I hope that everyone is having a great start to the holiday season. To kick off the festive fervor, in this edition, we’re featuring a guest article from a fellow EV enthusiast and long-term M&A advisor, Matthew Miller, managing director at Cascade Partners. Over the last year, commercial financing has dramatically slowed down, especially coming out of the de-SPAC boom, due to a combination of factors such as inflation and the Fed’s tightening of the monetary policy. All the while, the EV ecosystem is gearing up for unprecedented investments over the next many years. However, this is turning out to be difficult given the current market conditions, with less certainty on which way the U.S. economy will land. In his article, Matthew dives into the recent statistics on mergers and acquisitions activity and financing efforts over the last year and shares his take on the road ahead. In our second article, Bob Weiss, the Chair of Dickinson Wright’s EV advisory group, shares an excerpt of his recent interview with Mike Hall, Executive Director of Automotive Analysis at S&P Global Mobility, an arm of S&P Global that provides in-depth insight derived from automotive data enabling its customers to make business decisions. I hope you enjoy this edition of our newsletter.

Rasika A. Kulkarni | Editor and Associate Attorney

What's the Deal With EV M&A and Investment?

Given the recent headlines, one might wonder about EV's promise or, worse, feel whiplash.

ON Semiconductor, which makes chips that go into cars, provided weak fourth-quarter sales guidance, while battery maker Panasonic cut its fiscal year 2024 sales outlook. That followed downbeat updates from Mercedes-Benz and Volkswagen about slowing EV sales and decisions by Ford and General Motors to slow their EV-related spending due to weakening demand. Tesla's third-quarter earnings missed Wall Street estimates, and CEO Elon Musk sounded downbeat about growth rates amid rising interest rates and declining vehicle affordability on the company's conference call.

Still, the news isn't all bad. Stellantis reported a 37% year-over-year jump in EV sales in the third quarter and reiterated its goal to have 40% of its sales globally come from all battery electric vehicles. BEV sales in the U.S. and Europe are up about 50% year to date, and sales in China are up about 20%. Toyota announced it is more than doubling its investment in a battery plant under construction in North Carolina, a move aimed at increasing its ability to meet demand for hybrid models.

"This is an air pocket after years of white-hot demand... it's not the end of the growth cycle for Tesla and other EV makers," says Wedbush analyst Dan Ives. "This is a transition phase to the next stage of growth."

What does this mean for M&A and investment in the EV space?

EV Drivers Pump the Brakes on M&A Activity

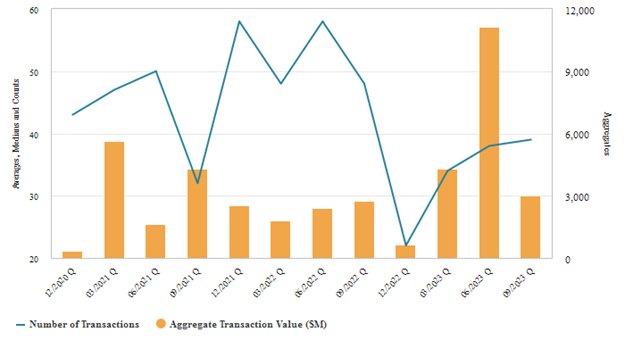

According to S&P Capital IQ, only 25 EV-related M&A transactions were announced or completed in the United States and Canada during the trailing twelve months (TTM) ended September 2023, a 43% drop from the 44 transactions during the TTM ended September 2022. EV participants recorded 32 transactions during the TTM ended September 2021.

Similarly, aggregate transaction value compressed to $1.29B during the TTM ended September 2023 from $1.9B during the TTM ended September 2022 and $7.6B during the TTM ended September 2021. The TTM period ended September 2021 included two outsized transactions – Panasonic Corporation sold its minority stake in Tesla, and EVgo (the nation's largest public fast charging network for electric vehicles, and the first to be powered by 100% renewable energy) combined with CLII, a publicly-traded SPAC – excluding them, transaction value was $1.4B.

EV is not alone, though. M&A value and volume have slowed in all industries since the TTM ending September 2021. While EV activity seemed to defy this trend through the TTM ended September 2022, when the broader M&A market faced headwinds, EV investment activity finally slowed.

Chart: M&A Announced and Completed in the United States and Canada

Source: S&P Capital IQ

Fewer But Bigger Rounds of Funding

Just 133 EV-related rounds of funding were announced or completed in the United States and Canada during the TTM ended September 2023, a 37% decline from the 212 transactions during the TTM ended September 2022 and 23% lower than the 172 transactions during the TTM ended September 2021.

Aggregate transaction value moved in the opposite direction as it spiked to $19.0B during the TTM ended September 2023 from $9.5B during the TTM ended September 2022. The TTM period ended September 2023 included two outsized transactions – one was non-convertible debt to Wolfspeed, Inc., a semiconductor manufacturer for climate tech and electric vehicles; the other was non-convertible debt from the U.S. Department of Energy to BlueOval SK, LLC, a joint venture between Ford and SK On to make EV batteries. During the TTM ending September 2021, the market attracted $11.9B.

Chart: Rounds of Funding Announced and Completed in the United States and Canada

Source: S&P Capital IQ

The Road Ahead

Technology will likely continue to drive the automotive industry for years to come, and a range of participants will likely continue to invest, as evidenced by several recent announcements. For example, Stellantis said it was spending about $1.6B to buy roughly 20% of Zhejiang Leapmotor Technology. It will become Leapmotor's exclusive export partner via a Europe-based joint venture in which Stellantis will own 51%. Hong Kong-based Thunder Power Holdings is joining the list of EV companies going public through SPAC mergers, reaching a deal with Feutune Light Acquisition at an implied pro forma enterprise value of about $400M. Denso and Mitsubishi Electric plan to invest $1B in Coherent's silicon carbide unit, which produces the more efficient silicon chips used in some EVs to speed charge and extend range.

The reasons for and types of transactions will likely continue to evolve, too. In Automotive: US Deals 2023 Midyear Outlook, PwC suggests that for companies to remain successful in the rapidly transforming automotive and mobility market, leaders should continue to review their company portfolios and consider divesting non-core assets to free up resources for investments in new technologies. For example, capital generated from divestitures can fund investments in growing automotive sectors, including electric vehicles. Companies that perform these analyses and prepare for this dynamic business environment in a timely manner are more likely to acquire quality assets.

Since access to financing has become more constrained, cash-rich original equipment manufacturers, major suppliers, and technology companies will be responsible for most of the traditional M&A, according to Bain & Company. Moreover, creative companies are leveraging various corporate finance options, including conventional mergers and acquisitions and a mix of alternative deal types. For example, OEMs, suppliers, technology companies, and other mobility players are forming alliances, spinning out divisions, and investing in corporate venture capital to get access to and leverage new technologies.

While many of today's headlines suggest demand is cooling, it seems more precise to say the growth rate is slowing. After a post-COVID spike in activity, the EV market may be maturing. Main Street buyers are replacing early adopters. Inflation, interest rates, and other economic headwinds are likely tapping down EV demand like other powertrains and industries.

So, M&A and investment activity will likely accelerate after coasting over the last year or so. Too many government regulations and other incentives like the Inflation Reduction Act exist. China and European countries are leading the development of the global EV market, and the U.S. can't afford to stand still. And strategic buyers and financial investors see EVs as a catalyst for above-average returns.

Matthew Miller | Managing Director at Cascade Partners LLC

Interview with Mike Wall, Executive Director –

Automotive Analysis, S&P Global Mobility

Question 1

Bob: Tell us about your background and experience?

Mike: I serve as the Executive Director of Automotive Analysis at S&P Global Mobility. Based on my significant experience working with both manufacturers and financial firms, I help our clients in their evaluation and understanding of the auto industry, with special focus on vehicle markets and trends. Providing insights into vehicle forecasting and market trends helps our clients assess near term risks and planning scenarios. I attended Grand Valley State University where I earned a degree in Finance.

Question 2

Bob: Tell us about S&P Global Mobility, its mission, resources and services.

Mike: S&P Global Mobility is a division of the broader S&P Global organization. We provide invaluable insights derived from unmatched automotive data, enabling our customers to anticipate change and make decisions with conviction. Our expertise helps them to optimize their businesses, reach the right consumers, and shape the future of mobility. Our data, analytics and insight run across the vehicle life cycle from Forecasting & Planning to Sales Performance and Marketing and finally delivering essential intelligence for when the vehicle is in use.

Our solutions are used by nearly every OEM, more than 95% of tier one suppliers, media agencies, governments, insurance companies, and financial stakeholders to provide actionable insights that enable better decisions and better results.

Question 3

Bob: Governments and OEMs have set aggressive goals in the rapid transition from ICE to BEV – Examples include the Biden administration's goal of EVs constituting 50% of new car sales in U.S. by 2030, and in the EU, gasoline powered vehicle sales prohibited as of 2035. In your view, given where we are today and the head winds facing rapid adoption, are those realistic objectives?

Mike: Attaining these aggressive objectives on time is premised on a number of interrelated sub goals being more or less simultaneously accomplished. For example, one of the key components is customer adoption. Customer adoption is impacted by two primary factors: (1) adequacy of charging stations; and (2) lower cost purchase options. Although the government is providing significant financial incentives to private industry to invest in new charging stations, given the magnitude of what is required to relieve customer anxiety, it is uncertain whether this sub goal will be timely achieved. Similarly, there are limited models available in the under $30K price point. Although models in that price range are planned, it is uncertain as to whether those vehicles will be sales successes. In a sense both of these sub goals will have to be achieved, along with several others to meet the government's aggressive 2030 sales goals. In summary, I believe these goals are hypothetically obtainable, but there is significant risk that they won’t be timely achieved.

Question 4

Bob: In your view, what are the greatest challenges that would have to be overcome to attain those goals?

Mike: It is hard to single out any one factor as being more critical than another. The primary factors from my perspective are: (1) sustainability of government incentives, particularly customer rebates; (2) adequate charging infrastructure; (3) availability of lower cost purchase options; and (4) viability of the supply chain, in particular, the availability of critical materials.

The first 3 are critical to reaching a necessary level of customer adoption. In addition to these financial factors, there needs to be an educational process of the consumer to promote the multiple benefits of EV's and ease the current anxiety in making the leap to EV. In sum, there needs to be a change in the consumer’s mindset as well as more favorable financial factors.

Question 5

Bob: How important are government incentives, e.g. consumer tax rebates, grants, loans, loan guarantees to OEMs and suppliers? What are the consequences of a change in administration resulting in reduction/elimination of this extraordinary government support? How real a risk is there of this happening?

Mike: Sustaining government incentives and regulatory requirements are essential. It is hard to quantify the risk of diminution of government support, but it would appear that the Republican Party is less enthusiastic and committed to government’s role in influencing the market place and using taxpayer's money to do so. Whether that mindset will continue and cause meaningful change in government policy is possible, but uncertain. One also has to take into consideration the change in the global footprint of manufacturing capabilities for ICE vehicles. That capacity will continue to be reduced as the EV capacity ramps up. Eventually supply and demand variables will begin to kick in.

Question 6

Bob: S&P projects that the brands selling EV's in the U.S. will increase exponentially from now to 2030 and the number of models sold will increase almost tenfold from 49 to 300+ by 2030. Will the market support that expansion and, if not, what are the characteristics of the companies that will succeed?

Mike: In 2022, there were 49 EV models. It is projected that there will be 300 models available for sale by 2030. Managing the transition from manufacturing/sales of ICE to BEV, the drawdowns and ramping up, will be challenging, not just for the OEMs, but for all levels of the supply chain. Obviously, in a competitive marketplace there will be winners and losers. The level of consumer demand will depend on the factors that I discussed earlier and, in particular, the availability of low cost options. The availability of low cost options will depend on a number of factors, including increase manufacturing efficiency, developing of battery technology and other factors.

Question 7

Bob: How great a threat to U.S. domestic sales is Chinese manufacturers entering the U.S. domestic market?

Mike: Currently, Chinese OEMs have advantages in manufacturing costs and technology. They have saturated their domestic market and are significantly penetrating the European market, which has imposed less trade barriers than the U.S. In all probability, they will attempt to enter the U.S. market within this decade. The extent to which they will succeed is largely dependent on U.S. government trade policy and the U.S. OEMs ability to compete at their low price point.

In Case You Missed It

In this edition of “In Case You Missed It,” we provide commentary and links to several interesting articles providing different perspectives regarding the challenges and opportunities associated with the rapid transition to EVs.

It seems that a reassessment has begun regarding the viability of meeting the aggressive goals set by government and industry players. There seems to be a growing sentiment among analysts and some OEMs that the 2025/2030 EV sales goals are not realistic given current and anticipated rates of adoption.

EV Transition Slows as Inventory Grows and Industry Hits Hurdles

In an article entitled “EV Transition Slows as Inventory Grows and Industry Hits Hurdles," appearing in the October 31st edition of Automotive News, the author notes that what he describes as "sluggish demand" (largely due to range anxiety and the high costs of available vehicles) is causing industry leaders to reevaluate the pace of the transformation.

EV Makers Turn to Discounts to Combat Waning Demand

In a related article appearing in the November 7th edition of the Wall Street Journal entitled "EV Makers Turn to Discounts to Combat Waning Demand," the author notes manufacturers are offering cash discounts and attractive lease terms in response to declining EV sales and growing inventories. He attributes a significant contributing factor of the slowdown in sales to the dearth of available low cost model options and new restrictions on tax credits. OEMs are responding by delaying opening of new battery plants, cutting production shifts and providing attractive lease terms. However, discounting and seductive lease terms materially increase existing losses on EV sales and place EV startups with limited cash availability in jeopardy.

Foxconn Makes Your iPhone. Now it Wants to Make Your Electric Car

In an article entitled "Foxconn Makes Your iPhone. Now it Wants to Make Your Electric Car," appearing in the November 1st edition of Bloomberg Businessweek, the author describes the growing trend of OEMs outsourcing the EV manufacturing process and Foxconn‘s intentions to enter that market, notwithstanding its lack of experience as an automotive manufacturer. Following Magna and Valmet’s playbook, its pitch to OEM’s is “the same promise it once made to Apple Inc.: Come to us, and we’ll supply, design or assemble any part of your car, or the whole thing, faster and cheaper than you can.” Although it lacks automotive manufacturing experience,

it’s hard to dismiss a company with $222 billion in annual revenue and its successful track record with Apple and other tech companies.

The U.S. Can Counter China’s Control of Minerals for the Energy Transition

A recent Guest essay in the New York Times entitled "The U.S. Can Counter China’s Control of Minerals for the Energy Transition," appearing in the November 6th edition of the NYT highlights the dominance of China in controlling the materials critical to the production of lithium-ion batteries, as well as the processing of those materials. The author, a professor of environmental studies at Wellesley College, suggests a number of actions that the U.S. can undertake to mitigate China’s outsized impact.

[View source.]