes, antitrust authorities hold the power to levy significant fines for “gun-jumping”—the act of concluding a merger before obtaining the necessary regulatory approval. Each jurisdiction's regulations present its unique considerations, establishing distinct thresholds for turnover or market share that necessitate a filing.

This global rise of merger control requires merging parties and their advisors to plan strategically for both substantive and procedural timing issues as they seek approvals across an increasingly broad spectrum of regulatory landscapes.

From a handful of merger control regimes in the 1980s, there are now 140+ jurisdictions worldwide.

Juggling Parallel Processes Requires Informed Predictions on Timing

In today’s globalized economy, it is not unheard of for international mergers to trigger over 20 parallel filing processes before the transaction can be closed. When a transaction requires multijurisdictional, parallel merger filings, time management becomes a pivotal aspect.

Conduct a Thorough Multijurisdictional Analysis

Antitrust counsel must conduct a thorough multijurisdictional analysis to figure out where filings are required. They must also consider the likely timing required for approval in each jurisdiction, which can vary significantly. Timeframes are influenced by numerous factors, such as the transaction’s complexity and its potential impact on the competitive landscape of each jurisdiction.

For example, while the EU may offer swift clearances within a month for uncomplicated cases, a complex Phase II investigation could stretch to an average of 18.4 months, a timeline even lengthier than the US’ 11.8-month average. Additionally, it's worth noting that jurisdictions with ostensibly brief statutory review periods, like China’s SAMR, can unexpectedly extend due to preliminary discussions with regulators before the formal filing process is deemed complete.

Advise Clients on Approval Processes

From the outset, counsel must advise clients on the potential duration and unpredictability of approval processes, including the possibility of extended remedies negotiations with regulators. This foresight is instrumental when negotiating “long-stop” dates, which dictate when parties may abandon the transaction if approvals are pending.

Align Approval Timings Across Jurisdictions

Additionally, aligning the approval timings across jurisdictions is advisable, particularly when considering remedies, as addressing multiple regulators' concerns concurrently may lead to a cohesive global remedy package. Strategic counsel will be able to advise on the best time to kick off pre-filing talks or make the filings in each jurisdiction to bring the timetables as closely in sync as possible.

Counsel Needs to Weigh the Pros and Cons of Transparency with the Regulators

Working with regulators spanning the globe from Australia to the US introduces unique strategic considerations. While the information submitted to regulators typically remains confidential by law, the interconnected nature of global antitrust enforcement often leads to requests for waivers allowing different regulators to discuss the deal with each other.

In practice, parties tend to grant these waivers, in the hope of maintaining positive relationships with the authorities but also to streamline the process if cross-border remedies are necessary. Nevertheless, legal counsel must weigh the pros and cons of such transparency. Granting a waiver could inadvertently seed additional regulatory concerns, as one regulator may adopt another’s perspective, potentially complicating the merger review with fresh theories of harm.

Furthermore, the granularity of information required in a filing varies significantly between jurisdictions, which adds another layer of complexity when considering waivers. For instance, the European Commission’s Form CO demands a comprehensive sweep of transactional and strategic business documents, far beyond the scope of the Hart-Scott-Rodino (HSR) filing in the US. Thus, providing a waiver might inadvertently lead to a broader exchange of information than initially intended, potentially affecting the strategic leverage of the merging entities.

This complexity is heightened by the nuances of legal privilege across jurisdictions; communications privileged in the US may be fully exposed in Europe. To navigate this, conducting an exhaustive privilege review and meticulously delineating sensitive documents becomes crucial, although costly. This step ensures that counsel can safeguard against unintended disclosures, a critical measure when further investigation or litigation is on the horizon.

Keeping up with Regulatory Requests for Information Poses Technical Challenges

In the current climate of increased scrutiny on mergers, regulators are focused on the story told by parties’ internal communications, demanding ever-larger quantities of internal documents to understand the rationale behind transactions.

The US regulators stand out for their comprehensive demands for data with requests often resulting in the disclosure of millions of documents, which they can review using sophisticated Technology-Assisted Review systems. By contrast, other jurisdictions have historically requested fewer documents and offered more flexibility to their requests. However, this status quo looks to be changing as non-US regulators, including the European Commission and the CMA, develop their technical capabilities to allow them to review larger datasets.

A notable development in requests for information is the broadening of target data sources, with demands now encompassing everything from personal mobile devices to cloud-based collaboration platforms from Microsoft Teams to collaborate. This escalation significantly increases the burden on merging entities and their legal teams to collect and review such diverse data. It also raises privacy concerns for executives who may not be thrilled to hand over their phones for review by regulators, or their legal advisors. To avoid delays, legal counsel will need to navigate sensitive discussions with their clients to get them comfortable with the regulators’ demands.

Moreover, counsel should offer pre-emptive training for employees on how to describe the transaction rationale and synergies, especially in the nascent stages of a deal. Such guidance can be critical in helping clients avoid the risk of committing unwise (and sometimes even untrue) statements to writing that can sabotage a deal at the regulatory review stage, when such documents are discovered by the regulators during an in-depth review.

Final Takeaways

Managing parallel merger control proceedings in complex transactions will only get more complicated as the number of merger control regimes grows worldwide and the scrutiny of existing regulators gets tougher. While the efficacy of crystal ball gazing will always be questionable when dealing with unpredictable regulators, it will be critical for counsel to manage their clients’ expectations effectively from start to finish. This will give transactions the most chance of success, despite the procedural and technical hurdles encountered along the way.