Investors have recently provided solid funding to the space technology sector, with the trend showing signs of continuing in Q1 2025.

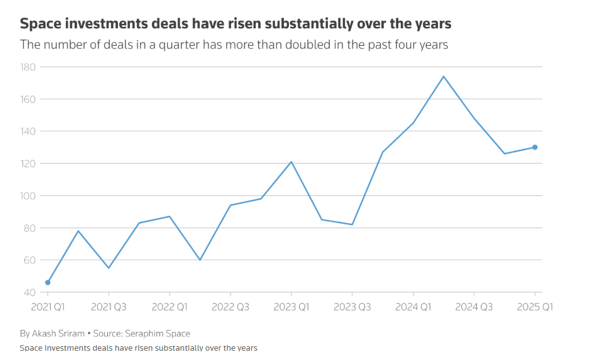

The general trend over the last half decade for the number of investments in space technology has been upward. Investment firm Seraphim Space states that the number of deals have risen “substantially” since Q1 2021, showing in the chart below that the number has “more than doubled in the past four years.”

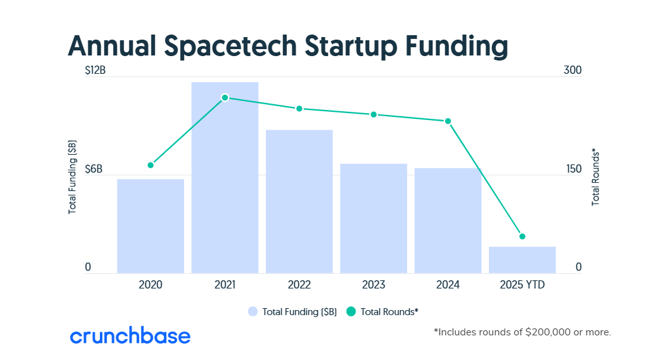

Over 2023 and 2024, investment globally in the sector has reportedly been steady at more than $6 billion annually. Crunchbase reports that in 2024 there were 232 funding rounds of $200,000 or more, as shown in the chart below.

In 2024, according to Pitchbook, investments in the space technology sector totaled $9.1 billion. This funding reportedly shifted toward later-stage companies. Exits in the industry for 2024 reportedly reached a value of $1.4 billion.

The trend appears to be continuing in 2025. Total funding for space technology startups in Q1 2025 was reportedly about $1.6 billion. This included 56 funding rounds greater than $200,000, and four rounds greater than $100 million. Notable investments in Q1 include a reusable rocket developer reportedly raising $260 million for a series C round. Another investment was a late stage funding round, for a company that leases space on its satellites, reportedly for $170 million.

Will space technology startups continue to fly high? Some reports view the sector as “maturing into a disciplined, revenue-driven market.” Others see uncertainty due to tariffs, international political re-ordering, geospatial AI, and volatility in public markets. One investment firm reports momentum may be fading in part due to U.S. government federal spending cuts.

Time will tell how much propellant is left in the tank for the sector.

Editor: Maria V. Stout