The increased interest in installing solar at affordable housing projects is not surprising given that the IRC Section 48 energy investment tax credit (ITC) [1] could subsidize as much as 70 percent of the cost and the Inflation Reduction Act (IRA) made it easier to monetize the ITC. The benefits for installations at affordable housing projects that qualify for the low income housing tax credit under Section 42 (LIHTC) are even greater because LIHTCs are no longer reduced if the ITC is claimed. Further, with appropriate structuring, many states include the solar cost in basis for purposes of the LIHTC calculation. Of course, there are also energy cost savings and other non-tax benefits, not discussed here. Our purpose is to assist stakeholders in both sectors (solar and LIHTC) with structuring options to maximize both tax credits.

The ITC for Solar Generation and Electricity Storage in a Post-IRA World

The IRA increased and extended the ITC, and also made it easier to monetize the credit. For those not familiar with the ITC, this section provides background information.

- Who can claim the ITC?

The ITC is a one-time credit claimed by the tax owner, as of the "placed in service" date, which is generally the time of commissioning. There is no need to apply for or be allocated tax credits, like for the LIHTC (unless the taxpayer is seeking to claim the 20 percent low-income communities bonus ITC described below).

2. How is the ITC calculated?

Generally, the base rate is 30 percent of the cost of the solar property (and energy storage property as discussed below), subject to satisfying certain federal wage and apprenticeship requirements. However, in the case of solar facilities with a maximum output of less than 1 megawatt (MW) (i.e., most installations at LIHTC projects), the base rate is automatically 30 percent. Note, however, that "single project" rules may require aggregating the capacity of all solar facilities installed at the LIHTC project for purposes of this requirement.

3. What costs are included in the eligible ITC basis?

The eligible basis for a solar generation facility typically includes the costs (including installation) of the solar panels, inverter, racking equipment, any other equipment comprising the generating system that must be placed in service together, and any other property owned by the same taxpayer that is integral to the generation function. Equipment from and after the point of interconnection is excluded (e.g., transmission property and substations).

For the eligible basis of an energy storage system (BESS), the costs include all of the equipment needed to be placed in service together to receive, store, and dispatch electricity and any property integral to such function that is owned by the same taxpayer

4. What are the options for increasing the ITC?

The IRA added three types of "bonus credits" for solar and storage property, which stack and thus can bring the ITC up to 70 percent:

- Energy Communities – 10 percent bonus for property located on brownfield sites or in areas that meet certain criteria for economic distress and former fossil fuel production.

- Domestic Content – 10 percent bonus for projects comprised of certain minimum thresholds of U.S.-manufactured steel, iron, and manufactured products.

- Low-Income Communities – 20 percent bonus for solar facilities with maximum output of less than 5 MW that are part of an affordable housing program (e.g., LIHTC projects), discussed in more detail below.[2]

5. When does the solar ITC expire?

The IRA effectively extended the ITC for solar and electricity storage for at least 10 years with the addition of a new Section 48E (which requires zero carbon emissions). The Section 48 ITC is available if construction starts by the end of 2024, subject to a continuous construction requirement, which is generally satisfied if the property is placed in service by the end of the fourth calendar year following the construction start date.

6. Does claiming the ITC affect the amount of other federal tax credits and tax deductions?

LIHTCs are no longer reduced if the ITC is claimed, and, as noted above, installing solar could increase the LIHTC because many states allow the cost to be included in LIHTC basis. For depreciation, the basis of the solar property is reduced by 50 percent of the ITC. During 2024, 60 percent of the basis of the solar (and storage) property is eligible for bonus depreciation (or amortization) in the year of placement in service (with an annual 20 percent phase-out thereafter). In addition, the any remaining basis of such property (i.e., 40 percent if 60 percent of cost is amortized under bonus depreciation) is depreciated using five-year MACRS (which provides accelerated cost recovery over five years).

7. How did the IRA make it easier to monetize the ITC?

The IRA added two ways that owners can receive the value of the ITC even if they are exempt from federal income tax or pay taxes but do not have enough tax liability to use all or part of the credit. New Section 6417 allows tax-exempt organizations to treat the ITC as a tax payment, which gives rise to a deemed overpayment and a refund check from the IRS (so called "direct pay"). New Section 6418 is available to taxpayers that are not eligible for direct pay, and permits the ITC to be sold to an unrelated party for cash, with no taxation of the cash payment.

Low-Income Communities Bonus ITC for Solar Installed at LIHTC Projects

Solar projects (including connected storage) with maximum output of less than 5 MW that are at LIHTC projects automatically qualify for the affordable housing 20 percent bonus ITC, provided that (i) at least 50 percent of the financial benefits from the electricity generation are distributed equitably among the low-income residents and (ii) the tax owner applies for and receives a capacity allocation award for 2023 or 2024 under a program administered by the Department of Energy (the Program).

The main impediment to claiming the additional 20 percent ITC is the capacity allocation requirement, because demand has far exceeded available capacity and we would expect that to continue for 2024 (and beyond under the program to be established in 2025 to administer similar capacity allocations under Section 48E (Section 48E Program)). Congress authorized a total annual capacity limitation of 1.8 gigawatts (GW) under both programs. Applications during the 2023 cycle (across the four facility categories) represented over four times the capacity limitation available for allocation.

For 2023 and 2024, the Treasury Department and IRS allotted 200 MW of the 1.8 GW for allocation among Category 3 applicants (which is the applicable category for solar facilities that are part of affordable housing programs), of which no less than 50 percent (100 MW) is reserved for applicants that meet one or both "additional selection criteria" described below. As of the date of this writing, it appears that the unreserved 100 MW for 2023 was fully subscribed (and likely, oversubscribed); whereas 53 percent of the 100 MW reserve bucket remained available. These results can be found on the Program Capacity Dashboard maintained and updated by the DOE.

It would appear, based on 2023 applications, that applicants owning solar projects that meet additional selection criteria are relatively assured receipt of a 2024 allocation award if they submit their applications during the initial 30-day review period, which has not opened yet for 2024.[3] This is because such applicants have priority consideration for the entire category allotment during such period (i.e., if the capacity needed for such prioritized Category 3 applicants exceeds the 100 MW reserve, such applicants receive allocation from the 100 MW of unreserved capacity before any capacity is allocated to Category 3 applicants that do not meet at least one additional selection criteria). This is important because tax credit buyers and tax equity investors are not likely to commit to provide funding beyond the value of the 30 percent ITC unless they are comfortable the project will receive a capacity allocation award. Such tax credit financing is not required initially, but commitments to provide such later tax equity financing could affect the availability and pricing of the construction financing.

There are two categories of additional section criteria: one based on ownership and the other based on location.

Ownership Criteria. To meet this criteria, the tax owner of the solar property must be either a Tribal enterprise, an Alaska Native Corporation, a renewable energy cooperative, a qualified renewable energy company meeting certain characteristics, or a qualified tax-exempt entity. If the facility is owned by an entity disregarded as separate from its tax owner, the tax owner, and not the disregarded entity, is the applicant and treated as the owner for purposes of meeting the ownership criteria. If the tax owner is a partnership (including an LLC taxed as a partnership), the ownership criteria can be met if one of the partners meets the criteria and such partner (i) holds at least a 1 percent interest in each material item of partnership income, gain, loss, deduction, and credit and (ii) is the managing member or general partner (or similar title) under state law (or directly owns 100 percent of the equity interests in the managing member or general partner) at all times during the existence of the partnership (1% Partner). This rule allows tax equity partnerships, which are commonly used to monetize tax credits (including the LIHTC), to qualify for priority consideration if the 1% Partner is a tax-exempt entity or otherwise meets the ownership criteria. In the preamble to the regulations, the Treasury Department and IRS clarify that ownership can be through a taxable subsidiary. This leaves open the possibility of structuring the transaction in a way that avoids having part of the property classified as "tax-exempt use" property under Section 168(h)(6), which portion would not be eligible for accelerated depreciation or bonus depreciation. Experienced tax counsel should be consulted for any such structuring.

Geographic Criteria. There are two types of locations that meet the geographic criteria. One is a "Persistent Poverty County" (PPC), which requires a poverty rate of 20 percent or more for four consecutive time periods, about 10 years apart, spanning approximately 30 years. The other is a "disadvantaged" census tract, as determined by the Climate and Economic Justice Screening Tool. To be so designated, the census tract must (i) have a household income in the 65th percentile for low-income (meaning 200 percent or more below the federal poverty level, students enrolled in higher education) and (ii) be in the 90th percentile for either energy cost burden or pollution exposure criteria. Energy cost burden is calculated based on the average household annual energy cost in dollars divided by the average household income. The pollution exposure test is based on the level of PM2.5 exposure, measured based on the weight per cubic meter of fine inhalable particles with 2.5 or smaller micrometer diameters.

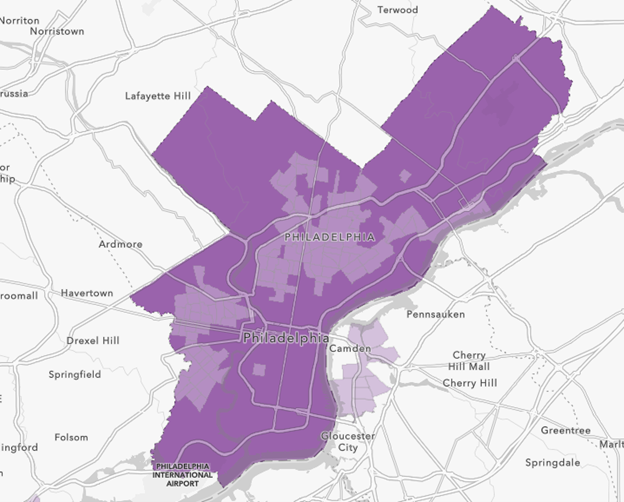

The Department of Energy (DOE) has generated an easy-to-use mapping tool, which is accessed by clicking "OK" at the bottom of the pop-up page describing the Program and then selecting the two "Additional Selection Criteria" options on the left-hand side under "Map Layers." The map enables the user to zoom in to a specific location to identify if the location qualifies as a PPC (illustrated below in dark purple) or a "disadvantaged census tract" (illustrated below in light purple).

Identifying Locations That Also Maximize the LIHTC

Geographical location also affects the LIHTC, as the eligible basis of a housing project located in a designated difficult development area (DDA) or a qualified census tract (QCT) is increased (or “boosted”) by up to 30 percent. This also means the available credits may be increased up to 30 percent.

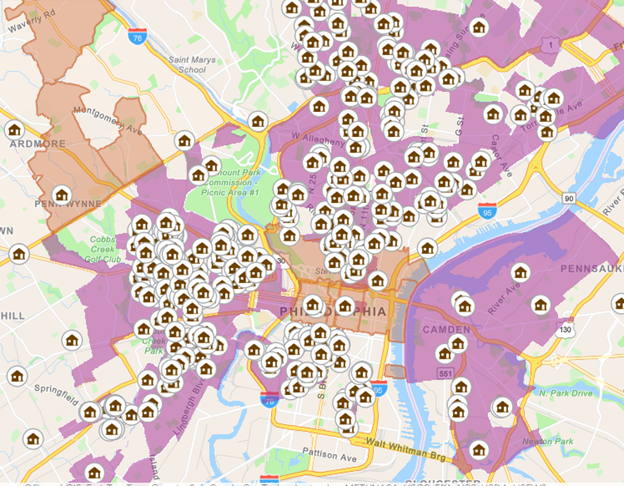

The Department of Housing and Urban Development (HUD) identifies the DDAs and QCTs annually in the Federal Register and provides a mapping tool that enables the user to identify locations that qualify for the boost (DDA’s are illustrated below in red and QCT’s are illustrated below in pink). This provides planning opportunities for LIHTC project developers which collaborate with solar developers to maximize both the LIHTC and the ITC by identifying a location designated as a DDA or QCT on the boost map, which is also identified on the DOE map as a PPC or disadvantaged census tract.

The HUD mapping tool can also be used to identify existing LIHTC projects (represented on the map above by the house icons), as in some cases it may be more desirable to have the solar project financed separately.

Advantages of Having the Same Entity Own the Housing Project and the Solar Project

Collaboration between solar developers and LIHTC project developers or syndicators can benefit all parties, including the property owner, subject to proper structuring and planning.

1. Solar developers expand the pool of available tax equity financing.

The existing investor base for LIHTC projects is experienced at providing tax equity financing and comfortable with the concept, including through tax credit sales.

2. Transaction cost savings may make it easier to find tax equity financing for Category 3 solar projects.

Flip partnership structures are typically used for monetizing the ITC, but the transaction fees may be too high to absorb for financing a single Category 3 facility. Whereas, the transaction fees can likely be absorbed if the solar facility is financed by the LIHTC tax equity investor, as such financings typically use similar flip partnership structures. We note, however, that the tax equity investor in an LIHTC transaction often has a 99.9 percent partnership interest prior to the flip date, in contrast to the 99/1 partnership structure commonly used for the ITC in order meet the IRS safe harbor for respecting the allocation of tax credits to each partner in a flip transaction. Further, in order to qualify for the ownership criteria preference, if applicable, the managing member would need to have at least a 1 percent interest in all partnership items (i.e., the tax equity investor’s interest would be capped at 99 percent, which may be unattractive to some LIHTC investors).

3. Claiming the ITC does not reduce the amount of available LIHTCs and often increases the LIHTC’s because many states permit the cost of the solar property to be included in the LIHTC basis of the housing property.

In other words, as discussed above, if the cost of the solar property is eligible for LIHTCs, the tax credit subsidy for the solar property would be even higher than the 30 to 70 percent ITC, and the ITC will likely be at least 50 percent if the solar facility qualifies for additional selection criteria.

4. LIHTC partnerships allow the solar developer to monetize depreciation, as opposed to a direct sale of the ITC under Section 6418.

Section 6418 only permits sales of the ITC and certain other tax credits. The IRA did not add a provision to monetize depreciation deductions through direct sales to unrelated third parties. Thus, tax equity financing is the only way to monetize the advantageous depreciation deductions available to the owner of the solar property.

5. Common ownership makes it easier to establish compliance with the financial benefit requirement applicable to Category 3 facilities, as residential building owners maintain the requisite tenant records on the low-income units.

All Category 3 projects have to provide information (in a Benefits Sharing Statement) detailing the calculation of the financial benefit from the electricity cost savings and identifying the methodology for “equitably” allocating at least 50 percent of such savings among low-income occupants. The statement is provided in draft form at the time of application and to residents once the system is in service. The financial benefits can be allocated through utility bill savings, increased services, reduced internet costs, or any other method described in the Department of Housing and Urban Development (HUD) guidance on the Treatment of Solar Benefits in Master-metered Building (released May 2023). If the solar facility is owned separately, the solar developer and building owner must identify who is responsible for distributing the savings. If the solar developer is responsible, it will have to work closely with the residential building owner to confirm which units have been designated as low-income under the relevant affordable housing program.

Hurdles to Be Aware Of When Combining a LIHTC Project and Solar Project

- There should be careful tax planning with regard to fees and cash flows to ensure that such payments will not be recharacterized as profits, as the ITC is allocated based on profit-sharing (unlike LIHTCs, which must follow loss allocations).

- Work with tax-exempt bond counsel to avoid the up to 15 percent haircut on the ITC for energy property financed with tax-exempt bonds.

- Monitor the placement-in-service dates of the building and the solar property to ensure that the tax equity investor is a partner when the solar property is placed in service, as the ITC can only be allocated to the partners in the partnership as of such date.

Conclusion

As explained above, there are many advantages of installing solar at LIHTC projects. The combination of LIHTCs, up to a 70 percent ITC, and the timing benefits of bonus depreciation and five-year MACRS provides a significant subsidy for the cost of the solar property. Collaboration between developers of LIHTC projects and solar facilities coupled with careful tax planning offers opportunities to maximize both tax credits and depreciation benefits.

We will continue to monitor guidance and regulations published by the Treasury Department and IRS on the myriad new tax incentives for the clean energy sector added or expanded by the IRA and provide alerts on such implementation guidance.

[1] Unless otherwise stated, all capitalized references to Sections are to the applicable section of the Internal Revenue Code of 1986, as amended (Code) or, where indicated, to the Treasury Regulations promulgated under the Code (Regulations).

[2] There is also a 20 percent bonus for small solar facilities that directly benefit certain low-income households and a 10 percent bonus for those located in a low-income community or on Indian land. A detailed discussion can be found in our October 2023 Alert.

[3] The Treasury Department and the IRS will publicly announce the opening and closing dates for the 2024 Program year application period on DOE’s landing page, available at https://www.energy.gov/justice/low-incomecommunities-bonus-credit-program.