The SEC shortened Schedule 13D and Schedule 13G beneficial ownership reporting deadlines and amended disclosure requirements.

TAKEAWAYS

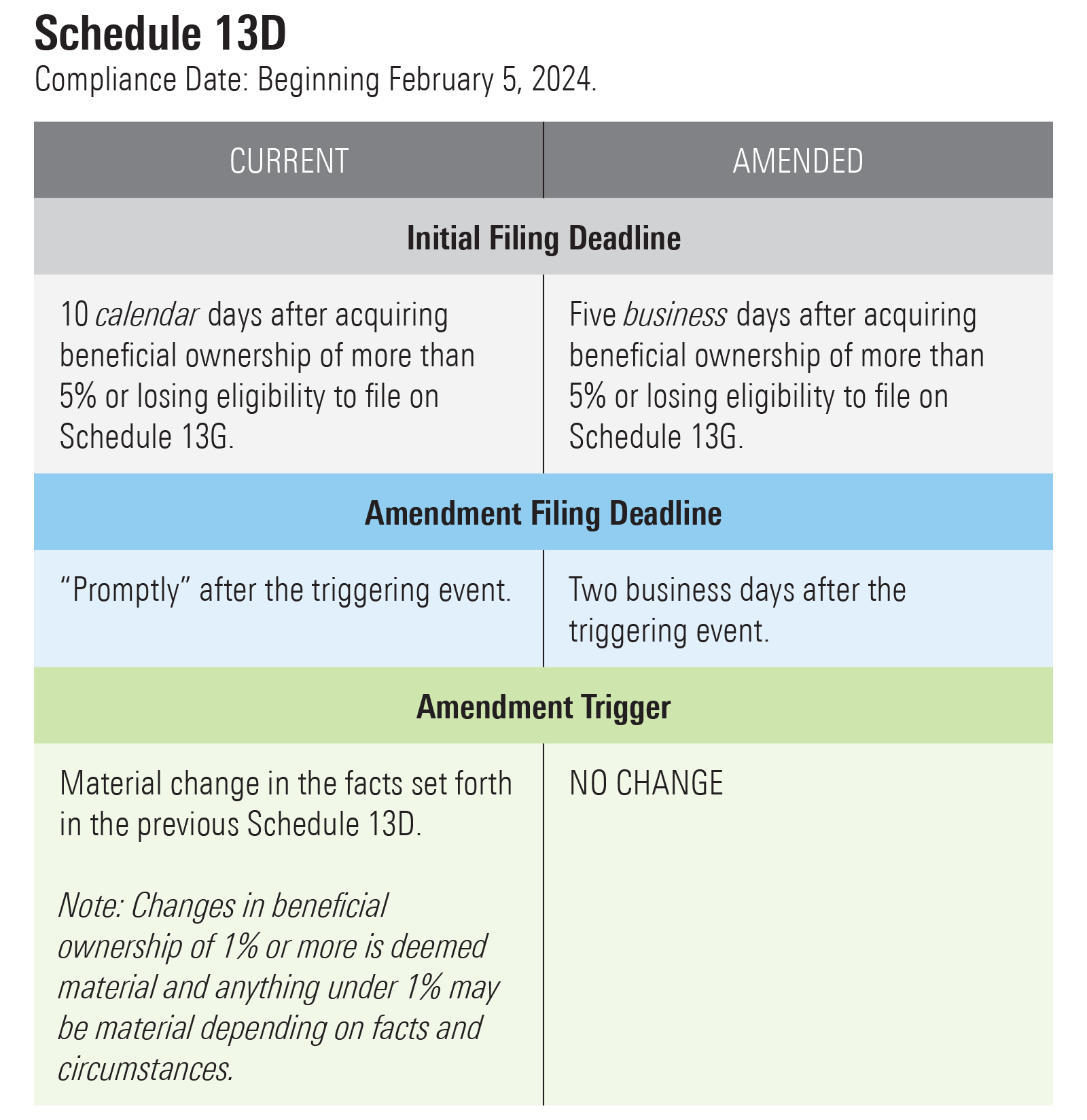

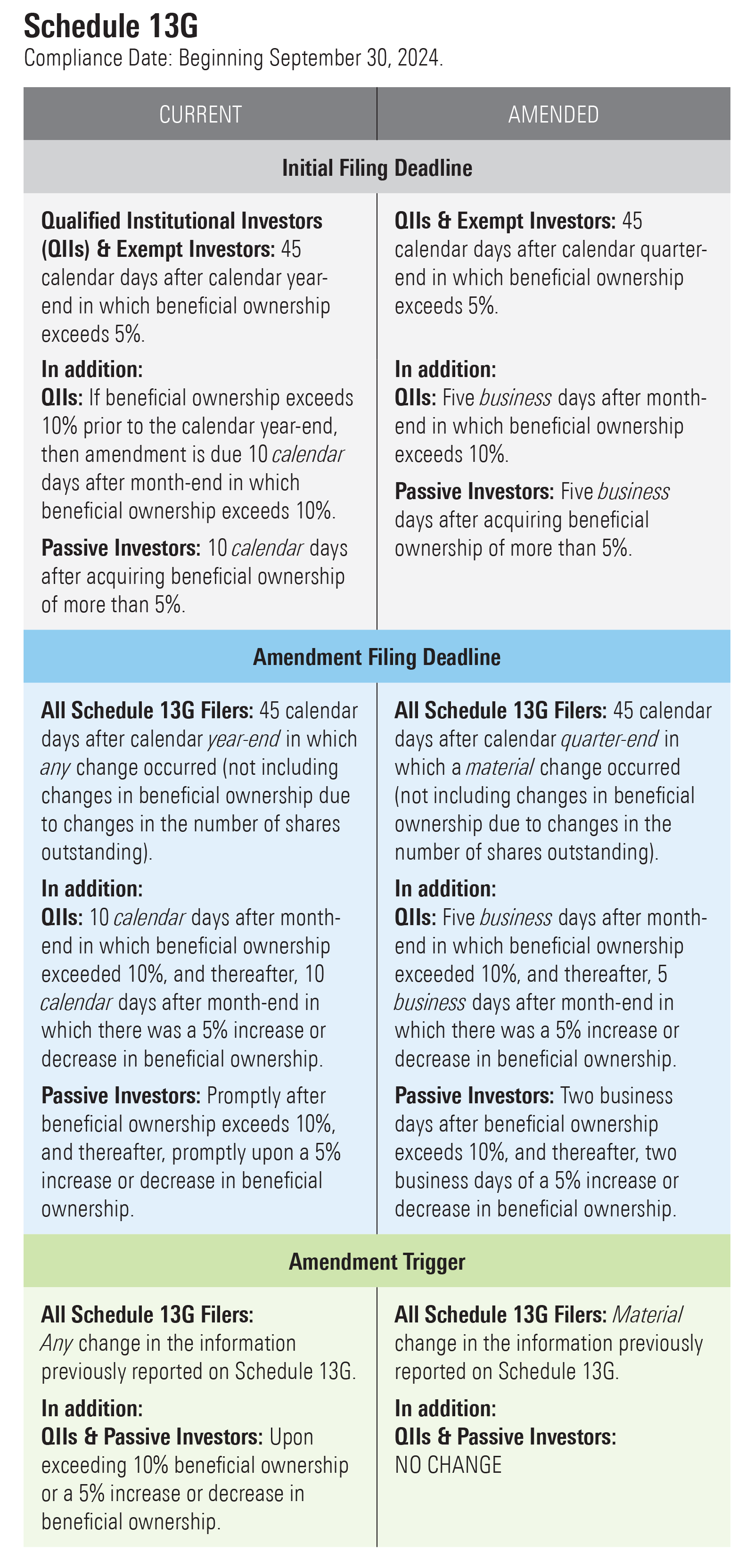

- The SEC modified and accelerated the initial filing and amendment deadlines, as well as amendment triggers for Schedules 13D and 13G. (See details in the table below.)

- The SEC issued clarifying guidance for (1) when holders of derivative securities (other than security-based swaps) may be deemed beneficial owners of the underlying securities, and (2) what circumstances may constitute a “group” for purposes of Sections 13(d)(3) and 13(g)(3) of the Securities Exchange Act.

- Schedule 13D filers will be required to disclose in Item 6 derivative contracts, arrangements, understandings and relationships with respect to an issuer’s securities, including cash-settled security-based swaps (SBS) and other non-SBS cash-settled derivatives.

On October 10, 2023, the U. S. Securities and Exchange Commission (SEC) adopted amendments (Amendments) to the beneficial ownership reporting requirements for beneficial owners of more than 5% of a class of securities registered under Section 12 of the Securities Exchange Act of 1934, as amended (Exchange Act). The Amendments adopt, modify or decline to adopt the rule amendments initially proposed in the SEC’s February 10, 2022, release (2022 Proposals).

Exchange Act Sections 13(d) and 13(g) require greater than 5% beneficial owners of Exchange Act Section 12-registered securities (i.e., functionally all equity securities traded on U.S. exchanges including the NYSE and Nasdaq) to report their beneficial ownership on either of the applicable Schedule 13D or Schedule 13G (for a discussion of the applicability of Schedule 13D and Schedule 13G, see the header below titled “Review: Schedule 13D and Schedule 13G Eligibility”). The Amendments shorten the initial filing deadlines for Schedules 13D and 13G, shorten the filing deadlines for amendments to Schedule 13D and 13G filings and change the amendment trigger for Schedule 13G filings. Compliance with the amended Schedule 13G deadlines will be required beginning on September 30, 2024, and for Schedule 13D filings, beginning on February 5, 2024. Summaries of the initial filing deadline, amendment filing deadline, amendment trigger and compliance deadlines appear in the tables below.

The Amendments extend the Electronic Data Gathering, Analysis, and Retrieval (EDGAR) cutoff time for Schedule 13D and 13G filings to be deemed filed on the date of submission to 10:00 pm ET, rather than the current 5:30 pm ET cutoff, synchronizing the cutoff with the Forms 3, 4 and 5 cutoff time. For purposes of calculating the five-business-day deadline for initial Schedule 13D filings, the fifth business day is five business days after the date on which the initial Schedule 13D filing obligation arises (i.e., the date on which the person acquires beneficial ownership of more than 5% of a covered equity security). For example, if a person acquires more than 5% beneficial ownership on a Monday, the initial Schedule 13D filing would be due the following Monday by 10:00 pm ET, assuming there are no intervening federal holidays.

Additionally, the Amendments will require that all Schedule 13D and 13G filings be filed using a structured, machine-readable data language (XML-based language). Compliance with the machine-readable data language requirement begins December 18, 2024.

Cash-Settled Derivative Securities

The SEC declined to adopt a proposal from the 2022 Proposals that would have explicitly deemed holders of cash-settled derivative securities (other than security-based swaps) to be beneficial owners of the reference covered class of securities if the cash-settled derivative securities were held either (a) for the purpose or effect of changing or influencing the control of the issuer or (b) in connection with or as a participant in any transaction having that purpose or effect. Instead, the SEC concluded that it would be sufficient to clarify in guidance how the existing rules—particularly Rule 13d-3—can be applied to holders of non-SBS cash-settled derivatives to treat them as beneficial holders in certain circumstances. These circumstances include when the:

- Non-SBS cash-settled derivative security provides its holder, directly or indirectly, with exclusive or shared voting or investment power over the reference covered class;

- Non-SBS cash-settled derivative security is acquired with the purpose or effect of divesting its holder of beneficial ownership, or preventing the vesting of beneficial ownership, of the reference covered class as part of a plan or scheme to evade the reporting requirements of Section 13(d) or 13(g); or

- Acquisition of the non-SBS cash-settled derivative security confers upon the holder the right to acquire beneficial ownership of the equity security within 60 days or confers on the holder the right to acquire beneficial ownership of the equity security with the purpose or effect of changing or influencing the control of the issuer or in connection with or as a participant in any transaction having such a purpose or effect, each regardless of when the right is exercisable.

From a practical perspective, because this guidance is highly fact-specific and looks to intentions and effects, rather than contractual language, it does little to provide certainty to market participants structuring transactions.

The Amendments also amend Rule 13d-10 to require that derivative contracts, arrangements, understandings and relationships with respect to an issuer’s securities, including cash-settled SBS and other non-SBS cash-settled derivatives, be disclosed under Item 6 of Schedule 13D in order to comply with Section 13(d)(1) and Rule 13d-1(a). This additional disclosure may put pressure on filers’ analysis of when such instruments involve beneficial ownership of the underlying securities.

“Group” Status

The SEC also chose not to adopt a proposal from the 2022 Proposals that would have created a defined legal standard for what satisfies the “act as a … group” standard in Sections 13(d)(3) and 13(g)(3) of the Exchange Act and Rule 13d-5(b) under the Exchange Act. Instead, the Amendments include guidance on the application of Sections 13(d)(3) and 13(g)(3) of the Exchange Act and existing Rule 13d-5(b) under the Exchange Act that clarifies and affirms that, among other matters, two or more persons who act as a group for purposes of acquiring, holding or disposing of securities may be treated as a group. Included in the Amendments are new paragraphs to each of Rule 13d-5(b)(1) and (2) specifying that a group shall be deemed to acquire any additional equity securities acquired by a member of the group after the group’s formation and carving out any intra-group transfers of equity securities. The new guidance regarding group formation includes an affirmation of the SEC’s and courts’ expressed views that the determination of “group” status depends on an analysis of all the relevant facts and circumstances, and not solely on the presence or absence of an express agreement. The guidance also includes the following statements describing actions that are insufficient, by themselves, to confer “group” status and the attendant disclosure requirements and beneficial ownership implications:

- Discussions, whether in private or public, between two parties that involve an independent and free exchange of ideas and views;

- Discussions among shareholders and the issuer’s management;

- Recommendations from shareholders in the context of a discussion that does not involve an attempt to convince the board to take specific actions through a change in the existing board membership, or to bind the board to take action;

- Rule 14a-8 shareholder proposals submitted jointly by multiple shareholders;

- Communications between a shareholder and an activist investor seeking support for its proposals to an issuer’s board or management, without consenting or committing to a course of action; and

- Announcements or communications by a shareholder of their intentions to vote in favor of an unaffiliated activist investor’s director nominees.

In contrast, the guidance expressly stated that a “group” is formed when a beneficial owner of a substantial block of securities intentionally communicates to other market participants that it will be filing a Schedule 13D with the purpose of causing such persons to make purchases of the same securities.

Review: Schedule 13D and Schedule 13G Eligibility

Any person (which includes funds, trusts and other entities) who acquires beneficial ownership of more than 5% of a class of covered equity securities must report their beneficial ownership on Schedule 13D, unless an exception allows them to report on Schedule 13G (a shorter form that requires less disclosure than Schedule 13D). The three categories of exceptions that allow a greater than 5% beneficial owner to file on Schedule 13G are:

- Exempt Investors (Exchange Act Rule 13d-1(d)): Persons who acquire all their securities prior to the issuer registering under the Exchange Act and who do not, subsequent to such registration, acquire additional securities of the same class that, together with all other acquisitions by the person of securities of the same class during the preceding 12 months, exceed 2% of the class.

- QIIs: Persons who (1) are specifically enumerated under Exchange Act Rule 13d-1(b)(1)(ii) and (2) acquired such securities in the ordinary course of business and not with the purpose or effect of changing or influencing control of the issuer, including, among others: broker-dealers, banks, insurance companies, investment companies, investment advisors, etc.

- Passive Investors (Exchange Act Rule 13d-1(c)): Shareholders who can certify that the securities were not acquired or held for the purpose of, and do not have the effect of, changing or influencing the control of the issuer and were not acquired in connection with or as a participant in any transaction having such purpose or effect. Directors and officers of the issuer are ineligible for the Passive Investor exemption (meaning if they beneficially own greater than 5% of a class of covered equity securities, they must report their holdings on Schedule 13D).

Practice Points for Shareholders and Issuers

In order to comply with the shortened filing deadlines for Schedules 13D and 13G, issuers and shareholders should ensure that they are closely coordinated with their compliance teams and counsel. Issuers should assess and revise as needed their procedures for monitoring beneficial ownership and Section 13 compliance and ensuring that greater than 5% shareholders are aware of their filing and amendment obligations and the issuer’s procedures with respect to such filings. Compliance personnel should adjust their calendars to account for the quarterly, rather than yearly, required updates to Schedule 13G filings beginning September 30, 2024, and ensure familiarity with the updated guidance with respect to “group” formation and disclosure requirements relating to cash-settled derivative securities. Most importantly, material acquisitions, dispositions and other changes in the information disclosed on Schedules 13D and 13G should be coordinated (ideally in advance, rather than after the fact) with the personnel responsible for Section 13 compliance (including any external counsel responsible for managing material transactions) to eliminate delays in processing time for required amendments. For example, while planning significant acquisitions, dispositions or other major corporate actions, specific individuals should be assigned responsibility for drafting any required Section 13 filings.

The new guidance with respect to “group” formation should also be reviewed by shareholders engaging or considering engaging in discussions with other beneficial owners of a covered class of equity securities to avoid the unintentional formation of a “group” and the resulting Schedule 13D or 13G amendment or initial filing trigger, as the formation of a group not previously disclosed is a material change necessitating a Schedule 13D or 13G amendment or initial filing.

[View source.]