2023 was the hottest year on record. Not only the hottest since U.S. meteorological recordkeeping began in 1850, but according to Scientific American, 2023 was also “the hottest temperature that our planet has experienced in something like 125,000 years.”[1]

Along with unprecedented temperatures, the entire world is experiencing more “compound events”; that is, when multiple extreme weather events take place at the same time.[2]

"The risk of extreme events is growing, and they're affecting every corner of the world."

Sarah Kapnick, chief scientist, the National Oceanic and Atmospheric Administration

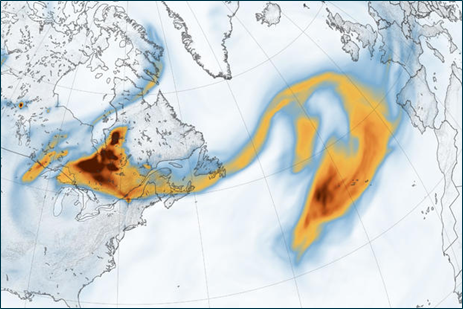

In addition to high temperatures, California experienced historically heavy rainfall that led to floods, landslides, and power outages in previously drought-plagued areas.[3] February through April brought severe tornados and a “bomb cyclone,” where winds reached hurricane-level speeds.[4] By early April of 2023, almost as many lives had been lost to tornados as in an entire year.[5] May and June brought Canadian wildfires that spread hazardous smoke across much of the United States as well,[6] with atmospheric plumes reaching as far as northern Spain.[7] July through September saw record heat waves, and October through December brought high temperatures, as well as heavy rains, flooding, and power outages.[8]

Smoke from Canadian wildfires seen reaching Europe in this satellite image from June 26, 2023.

NASA Earth Observatory

Was the weather we experienced in 2023 expected to be an anomaly?

No. The extreme weather events of 2023 are not likely to be an anomaly. This supposition is already being born out in 2024, as we are experiencing a cluster of interrelated compound events in North America. In February 2024, major storms caused significant flooding on the west coast, then blizzards dumped 11 feet of snow in the Sierra Nevada quickly thereafter. With more than 150 wildfires already blazing in western Canada, the wildfire season is coming early. The Province of Alberta started its official wildfire season a week earlier than normal this year.[9] In Texas, the Smokehouse Creek fire swept across the panhandle at breakneck speed in February and early March to scorch 1.1 million acres. It now registers as the largest wildfire in Texas’s history, decimating communities and wiping out ranching operations.[10]

It is hard to make direct connections between climate change and local weather events. Nathan Gill, an assistant professor in the department of natural resources management at Texas Tech University, notes “We’re not in a historic drought right now, so that’s not the climate story here. But I think there is a climate story more related to the season when these conditions are happening. We can’t necessarily say that one particular event was caused by climate change per se, but we can look at the broader picture and say conditions are changing and there might be a greater probability of something like this happening.”[11]

The UN World Meteorological Organization has predicted that in 2024 the naturally occurring El Niño climate pattern will contribute to increased temperatures due to “increasing concentrations of heat-trapping greenhouse gases from human activities.”[12] What is increasingly clear is that we can expect both seasonal and unseasonal weather risk events to occur concurrently with increasing frequency and severity in 2024 and for the foreseeable future. As a result, businesses need to identify them, prepare for them, and manage them.

Is there a difference between weather and climate risks?

Yes. We hear a lot about the weather and a lot about the climate without a clear distinction between the two. One way to think about the distinction is, as Mark Twain said, “Climate is what you expect, weather is what you get.”[13] The National Weather Service (NWS) offers a technical definition of weather as “the state of the atmosphere at any given time and place, with respect to variables such as temperature, moisture, wind speed and direction, and barometric pressure.”[14] NWS defines climate as “the expected frequency of specific states of the atmosphere, ocean, and land including variables such as temperature (land, ocean, and atmosphere), salinity (oceans), soil moisture (land), wind speed and direction (atmosphere), current strength and direction (oceans). Climate encompasses the weather over different periods of time and also relates to mutual interactions between the components of the earth system (e.g., atmospheric composition, volcanic eruptions, changes in the earth’s orbit around the sun, changes in the energy from the sun itself).”[15] In other words, “weather” refers to relatively short-term events, such as heat waves, cold snaps, downpours, hailstorms, and dry periods; “climate” refers to weather conditions over long periods of time. Climate is “based on analysis of historical data.”[16]

Can anything be done about climate change?

Maybe. Climate change is now on many agendas. For the past 30 years, several national and supranational organizations and governments have made efforts to develop best practice recommendations to address management of, and reporting on carbon emissions, their direct and indirect consequences, and risk mitigation. Many professional, consumer, and shareholder groups are shaping Environmental, Social, and Governance (ESG) dialogue on integration of reporting standards.[17] There is no doubt, however, that treaties, agreements, legislation, and regulations will continue to develop. In fact, two recent developments are noteworthy: the COP28 Dubai climate accord, and the SEC’s final rules for climate-related disclosures by public companies.

2023 will be remembered as the year when many countries reached a global accord on emission reductions at the “COP” conference convened by the United Nations for the past 28 years. The Conference of the Parties of the UN Framework Convention on Climate Change met in Dubai and came to an important agreement. Endorsed by both traditional and renewable energy leaders, Ignacio Sánchez Galán, executive chairman of Iberdrola, noted, “COP28 will be remembered as the summit that snatched a remarkable victory from the jaws of defeat. For the first time, the world has new agreed language on transitioning away from all fossil fuels, and more than 110 countries have agreed to triple renewable energy capacity by 2030.”[18]

Only a few months after COP28 on March 6, 2024, the SEC issued its long-awaited final rules on climate-related risk reporting (Final Rules). The SEC “adopted rules to enhance and standardize climate-related disclosures by public companies and in public offerings. The final rules reflect the Commission’s efforts to respond to investors’ demand for more consistent, comparable, and reliable information about the financial effects of climate-related risks on a registrant’s operations and how it manages those risks while balancing concerns about mitigating the associated costs of the rules.”[19]

As SEC Chair, Gary Gensler, noted: “The final rules build on past requirements by mandating material climate risk disclosures by public companies and in public offerings.” Some may claim the Final Rules went too far, some may claim they did not go far enough,[20] but the fact is that we now have SEC rules in final form. In addition to effecting transparency, the Final Rules will influence how registrants manage for climate and weather risks. Of particular note, registrants are required to disclose the following:

-

Climate-related risks that have had or are reasonably likely to have a material impact on their business strategy, results of operations, or financial condition;

-

Actual and potential material impacts of identified climate-related risks on their strategy, business model, and outlook;

-

Activities to mitigate or adapt to a material climate-related risk, a quantitative and qualitative description of material expenditures incurred, and material impacts on financial estimates and assumptions that directly result from such mitigation or adaptation activities;

-

Disclosures to mitigate or adapt to a material climate-related risk;

-

Board oversight of climate-related risks and management’s role in assessing and managing material climate-related risks;

-

Processes for identifying, assessing, and managing material climate-related risks and, whether and how any such risk management processes are integrated into the overall risk management system or processes;

-

Capitalized costs, expenditures, charges, and losses incurred as a result of severe weather events and other natural conditions, (subject to applicable one percent and de minimis disclosure thresholds, disclosed in a note to the financial statements).

What Are The Dangers of Extreme Weather Events?

Extreme weather events can have negative economic, social, and environmental impacts. There is much that a business can do to minimize its economic costs from adverse weather events. Now that U.S. public companies must report details of their climate-risk management efforts, the focus on climate and weather risks is addressed in detail in this series.

Weather is changeable and notably hard to predict, even with sophisticated information systems, real-time data processing, and visualization capabilities. Weather and climate Enterprise Risk Management is, therefore, an important business objective that is often time consuming and difficult to implement. In fact, consistency in risk-related terminology, measures, and models can be one of the hardest aspects of ERM integration across knowledge silos.[21] But global climate-resilient businesses must adopt and develop real-time risk management frameworks to identify, measure, track, and mitigate these risks. Businesses do this with their internal policies and procedures to ensure that operational and fiscal controls and measures stay on track and effectively address the reporting requirements for the kinds of “material climate-related risks” referenced by the SEC’s Final Rules.

What can a business do to protect itself against unexpected weather events?

A business can protect itself against many of the adverse economic consequences of extreme weather events, such as lower-than-anticipated demand for its products or services. Similarly, a business can protect itself against higher-than-anticipated supply costs and extreme volatility in its revenue streams.

What are some common risk management strategies?

To manage the economic consequences of weather-related risks, the Weather Risk Management Association suggests that a business typically follow one or more of three risk reduction approaches:

(1) risk transfer, (2) risk avoidance, and/or (3) optimal risk retention.[22]

What is meant by “risk transfer”?

Risk transfer typically involves the use of derivative products, insurance contracts, or a combination of both to shift risk to another party.

What is meant by “risk avoidance”?

Risk avoidance typically involves changing business practices to reduce the economic consequences of extreme weather events. It might involve the use of “forecast/decision making information to optimally realign/modify products and services in ways that remove or reduce weather/climate exposures.”[23] For example, an agribusiness might plant a particular mix of crops one year that are more likely to survive specific extreme weather conditions in a given season when a very wet spring or drought is anticipated, along with likely heightened pest and disease pressures. Indeed, modern plant breeding and selection efforts already closely focus on achieving these kind of climate-smart risk-resilient outcomes for savvy farming operations.

What is meant by “optimal risk retention”?

Optimal risk retention involves applying “enhanced knowledge of weather/climate systems” in seeking “to develop naturally offsetting/negatively correlated organic hedges/strategies (time, space, logistics, products, etc.) and/or take actions such as increasing weather/climate resilience through infrastructure/engineering products.”[24] Here, for example, an agricultural operation might employ multivariate analytics tools to assess multiple factors in the field to time cultivation interventions to address certain expected climatic conditions.

What is the focus of this series?

In this series, I focus on the first of these strategies: transferring weather-related risks (and, by association, climate-related risks) with use of weather insurance and weather derivatives. I address both insurance and derivatives because these different products are appropriate and are often used together to manage different types of weather risks.

Given my experience in advising clients on weather-related risk management, I have seen that there is “no one size fits all” solution. Some weather risks can best be managed by purchasing indemnity insurance; others by purchasing parametric insurance, others by entering into weather derivatives, others with a combination of indemnity and parametric insurance; and still others by using a combination of insurance and derivatives.

What are some common risk transfer triggers used for weather insurance and weather derivatives?

Weather-related risks that a business might want to transfer through an insurance contract or a derivative include the following:

-

Above (below) a specified amount of rainfall over a specified period at a specified place.

-

The number of times the temperature fell below (rose above) a specified temperature over a specified period in a specified place.

-

Catastrophic events, such as earthquakes, floods, drought, tornados, hurricanes, hail, and cyclones in a specified period at a specified place.

-

Greater-than-normal variances in temperature, precipitation, snowfall, snow depth, hail, windspeed, humidity, sunshine, and water flow in a specified period at a specified place.

-

Heating degree days (HDDs) and Cooling degree days (CDDs) that measure how warm (cold) is a specified place against a standard temperature, typically 65 degrees Fahrenheit.[25]

-

Crop yield-reducing events, such as dry weather, wet weather, frost, and heat in a specified period at a specified place.

Conclusion

Most organizations face weather and climate risks. As part of a comprehensive enterprise-wide risk management framework, managers have several risk transfer products available to them. This series on climate and weather risk provides a detailed review of this wide-ranging area. Organizations can look to standardized futures and option contracts traded on regulated commodity exchanges; they can enter into customized over-the-counter (OTC) weather derivatives designed with their specific weather-related risks in mind; they can put in place indemnity insurance; they can purchase parametric insurance; or they can mix and match multiple derivative products and insurance coverage to meet their specific needs.

In Part I of this Q&A series, we have considered the context of global climate change within which weather and climate decision making and regulatory reporting and compliance is taking place, as well as the principles that apply to weather risk management. In Part II, I look at various weather risk-transfer products; in Part III, I address the regulation of these products; and in Part IV, I take a deep dive into the taxation of these weather risk-management products.

In the preparation of Weather & Climate Risk Management, an occasional series from ASKramer Law, I want to extend my gratitude to Brian O’Hearne, CEO of Hailios, for his comments.

[1] “Earth Just Had the Hottest 12-Month Span in Recorded History,” Andrea Thompson, Scientific American November 9, 2023, https://www.scientificamerican.com/article/earth-just-had-the-hottest-12-month-span-in-recorded-history/ See also, Laura Paddison, “Humanity Just Lived Through the Hottest 12 months in At Least 125,000 years,” CNN, Nov. 9, 2023, https://www.cnn.com/2023/11/09/climate/global-warming-hottest-year-history-climate-intl/index.html; Sam Meredith, “‘Like Something Out of a Hollywood Movie’: Scientists Say 2023 Likely to Be the Hottest Year on Record,” CNBC, Nov. 8, 2023, https://www.cnbc.com/2023/11/08/climate-scientists-warn-2023-likely-to-be-the-hottest-year-on-record.html

[2] “The Extreme Weather Events of 2023,” Devika Rao, The Week, December 26, 2023, https://theweek.com/in-depth/1021278/2023-extreme-weather.

[3] Ibid.

[4] Ibid.

[5] Ibid.

[6] Ibid.

[7] “Smoke plume from Canadian wildfires reaches Europe” Li Cohen, CBS News, June 27, 2023, https://www.cbsnews.com/news/canadian-wildfires-smoke-map-satellite-europe/

[8] “Extreme Weather,” Rao.

[9] Wildfire seasons are starting earlier and getting longer” Denise Chow, NBC News, March 8, 2024. https://www.nbcnews.com/science/environment/wildfire-seasons-are-starting-earlier-getting-longer-rcna142231

[10] High fire risk remains, but the Smokehouse Creek Fire is almost fully contained at this time of publication.

[11] Ibid.

[12] “2023 Likely Hottest Year on Record; Further Spike Expected with El Niño,” United Nations, UN News, Nov. 8, 2023, https://news.un.org/en/story/2023/11/1143352

[13] “Climate versus Weather,” National Weather Service, https://www.weather.gov/climateservices/CvW, visited March 12, 2024.

[14] Ibid.

[15] Ibid.

[16] Ibid.

[17] These efforts are beyond the scope of this series.

[18] “Macroeconomic uncertainties will not halt progress on the energy transition in 2024 and beyond. Here’s why,” Ignacio Galán, January 4, 2024, https://www.iberdrola.com/press-room/news/detail/macroeconomic-uncertainties-will-not-halt-progress-on-the-energy-transition-in-2024-and-beyond-heres-why

[19] SEC Adopts Rules to Enhance and Standardize Climate-Related Disclosures for Investors,

SEC Press Release, 20-24-31 https://www.sec.gov/news/press-release/2024-31

[20] Shortly after the release of the Final Rules, the SEC has been sued already: “‘Sued on both sides’: SEC braces for lawsuits from supporters and critics of climate rule,” Stefania Palma, Aime Williams and Patrick Temple-West, Financial Times, March 6, 2024. See also, “Republican-led states sue US SEC over climate risk disclosure rules,” Clark Mindock, Reuters, March 6, 2024.

[21] “The Language of Enterprise Risk Management: a Practical Glossary and Discussion of Relevant Terms, Concepts, Models, and Measures” Jerry Miccolis | May 1, 2002 https://www.irmi.com/articles/expert-commentary/the-language-of-enterprise-risk-management-a-practical-glossary-and-discussion-of-relevant-terms-concepts-models-and-measures

[22] Weather Risk Management Association, “Weather/Climate-Related Risk Reduction Occurs in Three Forms,” https://www.wrma.org/page/what-is-weather-risk-management, site visited January 15, 2024.

[23] Ibid.

[24] Ibid.

[25] U.S. Energy Information Administration, “Degree Days,” https://www.eia.gov/energyexplained/units-and-calculators/degree-days.php Heating degree days (HDDs), site visited March 12, 2024. See also National Weather Service, “Heating and Cooling Degree Days,” https://www.weather.gov/key/climate_heat_cool, site visited March 12, 2024.

[View source.]