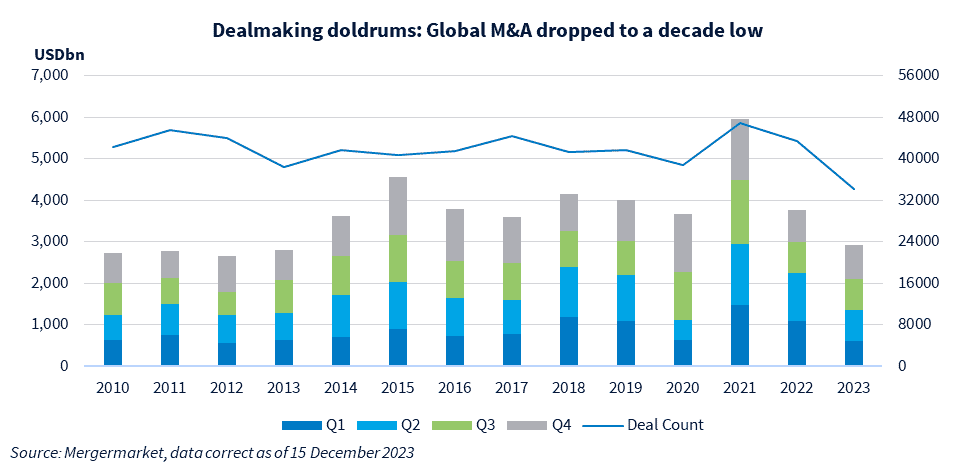

M&A activity in 2023 was subdued, as dealmakers grappled with geopolitical tensions, inflation, rising interest rates, and increasing regulatory scrutiny, against a backdrop of general economic uncertainty. Challenges in the U.S. banking sector in the early part of the year also took their toll.

But deals got done. While the total value of deals fell by about 23%,[1] to the lowest level since 2013, the number of deals fell by 16%, reflecting a focus on smaller deals. Some sectors stood out: tech, while down from prior years, continued its strong run, as artificial intelligence (AI) and other emerging technologies created market buzz, and oil and gas in Q4 edged out tech, by value, for the first time in recent memory, thanks in part to two blockbuster transactions.

In Q4 the M&A market showed some signs of recovery. Big-ticket ($2BN+) deals hit their highest levels since Q2 2022, and five of the year’s 10 largest global deals were announced. Further clarity on, if not resolution of, some of 2023’s challenges may lift M&A in 2024 as companies seek to implement growth, earnings, and valuation strategies.

In this alert, we review the M&A markets in 2023 and the major legal and regulatory trends affecting deals in 2024.

Global Activity

Global activity through December 15 reached $2.9 trillion in value, down 23% year-over-year.

- North America – North America deals totaled $1.46 trillion, down 12% from 2022. The second half of the year saw promising activity, with several megadeals announced in September and October, including Cisco’s agreement to acquire Splunk, Exxon’s agreement to acquire Pioneer, and Chevron’s agreement to acquire Hess. U.S. capital markets were buoyed in September by Arm’s $5 billion debut on Nasdaq (in which MoFo represented Arm), the largest IPO since 2021.

- Asia-Pacific – Asia-Pacific deals totaled $708.2 billion, a 26% year-over-year decline. Among other things, cross-border activity between China and the U.S. continued to stall. Japan was a bright spot, with the number of deals up 34% compared to 2022. Healthcare M&A in APAC saw its highest value level ever, and auto industry M&A was up 80% year-over-year.

- Europe – EMEA saw $676 billion in deal activity, a 35% drop compared to 2022. U.S. companies led the most in-bound acquisitions, with deals valued at $89 billion. Much like the global M&A market, the number of EMEA deals saw a notable increase in Q4, up 13% compared with Q3.

Tech – Tech remained a top choice for dealmakers, accounting for 27% of deal value. In our 2023 Tech M&A Survey, dealmakers picked cybersecurity as the most promising subsector for deals over the next 12 months, with the AI sector also presenting strong dealmaking opportunities.

Healthcare – Healthcare continued to perform. In North America, healthcare was the third-highest sector by volume, led by several large M&A transactions, including Pfizer’s $43 billion takeover of Seagen. As noted above, healthcare M&A in APAC saw its highest value level ever, led in part by Daiichi Sankyo’s $22 billion deal with Merck.

Private Equity – Sponsors took a cautious approach to M&A, with global private equity deals dropping 33% in volume and 41% in value year-over-year. In the face of rising interest rates, tightening credit markets, and other headwinds, sponsors adjusted their approaches to dealmaking, using relatively more equity, additional seller rollovers, and (as discussed below) private credit financing. Looking forward, 91% of PE firms surveyed in our 2023 Tech M&A Survey expect to use minority investments in their future tech transactional activity, up noticeably from 55% in 2022.

ESG in M&A

ESG is playing an increasingly important role in dealmaking. In our 2023 GCs and ESG Report, conducted in partnership with Corporate Counsel, 45% of respondents indicated that their companies take ESG factors into account when engaging in M&A activity; in the tech space, respondents to our Tech M&A Survey scored ESG as significant (7.85 out of 10) in choosing their most recent target, and even more so (8.45) with respect to selecting their next target.

Flexibility a Necessity

Companies used more structured deals, such as minority/staged investments, earnouts and CVRs, to reach agreements and to balance out traditional and new risks. The use of stock as consideration (in whole or in part) increased relative to 2022, reflecting potentially an attempt to align incentives in the face of volatility as well as the rise in equity markets later in the year. Carve-outs and divestitures were popular approaches, and spinoffs resurged in the second half, including Danaher’s $23.3 billion spinoff of Veralto. Companies that in a stronger deal market might have been sold were seen taking steps to stay independent longer, raising funds in other ways where needed but keeping an eye on potential exits.

Looking Forward

For 2024, dealmakers generally anticipate that the M&A environment will continue the trend from Q4 and improve. Inflation has fallen, though not yet to the Fed’s target. Interest rates have stabilized and may start to decline. Private credit has become more widely available, for more kinds of deals, and traditional credit markets are starting to improve. Equity markets, while still volatile, have regained lost ground and even hit new highs. But questions remain, with economic uncertainty, geopolitical tensions, aggressive regulatory scrutiny, and elections coming up in the U.S. and elsewhere.

Savvy companies, though, are expected to look for ways to effect strategies for growth, including by expanding product lines, and to enhance performance, including by divestitures, in the face of technological and other disruptions. Companies also will consider how best to raise needed capital and liquidity. Flexibility, creativity and nimbleness will be needed.

1. Generative AI Takes Flight and Raises Questions for Many Deals

Following technological breakthroughs and an explosion of interest, companies are rushing to acquire or develop AI resources.[2] AI tools have proliferated throughout businesses in all sectors, raising AI issues even in non-AI deals.

Key Drivers for AI M&A

AI infrastructure companies augmenting core product markets.

- Big tech companies, particularly cloud/datacenter providers, have partnered with AI startups through commercial deals with minority equity investments to help solidify their positions as suppliers of AI infrastructure components. For example, Microsoft committed $13 billion for OpenAI (a MoFo client), and Google and Amazon committed up to $2 billion and $4 billion, respectively, for Anthropic, with significant commitments for these startups to utilize the investors’ cloud services.

-

Companies designing semiconductor chips for AI applications have snapped up companies to facilitate the adoption of their chips. For example, Nvidia bought OmniML, whose software shrinks machine-learning models, including large language models, so that such models can run on NVIDIA chip-powered devices.

Enterprise software companies capitalizing on market demands. Enterprise software companies have moved to add AI capabilities in their product offerings, so their customers can build their own AI tools. For example, Databricks, a data management solutions provider, acquired MosaicML for $1.3 billion, adding capabilities for its business customers to build AI models using their own proprietary data.

“AI tools have proliferated throughout businesses in all sectors, raising AI issues even in non-AI deals.”

Vertical players seeking to accelerate AI adoption.

Players in industries with more mature AI use cases, including biotech, legal, fintech and edtech, have acquired AI startups with industry-specific AI expertise. For example, Thomson Reuters paid $650 million to acquire Casetext, whose key product, CoCounsel, is intended to act as an AI legal assistant. These acquisitions frequently are intended to accelerate the acquirors’ own AI strategies as well as to acquire the startups’ existing products.

Startups accelerating exit timetable.

Amidst rapid evolution, AI startups risk quick obsolescence and an uncertain road to commercialization, all in the face of fierce competition from more mature companies with established distribution channels and other resources. Such reality checks may prompt startup founders and their venture capital backers to move up their exit timetable, resulting in AI startups being sold sooner than anticipated.

Emerging AI-Related Deal Features

Retention structures top of mind.

Talent acquisition is often a key component for tech M&A, and the talent wars have intensified in AI. Acquirors must consider retention and related tax, fiduciary, and other structuring concerns in the face of the rapidly growing demand for such talent.

Diligence and reps and warranties.

AI raises new business and legal questions, and with those come changes in diligence and related reps and warranties. For example, both parties might want to consider, if a target company:

- develops AI tools (either for its own use or for third-party usage): (i) sources of data used in developing, training, and/or fine-tuning AI models, and the permission and restrictions on using, storing, managing, accessing, and processing such data from contractual, data protection, and other regulatory perspectives, and (ii) liabilities (including contractual warranties or indemnities) associated with outputs from AI tools, for accuracy and reliability of such outputs, as well as copyright or other intellectual property infringement claims.[3]

- develops or uses AI tools: (i) dependencies on third-party resources (e.g., data, technologies, cloud, or other infrastructure providers), and availability of such resources post-closing or the ease of switching providers post-closing, (ii) AI governance to mitigate the risks of safety and biases and ensure compliance with relevant privacy and other regulations, such as from the EU, U.S. federal and state governments and regulators (including regulations to come following President Biden’s AI Executive Order),[4] and other applicable jurisdictions, and industry benchmarking standards, particularly in high-scrutiny use cases (e.g., hiring, education, benefit eligibility, credit worthiness, and health), and (iii) ownership and IP protectability of AI-generated technologies and content.

2. Antitrust: Continued Aggressive Enforcement and Major Shifts in Review Process

In 2023, U.S. and global antitrust agencies kept their promises to increase scrutiny of acquisitions. In 2024, the scrutiny is expected to continue and major administrative changes—including a new HSR form and recently finalized revised merger guidelines—if fully effected, will lead to more transactions subject to regulatory scrutiny, more time and effort for merger filings, ongoing monitoring of proposed settlements, if accepted, and the potential for protracted litigation, even after closing.

Courts skeptical of non-traditional harms, but agencies press on. The FTC and DOJ were successful in blocking or securing divestitures for several transactions (e.g., ICE/Black Knight), but courts are rebuffing the agencies’ more novel theories.

-

In California, the federal district court rejected preliminary injunctions for Meta/Within (alleging the deal would eliminate a nascent competitor) and Microsoft/Activision (alleging Microsoft would use this vertical combination to foreclose competing gaming console providers).

-

The FTC has been especially aggressive in its use of internal administrative proceedings. For example, in Microsoft/Activision, the FTC resumed its internal challenge just weeks after the federal court trial loss. In April, the full Commission also overruled the findings of its own administrative law judge in Illumina/Grail, ordering Illumina, almost two years after closing, to divest Grail, with the Fifth Circuit agreeing with the Commission that Illumina’s acquisition would likely violate antitrust law, one of the rare instances where a court has found that a vertical merger would likely violate antitrust law.[5]

-

Following multiple deals where parties “litigated the fix” in court, both FTC and DOJ closed cases where the parties agreed to divestitures or other remedies, but the agencies have insisted upon ongoing conditions, such as the appointment of a monitor, to supervise compliance (e.g., Amgen/Horizon Therapeutics, AssaAbbloy/Spectrum).

-

State enforcers remain highly involved in merger review. For example, state attorneys general objected to the pre-closing payment of a special dividend by Albertson’s in connection with Kroger’s proposed acquisition, which they alleged would weaken Albertson’s prior to closing, but state and federal courts rejected their objections.

The HSR form is expanding. The proposed changes[6] would require parties to include, among other things:

-

an expanded universe of documents, including some created earlier in a party’s deal consideration;

-

new narrative responses regarding competition; and

- disclosure of debtholders, indirect owners, and others who might influence the parties.

New Merger Guidelines reveal an attempted paradigm shift. Key changes in the new Merger Guidelines, released in December 2023,[7] include:

-

abandonment of the consumer welfare standard;

-

new tests for market definition and lower thresholds to presume mergers are illegal; and

-

sections targeting particular industries, markets, or strategies, including a renewed focus on labor impacts, use of data (including pricing algorithms), multi-sided platforms, potential market entrants, and serial acquisitions and roll-up strategies.

“New Merger Guidelines reveal an attempted paradigm shift.”

The new Merger Guidelines softened initially proposed language and cited to more recent cases, compared to the draft Merger Guidelines released in July. Courts have typically followed prior Merger Guidelines, but that may change as the new Guidelines appear to reject aspects of the prior Merger Guidelines and depart from recent court precedent.

Enforcement abroad is increasing. Global developments have paralleled the aggressive approach of U.S. enforcers but have not moved entirely in lockstep.

-

The European Commission (EC) this year adopted a package of reforms to simplify its merger control regime, creating a new “tick-the-box” notification for low-risk cases.

-

International agencies remain active in merger enforcement, with, for example, the UK’s Competition and Markets Authority conducting an aggressive review of Microsoft’s acquisition of Activision before clearing the deal after the parties made additional licensing commitments, and Adobe and Figma terminating their merger agreement following challenges from the EC and UK.

-

Chinese regulators have been looking aggressively at transactions involving U.S. technology firms, leading to delays. For example, Intel terminated its acquisition of Israeli chipmaker Tower Semiconductor after the State Administration for Market Regulation (SAMR) did not approve of the deal.

“Global developments have paralleled the aggressive approach of U.S. enforcers but have not moved entirely in lockstep.”

What’s Next? 2024 presents a potential paradigm shift for merger enforcement. Careful planning, including proactive consideration of divestitures and other “fixes” where appropriate, and customization of acquisition agreements to provide appropriate efforts covenants (including with respect to control over the approach to the regulatory review process and any litigation with regulators), pre-closing target company operations covenants (that contemplate the possibility of extended review periods), termination provisions, and remedies and related terms, will be key, as businesses and the antitrust agencies adjust to the new rules and courts respond to these dramatic changes.

3. National Security Processes Playing an Enhanced Role

U.S. Review Intensifies Focus on High-Risk Sectors

In the U.S., scrutiny of investments for national security issues in 2023 continued to increase, particularly for transactions by persons from China, Russia, and other countries the U.S. government perceives as strategic competitors and for transactions involving emerging technologies. Among other things, CFIUS is:

-

subjecting more transactions to investigation following initial review,

-

requiring full visibility into the acquiror’s ownership, including limited partners in fund structures, and

-

requiring substantially more mitigation agreements.[8]

One update that might have gone unnoticed: In mid-May, CFIUS stated that mandatory filings for certain staged transactions must be made up front, when the foreign investor acquires an equity interest, and not only when the CFIUS-relevant rights are triggered. CFIUS still appears, however, to distinguish purely contingent interests, such as SAFEs or convertible notes.

“2023 saw further proliferation of FDI regimes around the world, driven by a continued global trend towards protectionism (critical infrastructure, security of supply chains, and technology sovereignty) and accelerated by global events....”

Global Foreign Direct Investment Review Regimes Expand

2023 saw further proliferation of FDI regimes around the world, driven by a continued global trend towards protectionism (critical infrastructure, security of supply chains, and technology sovereignty) and accelerated by global events, such as the Ukraine war and growing economic and political tension with China.

European Union:

-

Several new FDI regimes emerged in the EU (e.g., Belgium, the Netherlands, Luxembourg, and Sweden) or will be added in 2024 (e.g., Ireland). All 27 EU Member States thus either have an FDI regime or are in the process of adopting one (there is no harmonized EU-wide FDI regime). Mandatory filing requirements apply across a broad range of sectors.

-

The EU’s annual report for 2022 shows that the vast majority of filings received unconditional clearance (86%), but authorities sought mitigation measures in 9% and prohibited 1% of cases (with 4% withdrawn). In 2023, prohibition decisions were not focused exclusively on Chinese investors (e.g., France blocked an indirect U.S. investment; Denmark blocked a Japanese investment).

-

The EU’s Foreign Subsidies Regulation (FSR) came into full effect in October 2023. The FSR is designed to prevent foreign subsidies from interfering with EU interests. It requires notification of foreign financial contributions with respect to certain larger M&A transactions and imposes other far-reaching obligations, and so requires thorough analysis of payments and other benefits received from foreign governments.[9]

UK: The first two years under the UK National Security and Investment Act (NSIA) saw 17 remedies cases, five of which involved either prohibiting or unwinding transactions. The UK government is reviewing the operation of the regime and consulting on some potential amendments, including refinements to the scope of certain mandatory sectors and the possible introduction of exemptions for certain categories of transactions (including internal reorganizations).[10]

China: The PRC has a far-reaching investment control regime with potentially low nexus requirements, broadly drafted sectors, and a lack of guidance. Although there is little publicly available information on how China has exercised its FDI review authority, China continues to scrutinize, delay, and in some cases scuttle sensitive transactions.

South Korea and Singapore[11] are undertaking modest expansions of existing review programs to capture investment in more companies considered critical to national security interests.

Formal U.S. Outbound Investment Review Announced

In August, President Biden issued a long-anticipated executive order addressing investments by U.S. persons in companies that engage with certain categories of technology and products located in the PRC. The new outbound investment program (often referred to as “reverse CFIUS”) covers certain investments in semiconductors and microelectronics, quantum information, and AI systems.[12] The program is not yet effective or in final form, and key constituencies are sure to weigh in as the rulemaking process continues.[13]

We can expect this form of outbound screening to expand to other jurisdictions, including the UK, where the UK government recently reminded stakeholders that the NSIA regime already applies to outward investment, albeit only in the limited situations where asset transfers take place.

Global Sanctions and Export Controls Increase

Governments continued to increase trade and financial sanctions (including those imposed by the U.S., UK, and EU against Russia in December 2023) and export control restrictions, as well as related enforcement actions (including actions by the U.S. that resulted in large settlements with Binance). Governments affected by such restrictions adopted additional countermeasures (such as conditions imposed by Russia on investors from “unfriendly countries” attempting to exit Russia). Global companies thus face increasingly complex and potentially conflicting requirements that can affect sales and divestitures as well as acquisitions and post-closing integrated operations.

4. Privacy & Security Issues Grow as Data Value Rises

Virtually every deal has data privacy and security implications, and the potential exposure continues to grow.

Continuously evolving U.S. and global legislative landscape. The U.S. has historically lagged with respect to omnibus (i.e., not sector-specific) privacy legislation, but by the end of 2023 five U.S. states had omnibus privacy laws and more will follow in 2024.

- Most U.S. state laws apply only to personal data collected in a business-to-consumer context, though the California Consumer Privacy Act (CCPA), like most non-U.S. privacy laws, applies to any personal data, so also, for example, to personal data collected in a business-to-business or employment context.

- The U.S. state laws regulate the collection and processing of “personal data,” defined very broadly.

- The U.S. state laws provide for significant penalties; the CCPA, for example, authorizes civil penalties of $2,500 per violation, which could be based on the number of individuals affected by the violation and can be trebled for intentional violations.

In jurisdictions outside the U.S., we continue to see a steady drumbeat of data privacy and security legislative and enforcement developments.

“In jurisdictions outside the U.S., we continue to see a steady drumbeat of data privacy and security legislative and enforcement developments.”

Data security threats and preventive measures. Threat actors persist in finding new ways to compromise systems and data. Strong data security measures are crucial, and we are seeing more buyers engage information technology specialists to assist with review of a target company’s systems. A company’s data security procedures should be measured against applicable laws (e.g., the Massachusetts Rules Regarding the Protection of Personal Information), as well as against the general standard of “commercially reasonable” measures, which has been used by the Federal Trade Commission. A company’s contracts with customers, service providers, and others also may impose data related obligations.

Data security incidents. Even with tight security, breaches occur, and companies must be prepared to respond to, remediate, and, as and when appropriate, disclose them. It can take months, though, for a company to detect a security breach. A buyer may find that it has closed with a target that has experienced a breach, or, worse, that the same breach has infected the buyer’s systems as the buyer integrated the target. Public companies now must disclose certain breaches publicly under the SEC’s July 2023 rules.[14]

In 2024, data privacy and security issues are expected to continue to grow as key considerations in M&A, as data becomes more valuable (sometimes emerging as an unexpectedly large asset of a company as well as a source of a company’s obligations to others) and threats more pervasive and insidious. The increased privacy and security risks and evolving regulations will require appropriate planning, diligence, negotiation, and other deal steps.

5. Private Credit Expands During a Tough Lending Environment

2023 was a tough year for buyers seeking acquisition finance, with interest rates rising and banks less willing to fund aggressively. The dislocation in the bank market starting in early 2023 caused by macroeconomic concerns, bank failures, and rising interest rates helped to dampen the interest of banks in making larger loans.

Growth in Private Credit

The year saw continued growth, though, in “private credit” acquisition loans by non-banks, such as asset managers, hedge funds, and private equity funds, which usually make loans directly to borrowers without an investment bank, broker, or other intermediary. Such lenders have dominated the recent market for acquisition loans to private equity-owned middle-market companies. The past year saw them also make loans for larger deals, which historically had been arranged and led by investment banks, with loans broadly syndicated.

- Extending the benefits of private credit acquisition loans—easier negotiation of financing related M&A deal terms, increased certainty of financing, speedier closing, and limited loan marketing periods, among others—to larger M&A deals gives buyers more financing options and possibly better terms.

- There are some disadvantages, though, particularly in the middle market, such as more complex pricing, often a maintenance financial covenant, and higher call protection.

“The year saw continued growth, though, in “private credit” acquisition loans by non-banks, such as asset managers, hedge funds, and private equity funds....”

Borrowers Increase Negotiating Leverage

The dislocation in the first half of the year caused borrowers to accept pricing and deal terms lenders, particularly banks, were willing to give. This was a turnaround from the trend of prior years. Yet with 2023 Q3’s easing of broader economic concerns and related deal volume growth, terms became more favorable to borrowers. Further, private credit lenders’ move into funding larger M&A deals created a competitive dynamic with investment banks.

Impact of Acquisitions on ESG Loans

In 2023, market participants and bank regulators encouraged lenders and borrowers to review whether ESG standards specified in loans that offered benefits to borrowers—such as lower debt service costs—were realistic, and whether testing was done with appropriate rigor. ESG lending volume dipped as such standards were reviewed. Still, an acquisition may affect the ability of either the buyer or the target to satisfy any such ESG standards included in their own financings. Additionally, if ESG standards are included in financing for the acquisition, the buyer (and often the lender) will need to be able to conduct relevant due diligence of the target to ensure the standards can be met at closing. Some financing contracts allow addition of ESG provisions following the closing if the standards cannot be met or adequately diligenced before the closing.

6. Buyers Beware: Damages for Aiding and Abetting a Target’s Disclosure Violations

In a pair of cases, the Delaware Chancery Court in 2023 found acquirors liable for aiding and abetting breaches of fiduciary duty by the targets’ officers.[15] In each case, the court found, after trial, that:

- One or more target executives had preferred a particular buyer for unique personal reasons and taken actions to favor that buyer in violation of the executives’ fiduciary duties, and the acquiror had knowledge, or constructive knowledge, of and exploited or participated in those breaches.

- One or more target executives had violated their duty of disclosure by knowingly omitting from the proxy material information relating to the target executives’ favoritism towards the acquiror, and the acquiror was aware of the omitted facts and, pursuant to provisions in the applicable merger agreement, was obliged to correct misleading statements in the target’s proxy. For example, in Columbia Pipeline, the proxy failed to disclose a series of interactions between the target and the acquiror and that the acquiror had breached its standstill agreement with the target in the course of the sale process.

“It is not safe to assume that acquirors face little or no risk just because the proxy is ultimately the target’s responsibility.”

A court may impose joint and several liability against a target company fiduciary, as the primary violator, and the buyer, as aider and abettor. Even where damages for aiding and abetting a disclosure violation may be difficult to quantify, the court may impose “nominal” damages, which in the aggregate may be significant.

The cases further highlight the importance to the buyer as well as the target fiduciaries of appropriate disclosure by the target company. Appropriate disclosure by a target and approval by its shareholders can support “cleansing” (pursuant to the Corwin doctrine) of other actions that might otherwise breach fiduciary duties. Acquirors should carefully consider their contractual obligations with respect to the target’s proxy disclosures and keep in mind it is not safe to assume that acquirors face little or no risk just because the proxy is ultimately the target’s responsibility.

7. Increasing Experience with Rep & Warranty Insurance Claims

Following the heightened M&A volumes of 2021 and early 2022 and the proliferation of rep and warranty insurance (RWI) prior to that time, 2023 saw an uptick in the number of RWI claims and disputes over claims. A few trends have emerged, highlighting the importance of the insurance policy provisions for pursuing claims and the claims experience of RWI providers as well as premium costs:

New types of claims. Historically, many claims related to breaches of financial statements, undisclosed liabilities, compliance with laws, and material contracts reps. 2023 saw an increase in claims related to cybersecurity and privacy reps, tax reps, and, in the manufacturing sector, environmental reps. The size of claims still tends to be highest with financial statement and material contract related representations, where the buyer may claim damages based on a multiple (such as the multiple used in pricing the acquisition) of the amount of the loss rather than just the amount of the loss.

Claims payouts taking longer to obtain. Recent studies have shown that RWI claim payouts are taking longer to obtain (in the range of one to three years), with the claims process becoming more adversarial and resource-intensive. One factor behind this trend could be the complex nature of some alleged breaches. For example, claims such as trade secret theft and IP infringement are often aggressively pursued and lead to higher defense costs.

“RWI claim payouts are taking longer to obtain (in the range of one to three years), with the claims process becoming more adversarial and resource-intensive.”

Payout experience. The cost of RWI has been closely followed, but information on payouts on claims under RWI policies has been harder to find. One broker reported that, for claims since 2013, 33% settled within the policy’s retention, and, while a number of claims still remain active, only 15% have resulted in payment by the insurer.[16] The broker also reported that claims are made on about 20% of policies.

Inadequate information cited for delays. On paper, most RWI policies contain buyer-friendly insurer consent and notification requirements. However, in practice, insurers processing claims say they are provided inadequate information that prevents them from analyzing the quantum of loss or the presence of breach. Another common reason for the denial of claims is the failure of the insured to obtain the insurer’s consent in settlements.

8. Shareholder Activism Continues to Impact M&A

In 2023, shareholder activists continued to press M&A-related theses, along with more general board and governance initiatives. Shareholder activism related to M&A may increase in 2024 as the M&A market strengthens.

Activists press for, or complicate, M&A efforts by companies. Activists continued to pressure boards to sell companies, in whole or, increasingly (perhaps reflecting the weaker M&A market), in part (via a spinoff or divestiture). Activists also opposed announced transactions, often on the buy-side, by criticizing an announced transaction as too expensive (such as Ancora’s opposition to Forward Air’s acquisition of Omni), but also on the sell-side, by questioning the process or the price (such as Madryn’s opposition to the merger of SomaLogic with Standard BioTools).

“Activists continued to pressure boards to sell companies, in whole or, increasingly (perhaps reflecting the weaker M&A market), in part (via a spinoff or divestiture).”

SEC modernizes beneficial ownership filings. Under SEC rules amended in October and effective February 5, 2024:[17]

-

Schedule 13Ds must be filed within five business days, rather than 10 business days, after crossing the 5% beneficial ownership threshold (beginning February 5, 2024).

-

Schedule 13Gs by Qualified Institutional Investors must be filed within 45 days after quarter-end, rather than 45 days after year-end (beginning September 30, 2024).

These changes could have significant effects on some activist campaigns. For example, with the compressed reporting period, unless activists are willing to stay under the applicable reporting threshold, companies will get quicker notice of activist accumulations, and activists will have less time before their campaigns become public to expand their equity ownership base and their corresponding ability to profit from changes in the stock price.

The new rules were accompanied by guidance on cash-settled derivatives and group formation, to clarify, among other things, that:

- A Schedule 13D filer must disclose cash-settled and other derivatives that use the company’s shares as an underlying security.

- A group may be formed when a substantial beneficial owner (who is or will be required to file a Schedule 13D) intentionally communicates to others that the owner will file a Schedule 13D with the purpose of inducing such others to purchase the underlying securities, and one or more of the others purchase the securities as a direct result of that communication.

Boards increasingly reject activist nominations. The number of companies rejecting director nominations by activists due to purported non-compliance with the company’s advance notice bylaws increased significantly. Companies may be encouraged in this respect by recent Delaware decisions upholding the rejection of nominees at several companies.[18]

Initial experience with the universal proxy card. 2023 saw the first proxy season under the SEC’s universal proxy rules. While activism levels did not seem to increase as a result, for proxy fights that went to a contested vote, activists generally were more successful in securing at least one board seat as compared to 2022. In future proxy seasons, the influence of ISS and Glass Lewis could increase as shareholders look for guidance on choosing amongst director nominees.

Anti-ESG Movement. Activists have used ESG considerations as wedge issues in advancing their campaigns, in an attempt to sway institutional investors. While activists continue to do this, growing opposition to the overall ESG movement may impact their ability to leverage ESG themes going forward. At the same time, in response to mounting anti-ESG pressure, some institutional investors have updated their voting policies to deemphasize ESG as a standalone priority and instead emphasize risk stewardship.

9. Musk’s Agreement to Acquire Twitter Makes People Think About … Contract Damages

At the end of October, the Delaware Chancery Court gave dealmakers reason to rethink provisions for damages payable by a buyer for breaching a merger agreement where target shareholders are not parties. The court’s opinion[19] addressed the merger agreement between Elon Musk’s entities and Twitter, which provided, among other things, that:

-

Other than specified parties (which did not include shareholders), there were no third-party beneficiaries, and

-

If terminated under certain circumstances, the buyer would be liable for damages, including the shareholder premium and other benefits of the transaction lost by the shareholders.[20]

A Twitter shareholder sued Musk for allegedly breaching the agreement before Musk closed the transaction. After the closing, the shareholder sought a mootness fee for his purported role in causing Musk to close, but the court found the shareholder had no standing, because when he sued either he did not have third-party beneficiary status or his status had not vested.

Of more general applicability, the court stated that:

- Defining damages payable by a buyer to a target company to include lost shareholder premiums was an unenforceable penalty, since the target company itself would not have received that premium.

- A target company could consider making itself the shareholders’ agent for purposes of pursuing damages suffered by them, but that was on “shaky ground” since there was no basis for the company to unilaterally appoint itself agent.

- The parties could make shareholders third-party beneficiaries by the express terms of the agreement. However, here they had not done so, and in most deals both buyers and target companies generally tried not to give all shareholders standing to sue the buyer, which might lead to loss of control by the buyer and the target and might not be consistent with the “need to recognize the contractual primacy of the board … in the sale context”.

The court questioned, though, whether the parties, implicitly if not expressly, intended to make shareholders third-party beneficiaries after the target company had sought specific performance, since otherwise the apparently carefully drafted damages definition would not mean much.

“[T]he Delaware Chancery Court gave dealmakers reason to rethink provisions for damages payable by a buyer for breaching a merger agreement.”

The opinion does not diminish the availability to targets of specific performance remedies, which if obtained could result in, among other things, a closing of the acquisition and receipt by shareholders of the intended premium. Nor does it address a target company’s right to sue a breaching buyer for damages suffered by the company, such as costs and expenses, or the use of “reverse” termination fees payable by the buyer to the target in many transactions. However, target companies, in the absence of, and sometimes in addition to, other comparable remedies, want to be able to sue breaching buyers for the benefit of the lost premium, which can be a substantially larger amount. Target companies may take actions, in merger agreements or elsewhere, to address the court’s concerns, thereby further disincentivizing breach by buyers, but the market has not yet settled on a response to the opinion.

[1] All data correct as of December 15 and courtesy of Mergermarket, except as otherwise indicated.

[2] For regular discussions of AI developments, visit MoFo’s AI Resource Center.

[3] For an overview of generative AI-related issues, see our April 25, 2023 client alert, “Key Issues in Generative AI Transactions”.

[4] For discussion of key points of the executive order in more specific areas, see our Nov. 2023 client alerts on “Healthcare Industry Implications”, “Presidential Authority for Compelled Disclosures for AI Models and Computing Clusters”, “Consumer Financial Services Touchpoints”, and “National Security and Government Contractor Implications”.

[5] 5th Cir. Dec. 15, 2023. The Fifth Circuit remanded the case on the basis that the FTC did not properly evaluate the remedy. The Fifth Circuit also rejected Illumina’s claims that the FTC structure was unconstitutional. Illumina shortly thereafter announced a decision to divest Grail.

[6] For additional discussion of the proposed revised HSR rules, see our July 7, 2023 client alert, “FTC Proposes Significant Expansion and Changes to HSR Merger Notification Form”.

[7] For additional discussion of the new Merger Guidelines, see our December 21, 2023 client alert, “DOJ and FTC Finalize New Merger Guidelines – What You Need to Know”, and our July 27, 2023 client alert, “DOJ and FTC Release Draft of New Merger Guidelines”.

[8] For more information, see our Aug. 8, 2023, client alert, “The Long and Winding Road: Key Points from the CFIUS Annual Report”.

[9] For more information, see our Oct. 12, 2023 client alert, “Notification Obligations Under the EU Foreign Subsidies Regulation Enter into Force Today”.

[10] For more details, see our Nov. 17, 2023 client alert, “Government Consults on Potential Changes to the UK’s Investment Screening Regime”.

[11] For more details, see our Dec. 1, 2023 client alert, “Singapore Announces Targeted Investment Review Regime”.

[12] For a description of the new outbound investment program, see our Sept. 28, 2023 Lawfare article here, and our August 10, 2023 client alert, “High Walls and Small Gardens: Biden Administration Unveils Outbound Investment Screening”.

[13] Some of the commentary received is discussed in our Dec. 14 client alert, “Outbound Investment Review Program – Themes from Industry Comments”.

[14] See our July 28, 2023 client alert, “SEC Adopts Cybersecurity Disclosure Rules for Public Companies”.

[15] In re Columbia Pipeline Group Merger Litigation (Del. Ch. June 30, 2023); In re Mindbody, Inc. Stockholder Litigation (Del. Ch. Mar. 15, 2023). The court also found a buyer potentially liable for aiding and abetting a target CEO’s disclosure and other fiduciary obligations in Firefighters’ Pension System of the City of Kansas City v. Presidio, Inc. (Del. Ch. Jan. 29, 2021).

[16] Aon, 2023 Transaction Solutions Global Claims Study.

[17] For further discussion of the rule changes, see our Oct. 25, 2023 client alert, “U.S. SEC Adopts Amendments to Beneficial Ownership Reporting Rules”.

[18] Recent litigation and other developments with respect to advance notice bylaws are discussed in our Sept. 5, 2023 client alert, “Advance Notice Bylaws and the Increasing Number of Stockholder Director Nominations That Are Rejected by the Target Companies”.

[19] Crispo v. Musk (Del. Ch. Oct. 31, 2023).

[20] Provisions like this second bullet are commonly referred to as “Con Ed” provisions. They became more common after the Second Circuit in Consolidated Edison, Inc. v. Northeast Utilities (2005) found that a merger agreement did not give company shareholders standing to sue—since they were not parties and were not included in the agreement’s exceptions to a general disclaimer of third-party beneficiaries—and did not allow the company to seek damages for losses suffered by the shareholders, since the agreement provided for the company to seek damages only to the extent suffered by it.

[View source.]