[author: Carlos Juarez]

Introduced under Title III of the JOBS Act, Regulation Crowdfunding (“Regulation CF”) was promulgated to allow startups and emerging companies to raise capital from a wider pool of investors through equity crowdfunding platforms. Regulation Crowdfunding allows non-accredited investors to invest through these platforms. Currently, a company may raise up to $5 million in a 12-month period.

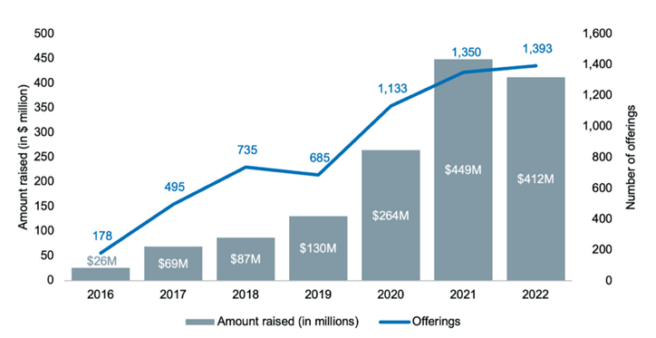

A study produced for the SEC’s Small Business Capital Formation Advisory Committee by Melody Chang, PhD, USC Marshall School of Business, reviewed crowdfunding data between May 2016 and December 2022. The report, “Women and Minority-Owned Businesses in Regulation Crowdfunding,” noted that $1.4 billion in capital was raised in 5,969 offerings by 5,211 individual businesses. Notably, during the COVID-19 pandemic, Regulation CF offerings increased to 1,133 deals in 2020 (a 62% increase year-over-year).

Number of Regulation CF Offerings & Amount Raised by Year

Source: SEC

Source: SEC

Regulation CF Data

The median amount raised by Regulation CF deals was $115,250 in 2022. However, Seed VC funding amounts overshadowed crowdfunding and all other funding alternatives, with a median $3 million raised per round. Pre-seed VC funding raised a median $600,000 per round. Angel investments were comparable to Regulation CF offerings raising a median $121,000 and $85,000 in seed and pre-seed rounds, respectively.

The report reviewed the offering structure of Regulation CF offerings. Of the 5,969 deals, 77.9% were equity or equity-linked offerings, 15.6% were debt offerings, and 6.5% involved other securities. Equity and equity-linked securities included common stock (27.4% of deals), limited/non-voting common stock (5.6%), preferred units (9.1%), simple agreements for future equity or “SAFEs” (27.8%), and convertible notes (8%).

Platforms

The study also looked at 101 active Regulation CF platforms during the study period, and of these, 39 had at least 10 crowdfunding offerings and 20 platforms had at least 20 crowdfunding offerings. The study showed that the top two crowdfunding platforms accounted for 60% of all crowdfunding offerings, with 2,860 deals completed raising approximately $857 million.

Participation by Women & Minority-Owned Businesses

The study noted that overall, women and underrepresented minority entrepreneurs have a higher chance of obtaining funding by participating in crowdfunding offerings compared to traditional funding sources. The gender composition of the management teams of companies has shifted. The share of companies with “all-female” management teams increased to 14.2% in 2022 from 9.6% in 2016. In addition, “all-non-white” management teams increased from 11.4% in 2016 to 22.5% in 2022. Of course, there are still significant disparities the study found. For example, companies with “all-female” management receive 1.5-2 times lower funding than that of “all-male” management teams. In addition, “all-non-white” management teams receive disproportionally less funding compared to “all-white” management teams.

Dr. Chang’s presentation and report provided policy recommendations that encourage the SEC to incentivize outreach to underrepresented entrepreneurs, reduce barriers to participation, address funding biases, and facilitate networking and mentorship. The report emphasized the overlooked opportunities of women and underrepresented minority entrepreneurs, who are shown to often outperform yet face market undervaluation.

Read the report and Dr. Chang’s presentation for additional data and conclusions.

[View source.]