[co-author: Austin Ward]

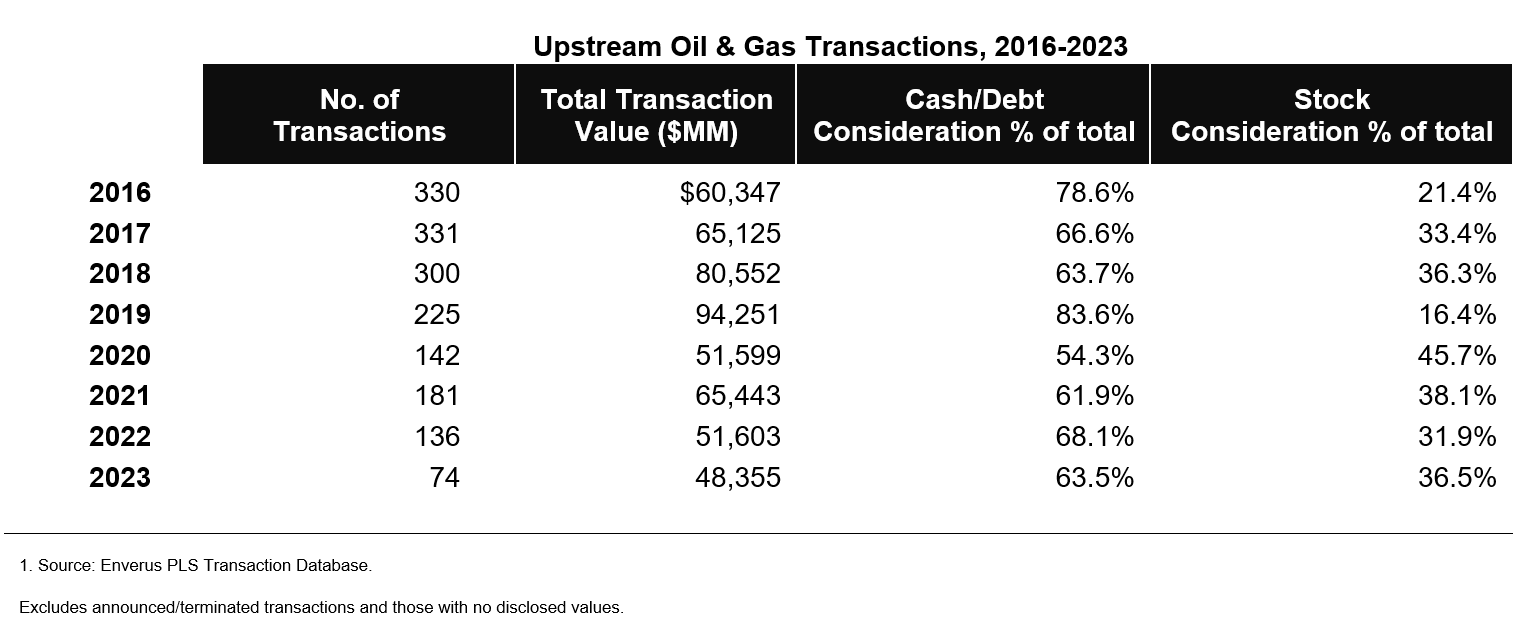

Over the last several years, an acquiring company’s stock has become a more commonly used currency in upstream oil & gas merger and acquisition transactions. This trend can be attributed to its benefits, such as providing flexibility and potential upside for both the acquiring and target companies. As shown in the table below, since 2016, stock as a percentage of total consideration in upstream oil & gas transactions has increased over time, indicating its growing importance in these deals.

Companies that are considering utilizing their stock as a form of consideration in a transaction should keep several key questions in mind:

- How Do I Establish the Purchase Price? In instances where the acquirer is a publicly traded company, establishing the purchase price amount is relatively straightforward. However, if the acquirer is a privately held entity, it can become more difficult to establish the purchase consideration to be allocated. In this instance, the acquirer's shares being used for consideration will need to be valued to establish the consideration amount. This would include estimating the company’s business enterprise value (i.e., total asset value), utilizing one or more of the three generally accepted valuation approaches (income, cost, and/or market approach). If the acquirer has a complex capital structure, with various classes of equity that have differing rights and preferences, this could also include the valuation of the applicable classes of equity.

- What Accounting Requirements Do I Need to Follow? In a transaction in which stock is used as consideration, like with all acquisitions, ASC 805, Business Combinations, requires the allocation of the purchase consideration to identified tangible and intangible assets for financial reporting purposes.

- How Have Market Conditions Changed Between Announcement and Closing? The value of shares to be issued as consideration might not always align exactly with the value of the acquired assets. Market conditions and other forces may change values in both the equity being used as consideration, and the assets being acquired, between the time that the transaction is announced and the time that it closes. The valuation analyst should keep in close communication with the acquirer’s management and the respective auditor to ensure that there are no surprises when the transaction closes, and the final purchase price allocation is performed.

- Are the Valuation Assumptions Consistent? In instances where the acquirer’s shares must be valued to establish the consideration amount, care should be taken to ensure that key valuation assumptions are consistent between the valuation of the acquirer’s equity and the assets of the acquiree. Examples of such valuation assumptions in the upstream oil & gas industry include the commodity pricing strip being used, volumetric risk, and discount rates. If there are substantial differences between the respective analyses, there should be supportable reasons for such differences.

- Is a Control Premium Required? In some instances where equity is being used as consideration, a question may arise as to whether a control premium should be applied to the consideration being paid. This will require the valuator to understand the terms of the purchase agreement and whether a control element has already been priced into the transaction. For example, in the acquisition of a limited partnership, a general partner may have also been acquired in the transaction. Often, the amount paid for this general partnership interest may represent the “control” factor, i.e., the ability to affect change in the projected cash flows above and beyond the acquisition of the limited partnership.

In conclusion, the use of stock as part of consideration has become much more common in today’s oil & gas acquisition market. In instances where a buyer’s stock is used as consideration for mergers or acquisitions, the factors noted above make it more critical than ever to have a strong, defensible valuation supporting the value of the consideration paid as well as the purchase price allocation.

CLICK HERE TO READ THE ARTICLE PUBLISHED IN OILMAN MAGAZINE