On December 23, 2023, BarnBridge DAO (“BarnBridge”) and its founders, Tayler Ward and Troy Murray, agreed to settle charges with the U.S. Securities and Exchange Commission (“SEC”). BarnBridge violated Sections5(a) and 5(c) of the Securities Act by offering and selling its SMART Yield products as fixed income notes, and therefore a security, without registering with the SEC or qualifying for an exception. BarnBridge DAO agreed to pay $1,457,000 in disgorgement, cease offering and operating its SMART Yield products, cease development and maintenance of its protocols and website, and publish notice of this agreement on its website and other channels. Ward and Murray each agreed to disgorgement of $125,000 and to stop operating and developing BarnBridge products.

Ward and Murray created BarnBridge and launched it in August 2020. They designed a protocol to create and then sell “structured finance-type investments in pooled crypto asset vehicles.” BarnBridge then sold these structured crypto products, known as SMART Yield bonds, to the public from March 2021 through March 2023. Ward and Murray frequently advertised their products through appearances on YouTube channels and through various social media mediums. BarnBridge had its own dedicated website, Medium account, Discord server, and Github.

BarnBridge operated as a DAO—a decentralized autonomous organization. DAOs have become popular in the crypto world as a way to decentralize ownership, control, management, and decision-making in these protocols. These projects are typically unincorporated, meaning DAOs have become a de facto legal structure without the same types of privileges and guardrails afforded to traditional structures, creating a murky legal area. Voting power is often tied to the ownership of governance tokens. This is often one of—if not the sole—use case of most cryptocurrencies. BarnBridge utilized their BOND token for this purpose. BOND holders could vote on various proposals in order to guide the direction of the DAO. BarnBridge did not maintain a principal place of business and had no corporate registration.

BarnBridge frequently compared their blockchain-based products to various financial products in the world of traditional finance, noting that they were simply bringing these existing types of products to the blockchain. BarnBridge specifically compared their SMART Yield as similar to mortgage-backed securities. By executing these products through smart contracts, BarnBridge claimed that these products operated without the need for broker-dealer intermediaries. Further, these crypto products were safer and “able to offer guaranteed returns with a level of security greater than that of AAA-rated securities . . . because smart contracts can guarantee coupon delivery at maturity.” BarnBridge ultimately offered 12 different SMART Yield products for investors throughout the time period.

These products ultimately took the crypto funds that users provided and strategically placed them in various crypto lending protocols in order to generate yield. The strategy was automated by the smart contracts underlying the protocol. The yield was then returned to the depositors with BarnBridge taking a cut from those proceeds. BarnBridge’s SMART Yield allowed investors to receive either fixed or variable gains through its products. SMART Yield had two tranches for investors – Senior for guaranteed returns or Junior for variable returns. If the yield generated by SMART Yield did not meet the guaranteed levels to pay out Senior depositors, capital from Junior depositors would be used to make up the difference. If SMART Yield generated more returns than needed to pay Senior depositors, the excess would be paid to Junior depositors. Higher risk, but higher reward.

As a decentralized finance (“DeFi”) protocol, BarnBridge attracted users from all over the world. This also obviously included a substantial amount of customers located in the United States, subjecting BarnBridge to U.S. securities laws and regulations. BarnBridge did not restrict the use of its products based on location and they did not have any means to verify whether its users were accredited investors. Other cryptocurrency entities have fallen under the SEC’s jurisdiction for similar actions.

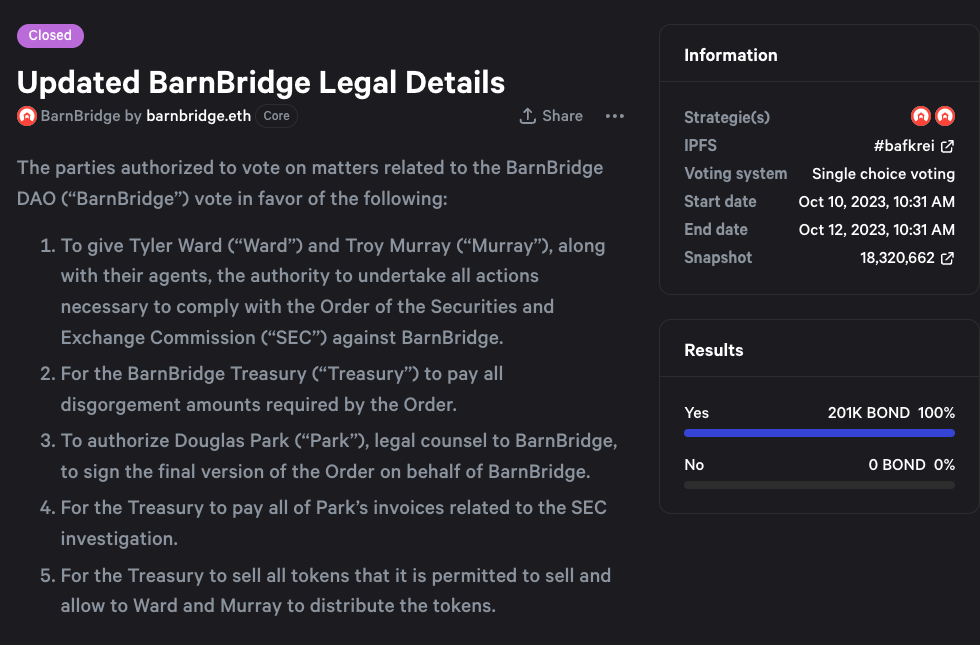

In July 2023, BarnBridge’s attorney communicated with DAO members through the organization’s Discord server. There he noted that the SEC had initiated an investigation into BarnBridge. At that point, all work on BarnBridge-related products came to a halt. Interestingly, the founders followed DAO protocols at certain points with regards to responding to the SEC investigation. In October 2023, the DAO voted unanimously to comply with the SEC’s investigation and authorized the DAO to pay all disgorgement amounts, for legal counsel to execute the settlement agreement, and to sell all tokens necessary in order to fund these endeavors.

The SEC ultimately determined BarnBridge’s SMART Yield products were securities through the “family resemblance” test utilized in Reves v. Ernst & Young, 494 U.S. 56, 64–66 (1990). The SEC reasoned that the SMART Yield products operated as “fixed income debt securities in the form of a callable note.” Notes are presumed to be securities unless they bear a strong resemblance to financial instruments that are definitively not securities. Courts rely on four factors in this “family resemblance” test: (1) the motivation of the parties; (2) the plan of distribution; (3) the expectations of the investing public; and (4) a risk-reducing factor such as the availability of an alternative regulatory regime that “significantly reduces the risk of the instrument, thereby rendering application of the Securities Acts unnecessary.” BarnBridge’s own claims support the SEC’s position as they frequently described these products as being similar to traditional securities. Ultimately, BarnBridge never registered with the SEC and no exemptions from registration were available.

Finally, as a settlement, this agreement does not necessarily create any binding legal precedent for the crypto industry. However, it does reveal the SEC’s general stance and the arguments it will likely rely on in future enforcement actions. As such, the legal underpinnings can be used by DAOs and other DeFi protocols for guidance on how to navigate the current securities quagmire. We expect that the SEC will continue to be aggressive in pursuing actions against cryptocurrency companies.