[author: Carlos Juarez]

As we previously blogged, the Securities and Exchange Commission’s Office of the Advocate for Small Business Capital Formation (OASB) recently published its Annual Report (the “Report”), which includes data on public offerings undertaken between July 1, 2022 and June 30, 2023 provided by the SEC’s Division of Economic and Risk Analysis. Companies raised approximately $1.12 trillion in registered offerings, which include IPOs, Regulation A offerings, and other public offerings, with US companies raising 78% of this total, or $874 billion. Companies raised $1.5 billion in Regulation A offerings, often called “mini-IPOs.” Other registered offerings accounted for 98% of public offerings, with companies raising $1.1 trillion.

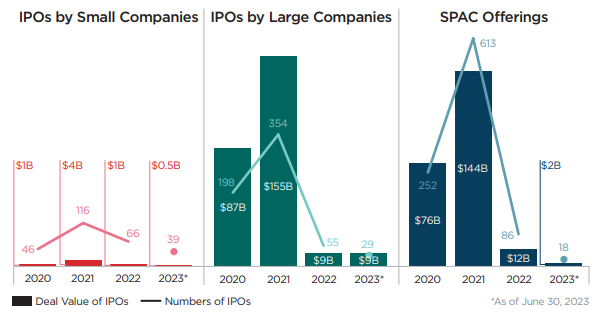

The IPO market has experienced a significant slowdown in recent periods. The OASB reports that IPOs accounted for $17 billion of offering proceeds in the period researched. The manufacturing, technology, financial services, and healthcare sectors are the most active sectors raising capital through IPOs. The number of VC-backed companies going public has dropped to 37%. The percentage of VC-backed IPOs was higher in prior years, for example, 65% in 2015 and 68% in 2020.

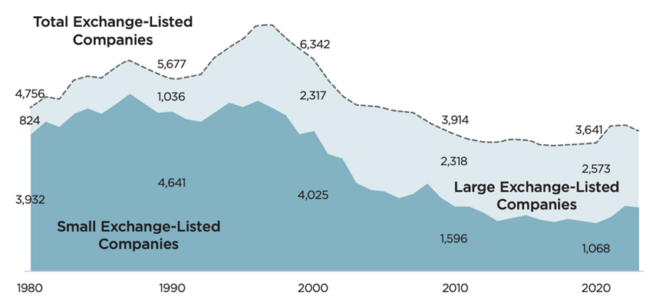

The public company landscape continues to change. The total number of exchange-listed companies has steadily declined since the dot-com bubble burst in 2000. As seen below, the overall number of exchange-listed companies has declined, but, more important, small exchange-listed companies account for the majority of the decline. The portion of aggregate public market capitalization represented by small exchange-listed companies has declined by half each of the past four decades.

Source: Sec. & Exch. Comm’n

The Report focuses on “small public companies” or public companies with a public float of less than $250 million. There are currently 2,696 small public companies, compared to 2,989 large public companies. Healthcare (largest number), technology, manufacturing, and financial services companies comprise the majority of these small public companies. IPOs by US small companies have remained relatively stable when compared to large companies and SPAC mergers, raising $500 million in 39 IPOs in the first half of 2023. However, post-IPO, these companies generally do not fare well—92% had a negative rate of return from their IPO price, 34% appeared on an exchange non-compliance list after their IPO and most suffer from limited research coverage (compared to mega-cap public companies).

Source: Sec. & Exch. Comm’n

In 2022, the number of exchange-listed IPOs dropped to its lowest point since 2009. For more data and analysis, read the full OASB Report.

[View source.]