[author: Jennifer Engle]

Introduction: The Importance of Accurate Inventory Valuation

Inventory valuation is often necessary for the purposes of evaluating and determining damages. Such damages could arise from a multitude of factors such as water intrusion, fire, theft and / or vandalism, among others. The accuracy and timeliness of an entity’s record keeping system and physical observation of the damaged inventory are often two integral components to evaluating the value of the damaged inventory. However, what if one or both of these pieces of information are unavailable?

This article discusses several approaches that can be utilized to estimate the quantities and valuation of inventory losses when physical observation of the damaged inventory is not available and / or feasible.

The Ideal Scenario: Leveraging Comprehensive Financial Documentation

Ideally, the business operation will have substantial financial documentation to support the inventory on hand at the date of loss or some date near that point. Should documentation be available and deemed reliable, an inventory roll forward can be considered a highly reliable method of valuation.

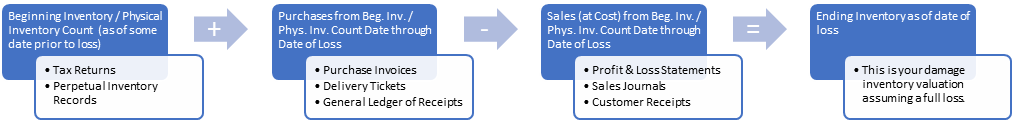

The below chart illustrates the key documentation needed and the steps to perform an inventory roll forward:

The above process can be utilized effectively when the documentation provided to support the out of sight inventory is deemed to be reliable and accurate. In addition to testing the reliability of the documentation, there are many factors which need to be applied and / or considered throughout the roll forward process to obtain an accurate result.

Such factors may include consideration for the following:

- normal shrinkage,

- purchases not yet delivered,

- the normal cost of goods sold could have an impact on the overall inventory valuation.

Navigating the Less Than Ideal Scenario: Partial Documentation

Perhaps the documentation needed for a full inventory roll forward is unavailable, but portions are available. A forensic accountant can utilize the available documentation to test and / or estimate the amount of out of sight inventory. For example, if the business can produce tax return records for several years, those documents can be used to establish a normal level of inventory which is typically on hand at year’s end. If this amount is materially different than that which is being reported as potentially lost, then further conversations would need to take place to understand why. Otherwise, the tax return could be used as a reasonableness test for the amounts reported as on hand. Additionally, if some portion of inventory remains on hand, a post loss physical inventory may be required and integral to the investigation. It is important to perform this count as close to the date of loss as possible, however, it should not be ruled out as a necessary step regardless of how much time has passed since the loss event.

Tapping into Other Sources of Information: Utilizing Forensic Accountants

If documentation from the business is wholly unavailable and / or there are material concerns over the legitimacy / accuracy of such documentation, there may be external sources a forensic accountant can use to obtain additional comfort and support for the out of sight inventory. The below case study discusses an example for this scenario:

Inventory Valuation Case Study #1 – Cellphone Retailer

For example, J.S. Held’s forensic accounting team was recently engaged to value an inventory loss for a local franchise cellphone retailer. The retailer provided a list of phones which were allegedly lost in the incident and provided supporting purchase and sales documentation as requested. However, our initial review indicated that the quantities claimed as stolen and the value of the inventory on hand did not seem feasible given the facts of the case. Additionally, this business had multiple locations and therefore the tax records were not informative as to a specific location’s ending inventory. These pieces of information led to concern over the reliability of the documentation we had received to review; so further investigation was required.

During our investigation, our team obtained the franchise agreement and discovered the retailer was required to purchase phones solely from its Master Distributor. Given this knowledge, we revisited the stack of purchase invoices which were provided as supporting documentation and noted that many did not source from the Master Distributor. When we began to review the invoices from other vendors, we noted anomalies within the invoices themselves (i.e., out of sequence invoice numbers / dates, etc.). Through additional research, we were able to determine the business owner also owned many of these other vendors. We then had follow-up conversations with the business owner whereby he admitted he “made a mistake” and these other invoices were in fact for inventory that had been delivered to one of his other locations. At the end of our examination, we were able to provide an adjusted inventory roll forward from the reliable records to estimate the value of the stolen inventory.

Thinking Outside the Box

Sometimes all documentation is very difficult to come by and outside the box thinking is required to obtain the level of comfort required to recommend a valuation on an out of sight inventory loss. Below are two case studies where our team had to do just that.

Inventory Valuation Case Study #2 – Post Loss Physical and Insured’s Website Used

An insurance company contacted us to assist in a theft valuation for a popular women’s hair wig retailer. We were advised by the client that the relevant policy language was to pay for any lost inventory at cost versus selling price. The business owner was unable to provide a detailed claim or anticipated loss amount due to the unsophisticated inventory tracking system that was in place at the date of loss. Additionally, invoice support was unavailable because the raw materials (“virgin human hair”) were purchased via a cash app from an overseas retailer and not itemized. Upon receipt of the virgin human hair, the insured then created custom wig pieces through processes such as cutting, bleaching, and dyeing. These wig pieces were then held for sale at their physical locations or online. In addition to the lack of detailed invoices, the business owner did not maintain any regular inventory records and was in the process of changing accountants when the theft occurred.

Through multiple conversations with the insured and the new accountant, we were able to identify some key information which would assist in quantifying the stolen inventory. We were able to use marketing videos from inside the store taken just a few days before the theft to estimate approximately how full the shelves were at the time of the loss in order to estimate quantities lost from the sales floor. Additionally, the insured maintained its wigs for sale online in a separate area within the store. So, we were able to conduct a post loss physical inventory of that area and compare such to the actual items for sale online in order to determine the specific quantities lost therein. Finally, we used cash app records, bank records, and tax returns to determine the average cost per wig to value the lost quantities.

In the end, this assignment had a lot of hurdles and moving parts in both the quantification of inventory pieces lost and the valuation of such. However, we were able to work together with the insured to obtain the documentation needed to arrive at the approximate quantity and valuation of the losses.

Inventory Valuation Case Study #3 – Volume of the Getaway Car Told the Story

Another recent example came when we were retained on a theft loss at a liquor store that had been open less than three months. This store was a new operation and therefore did not have any historical tax documentation to share. In addition to the inventory, which was claimed as lost, it also reported that the computer equipment housing all financial documentation was also stolen and therefore there was no financial documentation that the business owner could provide us other than a list of the lost inventory which he had created from memory. Besides this list, the only other documentation we were able to obtain from the business owner was a copy of the police report and the surveillance video from the neighboring business. These pieces of information provided us with details that typically would not be pertinent to our evaluation of lost inventory, however, in this case it was the only information we had.

From the police report and video, we understood there were two adult males in a specific vehicle. They were in the store for approximately seven minutes before being seen exiting on the cameras. When comparing this information to the list of stolen inventory from the business owner, it appeared to us that the list was overstated because it would require significantly more time and / or people to move the claimed level of lost inventory.

Initially, we evaluated the shelf space and square footage at the loss location to determine whether these volumes of product could reasonably have been held onsite at the time of the theft. Our findings indicated it was reasonable to have the alleged level of inventory onsite. However, given we had no purchase documentation to support that this store was fully stocked we were not comfortable basing our final opinions on that fact alone. Continuing to evaluate, we decided to determine whether it was feasible that the get-away car could have held the amount of liquor being claimed. The answer there was quite clear cut and definitive.

In short, we found that the available capacity of the getaway car was significantly less than the total volume of product and packaging that was being claimed as lost. Additionally, we reported that given the time constraints it was unlikely that the men could have packed the car in such a way as to use every ounce of available space. When presented with these findings the business owner agreed to a much lower value for the losses.

Conclusion: The Art and Science of Estimating Out of Sight Inventory Loss

Out of sight inventory valuations can be difficult to analyze but not impossible. While it is often impossible to obtain a definitive calculation to the penny as to the loss valuation, there are many techniques which can be applied to corroborate the amounts lost. It is important for the parties conducting the analysis to stay nimble when evaluating these types of losses and to think outside the box, as needed, to ensure proper estimates of out of sight inventory losses.

Acknowledgments

We would like to thank Jennifer Engle for providing insight and expertise that greatly assisted this research.