2016 AND LOOKING FORWARD

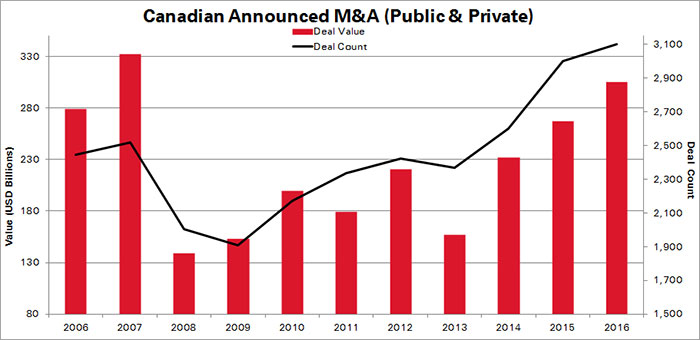

Canadian M&A activity rose once again in 2016, surpassing a record-breaking 2015 to become the most active year in Canadian deal-making history. In terms of deal value, 2016 will be second only to the peak of 2007.

The aggregate value of announced deals to date is C$399.9-billion, while announced deal volume reached an impressive 3,100 transactions.

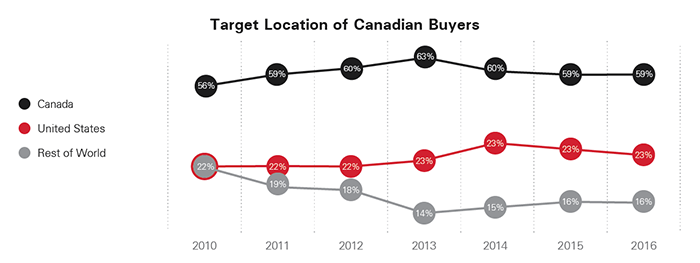

The clear leaders in cross-border M&A were Canada and the United States. Canadian buyers acquired more businesses in the U.S. than in any other country.

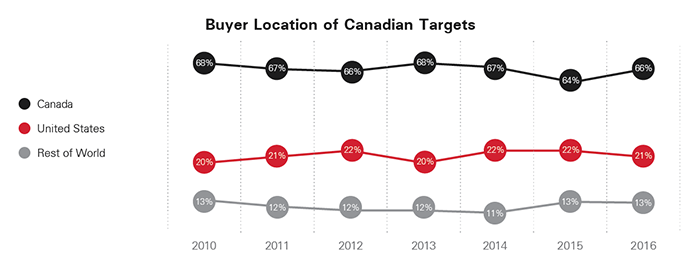

Similarly, Canada was the target country of choice for U.S. buyers in terms of both volume (590 deals) and value (C$18-billion).

Headline-making deals announced in 2016 included:

-

Agrium Inc. and Potash Corp.’s US$36-billion combination

-

Enbridge’s C$42.8-billion acquisition of Spectra Energy

-

TransCanada’s C$12.02-billion acquisition of Columbia Pipeline Group

-

Fortis Inc.’s C$11.05-billion acquisition of ITC Holdings Corp.

-

BCE Inc.’s C$3.3-billion acquisition of Manitoba Telecom Services Inc.

Here are some of the developments and trends we see impacting M&A in 2017.

FEDS WELCOMING NEW FOREIGN INVESTMENT

Prime Minister Trudeau appears ready to publicly work to make Canada more attractive to foreign investment.

The federal government announced that it intends to create a new “Invest in Canada Hub” and relax some foreign investment restrictions, including (with some exceptions):

-

Accelerating to 2017 the scheduled increase of the review threshold under the Investment Canada Act from C$800-million to C$1-billion

-

To conform with its obligations under the Canada-European Union Comprehensive Economic and Trade Agreement (CETA), implementing a new review threshold under the Investment Canada Act of C$1.5-billion for investors that quality as “trade agreement investors” (i.e., EU member states and countries with “most favoured nation” provisions with Canada)

-

Publishing guidelines for the national security provisions of the Investment Canada Act to assist foreign investors in navigating the review process.

With non-Canadian buyers comprising 34 per cent of inbound deals, Canadian targets will continue to shop themselves overseas.

INFRASTRUCTURE SPENDING WILL DRIVE NORTH AMERICAN ACTIVITY

The Fall Economic Statement outlined certain key federal government infrastructure priorities in advance of the 2017 budget. Notable for potential funding recipients, developers and investors, the finance minister proposed:

-

An additional investment of C$81-billion over 11 years, starting in 2017–18, for public transit (C$25.3-billion), green infrastructure (C$21.9-billion), social infrastructure (C$21.9-billion), transportation that supports international trade (C$10.1-billion) and projects that support Canada’s rural and northern communities (C$2-billion)

-

The creation of a new Canada Infrastructure Bank responsible for investing at least C$35-billion, whose primary mandate will be to help government identify and deliver projects that will provide economic, social and environmental returns and facilitate private capital investment.

Across the border, the U.S. president-elect has pledged to spend US$1-trillion on infrastructure over the next decade to rebuild key American infrastructure, including roads, bridges, tunnels and hospitals, relying in part on private capital and tax incentives.

We expect investors, both domestic and foreign, will look to capitalize on new Canadian projects and make strategic acquisitions in complementary industries (including construction and services).

PLANS OF ARRANGEMENT: NO SHAREHOLDER APPROVAL FOR BUYERS, QUESTIONS RAISED ABOUT FAIRNESS OPINIONS

When a recent Alberta trial court decision held that an acquisition by way of plan of arrangement could, in certain circumstances, require approval by the shareholders of the buyer (not just the target), long-standing public deal practice in Canada was called into question. The Alberta Court of Queen’s Bench broke with precedent and determined that to meet the test of being “fair and reasonable” under the applicable corporate statute in the circumstances, the shareholders of both companies in the transaction must be entitled to vote and granted dissent rights.

The uncertainty, however, was short-lived as the Alberta Court of Appeal reversed the decision, holding, among other things, that the requirement that an arrangement be fair and reasonable is a test to be applied in respect of the corporation that is being arranged (i.e., the target), and not in respect of the buyer or its shareholders.

Separately, in a proposed plan of arrangement involving the acquisition of InterOil Corporation by Exxon Mobil Corporation, the Yukon Court of Appeal overturned a decision to grant the final order approving the arrangement. The court determined that InterOil failed to prove the arrangement was fair and reasonable, as required by the corporate statute. In particular, the court focused on the failure of InterOil to engage a financial adviser to provide a fairness opinion on a flat fee basis, as opposed to the more traditional contingent success fee arrangement, as well as what the court perceived to be a lack of detail and financial analysis in the fairness opinion.

The decision raises questions as to the manner in which fairness opinions’ fee arrangements may be structured and how fairness opinions may be viewed by the courts in plans of arrangement going forward.

PENSION FUNDS WILL CONTINUE GLOBAL EXPANSION

In this prolonged environment of low interest rates, pension funds continue to seek out alternative investments to generate returns and have spent billions on “core infrastructure assets” — complete cash-generating assets such as highways and airports. In 2016, a consortium that included several of Canada’s largest pension funds acquired Britain’s London City Airport for C$3.64-billion.

However, as the “core” infrastructure market has become increasingly crowded, pension funds are expanding their overseas investment into “opportunistic” infrastructure projects — new projects built from scratch or existing assets requiring capital improvements. While these can be riskier investments, they carry the potential for higher returns commensurate with that risk.

NEW U.S. CORPORATE TAX POLICIES MAY TRUMP CANADA

A priority initiative of the U.S. president-elect will be to proceed with significant tax reform, including major changes to the U.S. corporate tax system. These changes include a dramatic reduction in the “headline” rate of federal tax — from 35 per cent to 15 per cent. Under current law, Canadian corporations generally face a combined federal/provincial rate of 26 to 27 per cent, so this change would tend to weaken, if not eliminate, Canada’s historical rate advantage.

The president-elect’s platform also calls for a one-time deemed repatriation to the U.S. of foreign earnings at a 10-per-cent rate. This would reduce, though not eliminate, the advantage enjoyed by Canadian multinationals that may generally repatriate foreign business earnings without imposition of Canadian tax.

Finally, the president-elect has proposed massive reductions in regulations. With congressional gridlock preventing meaningful U.S. tax reform over the past several years, the Obama administration has used regulations to close perceived “loopholes” in the U.S. tax system, including regulations focused on so-called “inversion” transactions. It remains to be seen whether and to what extent the new administration revokes or changes these regulations.

The overall effect of these changes on Canadian M&A activity remains to be seen. By direction, these changes tend to diminish the comparative advantage enjoyed by Canadian businesses, possibly diverting investments from Canadian to U.S. targets. However, the ability of the new administration to effect massive reductions in the U.S. corporate tax burden may be severely constrained by Congressional Republicans, who will be naturally averse to significant increases in the U.S. government deficit and looking for offsetting increases in revenues from other sources. Therefore, the overall impact on business taxation is not yet known.

As the details of U.S. tax reform become clearer, eyes will be on the Canadian federal and provincial governments to see how they respond to changes south of the border to ensure Canada remains fiscally competitive with its neighbour.

OIL & GAS IS THE NEW…OIL & GAS

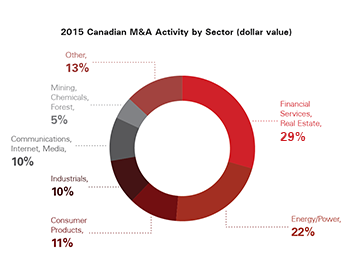

In 2017, we expect the oil & gas sector to continue its M&A resurgence. In 2014-15, fewer energy deals followed the decline in oil prices and resulting valuation gap for assets. However, 2016 saw energy/power come roaring back as the sector was by far the most active by deal value, accounting for over 40 per cent of M&A activity. This compares with just 22 per cent in 2015.

While 2016 also saw an uptick in the number of oil & gas companies undergoing a court-monitored restructuring or other insolvency process, including an increase in cross-border insolvencies, we expect more stability in the industry going forward.

CERTAINTY ON HOSTILE BID RULES — BUT FEW TAKERS

The final amendments to the new take-over bid regime came into force earlier this year, requiring that bids be:

-

Open for at least 105 days (unless shortened by the target, to no less than 35 days)

-

Subject to a minimum tender condition of more than 50 per cent of the outstanding securities of the class subject to the bid (not including those held by the bidder)

-

Extended for at least 10 days after the bidder first takes up securities under the bid.

The changes are intended to help target boards by providing more time to respond to unsolicited bids. Early indications are that fewer hostile bids may be made under the new rules given the additional time (and potential cost) to complete. Only six hostile bids were launched in 2016, compared to eight, nine, and 11 in each of the prior three years, and a high of 13 in 2011.

Going forward, we expect to see buyers consider alternative strategies for acquiring unwilling targets, including proxy contests to install a favourable board.

CHANGES TO NAFTA COULD IMPACT CROSS-BORDER DEAL-MAKING

The year ends on an uncertain note in respect of cross-border trade following the U.S. election. The president-elect has described his disdain for the North American Free Trade Agreement (NAFTA) and plans for the U.S. to withdraw or renegotiate. Prime Minister Trudeau has responded with an offer to consider renegotiations.

What impacts would a revamped NAFTA have on deal-making in Canada? Certain sectors are most likely to feel the direct impact, notably agribusiness and forestry. The Canadian beef industry depends on the U.S. for over 70 per cent of its exports, and would take a hit if country-of-origin labelling is implemented (an effort that was previously defeated by Canada and Mexico). The U.S. may also set new quotas on softwood lumber or a limit on the number of Canadian timber shipments.

Canada and the U.S. are the world’s largest trading partners with an average of C$2.4-billion in goods and services crossing the border every day. Given this advanced level of economic integration, any abrupt change in the current trading relationship will likely have significant implications to cross-border businesses, whether engaged in importing, exporting or both.

EMERGING TECH SECTOR HEATING UP

Tech companies like Google have made headlines over the past few years developing self-driving cars, and suppliers have already begun to manufacture automotive parts that will be compatible with the new technology. The pressure to keep up with emerging technologies has led to a wave of consolidation in the automotive supply sector over the past two years, with aggregate deals in 2015-16 totalling C$74.4-billion. Over the previous decade, annual deal value in the sector averaged only C$17.7-billion.

Canada has also seen a sharp increase in the number of emerging tech startups with new entrants popping up in the life sciences, financial, manufacturing, artificial intelligence/machine learning, legal and clean energy spaces, to name a few. One area of particular growth is mobile app development, as this has become a more critical channel for businesses to interface with customers.

Private equity and strategic investors have led an M&A boom in the cybersecurity industry. Deal volume in the sector rose by more than 30 per cent in the past year. Average deal size has also been increasing in several emerging sectors over the past three years, including information and communication technology (up 24 per cent), life sciences (up 17 per cent) and agribusiness (up 260 per cent).

All told, the picture in Canada is one of a tech market experiencing a rapid expansion. Considering both deal volume along with total capital invested, the growth rate in investment in Canada’s technology sector over the past three to five years has been approximately triple that of the U.S., a more mature market. Over the past 10 years, it has been approximately equal to the growth rate in Israel — another emerging tech success story. Many tech founders will be planning for exits, and firms in the mature U.S. market are often keen buyers in the sector. Others are exploring other means of expansion, such as strategic partnerships with global peers. We expect activity in the industry to continue in 2017.

* * *

Looking forward to 2017, we expect global economic forces, including the few discussed above, will continue to drive accelerated business and financial change within Canada. M&A will continue to be a preferred option for both domestic and foreign market participants to position themselves ahead of the curve and remain competitive.