Municipal tender offers have rapidly increased in volume since 2020, and 2023 is anticipated to be the highest volume year for voluntary municipal tender offers. As reported by the Bond Buyer, 2021 and 2022 each saw about $4 billion in municipal tender offers. As of July, about $14.1 billion has been tendered or invited to tender this year. In the current interest rate environment, municipal issuers increasingly use tender offers to generate debt service savings, especially since advance refundings were eliminated by the Tax Cuts and Jobs Act in 2017. Many issuers are navigating these transactions for the first time.

Here’s an overview of the basic structure, documentation and timeline of a tender offer to help issuers determine whether this financing structure could help them achieve their financing goals.

What is a tender offer?

In a tender offer, a bond issuer makes a public offer to bond holders to relinquish or “tender” their bonds for cash or to exchange their existing bonds for new bonds. The tendered bonds are then purchased by the issuer and canceled or exchanged for new bonds and then canceled.

Why do a tender offer?

Issuers use tender offers to refinance or restructure outstanding debt. Bonds with an above-market coupon rate that are not callable are particularly primed for a tender offer. Examples of scenarios when a tender offer could be indicated include:

- Alternative to advance refunding: If a refinancing of non-callable bonds would result in significant savings, the issuer can use a tender offer to purchase and cancel those bonds and refinance with more favorable debt.

- “Convert” taxable debt to tax-exempt: An issuer can use a tender offer to take out Build America Bonds (BABs) and other taxable, non-callable bonds (e.g., taxable bonds issued to advance refund tax-exempt bonds). The issuer can convert such bonds to tax-exempt, lower cost debt.

- Stress scenario/restructure: Issuers experiencing financial stress may find a tender offer helpful to address short-term cash flow needs or credit issues.

Who is involved in the tender offer?

The participants in a tender offer include the regular deal team, plus a Dealer Manager and an Information Agent and Tender Agent.

A Dealer Manager is a broker-dealer who acts as the issuer’s agent in conducting the tender offer. A Dealer Manager structures the tender and communicates with holders to “market” the tender, in the same manner as an underwriter structures and markets the sale of the bond. Often, the broker-dealer serving as the Dealer Manager will also serve as the senior managing underwriter since tender offers frequently involve issuing new bonds to fund the purchase of the tendered bonds.

The Information Agent and Tender Agent plays an important technical role which involves interfacing with the Depository Trust Company (DTC), identifying and engaging with bondholders, distributing tender offer materials to holders (including through DTC) and assisting with receiving and processing bonds tendered by holders.

What regulations apply to tender offers?

Tender offers for municipal bonds are subject to federal antifraud laws just like new offerings of municipal bonds but are exempt from SEC rules that govern corporate tender offers.

- SEC Rule 10b-5 and Section 17(a) of the Securities Act of 1933 (the “1933 Act”), which apply to statements made in connection with offerings of municipal bonds, apply to tender offers. Rule 10b-5 and Section 17(a) prohibit misstatements or omissions of material facts and fraudulent activities in connection with the purchase or sale of securities. Section 14(e) of the Securities Exchange Act of 1934 (the “1934 Act”) includes similar prohibitions for tender offers.

- Regulation 14D (promulgated under Section 14(d) of the 1934 Act) and Regulation 14E (promulgated under Section 14(e) of the 1934 Act) include requirements related to timing, disclosure to security holders and other procedural matters. The goal of these rules is to ensure investors are treated fairly and equally. Section 14(d) and Regulation 14D apply only to equity securities and thus do not apply to any bonds, including municipal bonds.

- Section 14(e) (which prohibits misstatements or omissions of material facts in connection with a tender offer, as discussed above) does apply to municipal securities; but

- Regulation 14E does not apply to “exempted securities” as defined in the 1934 Act, which includes municipal bonds.

- MSRB fair dealing rules apply to broker-dealers acting as an agent for an issuer in connection with a tender offer (Dealer Managers). The SEC corporate tender rules provide guidance for what the SEC considers to be fair and equal treatment for tender offers. In structuring terms and timing of a tender offer, transaction participants will often refer to those rules for guidance. They also may refer to an SEC 2015 no-action letter allowing tender offers for non-convertible corporate debt securities to be open for a shorter period of time (five business days) than Regulation 14E (which requires 20 business days).

How does the tender offer process work?

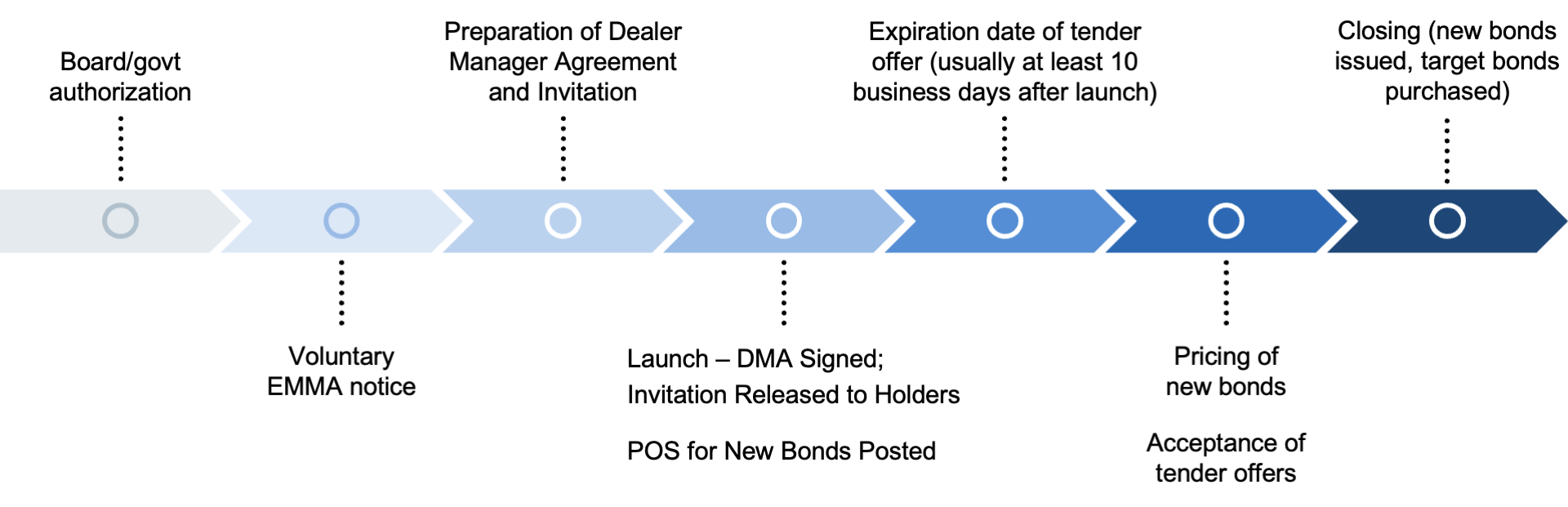

Significant steps in a tender offer include:

Board/governmental authorization: As with any new bond issuance, the issuer (and borrower/obligor, if applicable) authorizes the tender offer and the preparation and execution of the necessary documentation. It is important to confirm that a tender is not prohibited by the underlying bond documents governing the bonds that are the subject of the tender offer (“target bonds”).

Voluntary EMMA notice: The issuer may choose to post a voluntary disclosure notice on EMMA to alert the market of the anticipated tender offer.

Preparation of Dealer Manager Agreement: The Dealer Manager agrees to solicit tenders of target bonds and perform other related customary services. The Dealer Manager Agreement is prepared by dealer manager counsel and sets out:

- Compensation payable to the dealer manager; deliverables required at “launch” of the tender (date the invitation is released and disseminated to holders).

- Deliverables required at closing (when the tendered bonds are purchased).

- Circumstances under which the dealer manager’s services may terminate.

The Dealer Manager Agreement includes representations and warranties of the issuer that are similar to those included in a Bond Purchase Agreement.

Preparation of Invitation: The invitation to tender is the document provided to existing bond holders that provides the necessary information that allows them to decide whether to tender their bonds.

Federal securities antifraud laws prohibit the issuer and other transaction participants from making any material misstatements or omissions in connection with a tender offer. It therefore requires the preparation of a tender offer disclosure, which consists of an invitation describing the material terms and procedural matters of the tender offer. When new bonds are being issued to fund the purchase of tendered bonds, the invitation includes the preliminary official statement for such bonds.

Although the SEC’s procedural rules related to tender offers do not apply to tender offers for municipal bonds, it is helpful to structure the invitation referencing the information required by the SEC for regulated corporate tenders. Counsel drafts the invitation with significant input from the dealer manager(s), Information Agent and Tender Agent and financial advisors.

Invitations for tender offers generally include:

- Securities subject to the tender offer and CUSIP numbers.

- Specific terms of the offer, issuer’s plan of finance and source of funds for payment.

- Whether the offer may be extended beyond the announced expiration date and the process for an extension.

- Whether offeree may withdraw an acceptance, and the timing and procedures for a withdrawal.

- The process for selecting target bonds for purchase in the event more bonds are tendered for purchase than the issuer accepts for purchase.

- Conditions for completion of the tender offer, such as minimum amount of bonds that must be tendered by maturity for a tender offer to proceed.

- If the tender is conditioned on the successful offering of the issuance of new bonds.

- Rights of the issuer to withdraw the tender offer.

- Any fees payable by offerees in connection with the tender.

- Information on the required/expected future redemption of bonds not tendered – for example, whether the target bonds will be defeased if not tendered for purchase, or if the issuer expects to defease or redeem such bonds in the future.

- Updated information about the issuer material to the decision of whether or not to tender. This information would be included in the Preliminary Official Statement (“POS”) for any new bonds being offered in connection with the tender offer, so attaching the POS to the invitation would accomplish this purpose.

Launch: The “launch” of the tender offer is the dissemination of the invitation to holders of the target bonds. The Dealer Manager Agreement is signed on the launch date and includes a list of deliverables and opinions required at launch. The POS for any new bonds being issued to fund the purchase of bonds subject to the tender offer is posted on the launch date and attached to the invitation.

EMMA Material Event Notice of Tender: The launch of a tender is a listed event under Rule 15c2-12. The issuer’s disclosure counsel will coordinate with the issuer to ensure that the tender invitation is filed on EMMA concurrently with launch.

Acceptance of Offers and Pricing: The period between launch and expiration of the tender offer is analogous to the marketing period between posting a POS and pricing. The Dealer Manager interacts with holders of the target bonds to “market” the tender. The invitation will specify:

- The expiration date of the invitation – i.e., the deadline by which holders must tender their target bonds.

- Either the price to be paid for target bonds or the method by which that price will be set and the date on which notice of the price will be provided to holders.

- The date on which offers will be accepted.

The purchase price can be set in a variety of ways. The price may be:

- A fixed dollar amount established at launch.

- Determined by reference to a yield equal to a fixed spread over an index and set by reference to that index on a certain date.

- Determined by a Dutch auction or modified Dutch auction, pursuant to purchase price offers submitted by holders.

New Bonds: If the issuer is funding the tender by issuing new bonds, which is often the case, the new bonds will be offered and sold in a parallel process. Because the proceeds of the new bonds will pay the purchase price of the target bonds, tender offer acceptance happens in tandem with new bond pricing.

Closing: On the closing date, the target bonds that have been accepted by the issuer for purchase are purchased and canceled (or, in an exchange transaction, the target bonds are exchanged for new bonds and canceled). When new bonds are issued to pay the purchase price of the tender, the tender payment occurs immediately after the delivery of new bonds.