[co-author: Travis Moore]

Read the full Law360 article (subscription may be required) or view the article below.

During the last several years, many states have adopted automatic renewal contract, or ARC, laws for the protection of consumers, driven in large part by new subscription-based contracts sold in digital distribution and contracting channels, as well as the modern version of negative opt-out sales of products and services.

This article discusses the challenges in operationalizing compliance faced by the extended warranty business, as well as the nuances of whether extended warranties are exempt from ARC laws — given that they are deregulated from being insurance products yet regulated by state insurance departments.

The concept of an automatic renewal is not a new one for those who may recall this type of buying and selling for TV sales of encyclopedias and compact discs during prior decades, and is a business model that can produce consistent, recurring cash flows.

Legislatures’ and regulators’ concerns about ARCs are likewise not new, and have not diminished. At the federal level, the Federal Trade Commission issued its enforcement policy statement regarding negative-option marketing in November 2021,[1] and notice of proposed rulemaking to amend its negative option rule — originally adopted in 1973.[2]

Also, the Consumer Financial Protection Bureau published new guidance in its circular 2023-01: “Unlawful negative option marketing practices”[3] in January 2023.[4]

Unsurprisingly, the two primary areas on which consumer protection is focused are unfair or deceptive means for (1) enrolling consumers in ARCs in the first instance, and (2) inhibiting consumers’ easy disenrollment from ARCs through what today are referred to as “dark patterns.”

Dark patterns can include a broad array of website designs that cause false beliefs, hide key information, lead to unauthorized consumer charges and trick customers into sharing their personal data.

State laws governing ARCs seek to achieve consumer protection by requiring robust consumer disclosures and easy methods for them to opt out of ARCs for products and services falling within the purview of these laws.

The threshold and key question for the service contract — aka extended warranty or home warranty — and insurance industries and their regulatory compliance programs is whether these laws apply to their contracts.

Overview of State Consumer Automatic Renewal Contract Laws

What Is an Automatic Renewal Contract Clause?

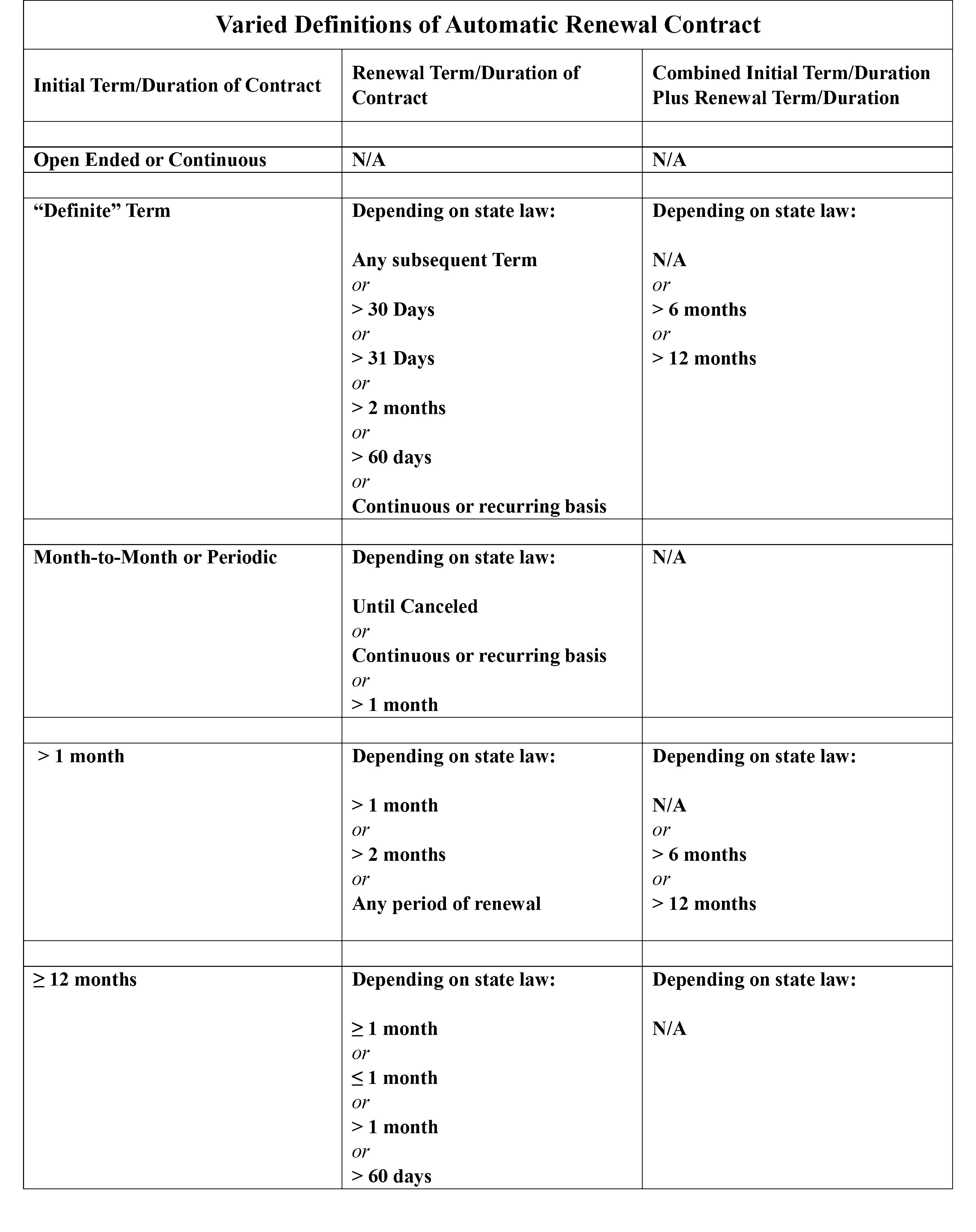

More than half of the states have adopted ARC laws in some form or fashion. These laws define what is an “automatic renewal provision” or an ARC in a wide variety of nuanced ways.

Automatic renewal generally means that the contract’s renewal term becomes effective unless the consumer gives notice to the seller of the consumer’s intention to terminate the contract before the renewal term starts.

Most states define an ARC as a contract having a definite term that automatically renews for a subsequent term, while other states describe an ARC as an open-ended contract that renews on a continuous or recurring basis.

The specifics of what that definite term or renewal term is requires a state-by-state ARC definitional analysis, a familiar task for those who serve the multistate regulatory world of insurance and service contracts. These variations are summarized in chart form as follows:

Types of Contracts Subject to Automatic Renewal Contract Laws

ARC laws do not always apply to all types of consumer contracts. Some ARC laws are targeted at specific types of consumer contracts, for example:

- Home security protection services contracts;[5]

- Health or fitness club memberships;[6]

- Magazines, media players, mobile apps and online software subscriptions;[7]

- Buying club contracts such as with Costco Wholesale Corp. or Sam’s Club;[8] or

- Utility services contracts.[9]

Other ARC laws have broad application to any product or services used primarily for personal, family or household purposes;[10] any good or service sold to a consumer;[11] or only a service sold to a consumer.[12] In addition, certain ARC laws also apply to consumer goods leases.[13]

A few states have ARC laws that apply to business-to-business or commercial contracts,[14] which are not the subject of this article. Two states have ARC statutory provisions contained in their service contract acts.[15]

Exemptions From Automatic Renewal Contract Laws

However, as with many laws, there are of course exemptions to the scope of the applicability of these laws. In many states, contracts exempt from ARC laws include contracts regulated by:

- A state public service commission, such as utilities contracts for receiving electricity and gas for homes;[16]

- The Federal Communications Commission, i.e., for telephone communications services;

- Landlord-tenant laws;

- Federal or state banking departments; and

- In many cases, state insurance departments.[17]

A few states expressly exempt service contracts or extended warranties.[18] California recently amended its consumer service contract law to allow month-to-month term service contracts.[19]

Utah’s ARC law applies only to real estate-related contracts[20] but could be interpreted to apply to a home warranty covering repairs or replacements of home appliances or HVAC systems.

However, some states’ ARC laws do not contain exemptions for insurance products[21] or service contracts, or the state’s insurance products exemption does not apply to service contracts because the service contract laws usually declare that service contract is not, and thus is not regulated as, an insurance product.

The question of whether a service contract is subject to a state ARC law often turns on whether the ARC law exempts insurance or entities regulated by the insurance department.

However, some states do not regulate service contracts under their insurance laws and/or grant enforcement authority for the regulation of service contracts to their departments of insurance, so these exemptions do not apply.[22]

To complicate things further, some states treat home service contracts, motor vehicle service contracts and consumer goods service contracts differently so one product may be regulated by a state’s department of insurance while another is not.

As a result of the inapplicability of these byzantine exemptions from ARC laws to personal lines insurance products and service contracts, ARC laws can apply to such insurance products and service contracts in some states.

Personal auto insurance, homeowner’s insurance, renter’s insurance, cellphone insurance and other types of personal lines insurance policies could be affected, perhaps unintentionally, by some ARC laws.

This is because these types of insurance policies usually automatically renew upon expiration of their stated terms, which oftentimes have six-month terms, or for nonstandard — high-risk drivers — auto insurance policies, even monthly terms.

In most states, an insurance company by statute must automatically renew these kinds of insurance policies, except when the insurer can cancel or not renew for statutorily specified reasons.

These reasons can include a customer’s nonpayment of an insurance premium or an insured’s material misrepresentation in a policy application, and cannot fail to renew an insurance policy for statutorily prohibited reasons — such as a change in the insurer’s eligibility or underwriting rules unless made on a uniform basis in the applicable state, which sometimes requires insurance commissioner approval.

If an ARC law does not exempt insurance products or contracts made by state insurance department-regulated entities, insurance companies issuing personal lines insurance policies meeting the definition of an ARC in theory must comply with such an ARC law.

Key Compliance Requirements

Businesses that enter into or issue consumer contracts governed by ARC laws face a number of compliance obligations that they must operationalize.

In non-direct-to-consumer business models, such as where an auto dealer sells vehicle service contracts or a big box retailer sells consumer electronics service contracts, issued by unaffiliated service contract obligers and sold as a secondary component of the primary retail sale — such as a vehicle, computer, television or refrigerator — the obligers will be heavily dependent upon their distributors for ARC point-of-sale regulatory compliance.

Consumer Contracting Disclosures

ARC laws require that consumers receive robust written disclosures about the recurring nature of these contracts and how to terminate them.

These disclosures typically must be presented in a “clear and conspicuous manner,” which generally requires a larger font size than surrounding text or otherwise calling attention to the text of the required consumer disclosure through set off by color, type or symbols. This includes:

- The automatic renewing nature of the contract;

- The length of the contract’s term and deadline by which the consumer must cancel the contract to avoid automatic renewal;

- The contact information that the consumer may use to easily cancel; and

- The amount and frequency of charges imposed on the consumer.

Consumer Contracting Consent

In addition, ARC laws require a consumer specifically to agree or express his or her assent to the contract’s auto-renewal terms.

There is some ambiguity as to whether this requirement means a business must have the contracting consumer sign a separate statement acknowledging and agreeing to the auto-renewal feature.

Because service contracts are often sold through indirect sales channels, this can pose a unique challenge to service contract providers that utilize third parties, including reprogramming automated checkout kiosks to include an additional consumer consent request.

Service contracts are also generally secondary to the purchase of an underlying product, meaning, for example, that an auto dealer or big box retailer focused on the sale of the car or electronic good may be tasked with ensuring compliance.

This may make it difficult, if not impossible, for service contract providers to meet the requirements of certain ARC laws.

In all events, service contract providers engaged in online digital sales should review their consumer consent forms and processes for electronic transactions conducted in reliance on the state-based Uniform Electronic Transactions Acts when designing ARC law compliance programs.

Consumer Contract Renewal Reminders and Cancellation Methods

The ARC laws embrace not only a clear and conspicuous precontracting notice to consumers but also certain post-contracting protections.

Automatically renewing contract issuers must send periodic reminders to contract holders to refresh them about an upcoming contract renewal date; typically, depending on the state, these notices must be sent within 30 to 60 days before the contract renewal date.

If an ARC law does not already exempt month-to-month contracts, these notice requirements are generally only applicable to contracts having a certain term longer than one month.[23]

Some states permit consumers to choose how to receive these notices, and can elect U.S. mail or electronic mail delivery. The purpose of these notices is, of course, to ease the ability of contract holders to terminate their contracts and avoid further recurring payment obligations.

Similarly, businesses must employ statutorily required easy-to-use methods for a contract holder to cancel a contract, such as the use of a toll-free telephone number, electronic mail, U.S. postal mail and online cancellation on a website. Many ARC laws require that, for a contract entered into online, the consumer must be able to cancel it through an online means.

Consumer Notice of Material Changes to Auto-Renewal Terms

In addition, some ARC laws mandate that, before implementing any material change to an ARC, the ARC issuer must inform the consumer contract holder of the material change before the expiration of the ARC’s initial term or any renewal term, as applicable.[24]

These notices must be in a clear and conspicuous manner, and include a description of how the consumer may cancel the ARC.[25]

Consequences and Penalties for ARC Law Violations

The issuer of an ARC that fails to comply with applicable ARC laws faces a number of consequences. First, the ARC clause can be void and unenforceable.[26]

Second, most ARC law violations constitute an unfair or deceptive act or practice under state general unfair or deceptive acts or practices laws.[27]

These laws often contain a private right of action further enhancing the liability risk posed by the ARC law, while some states expressly authorize a private right of action in their ARC laws.[28]

Some state ARC laws have a safe harbor from statutory violations if the ARC issuer has established and implemented written compliance policies and procedures, if a violation of the ARC law is caused by an error, and if the ARC issuer has refunded or provided a credit to the contract holder of amounts billed to or paid by it from the ARC’s renewal date until its termination date.[29]

Conclusions

ARC laws are very disparate and in some states apply to service contracts and, while perhaps unintended, may also apply to certain personal lines insurance policies, such as auto, homeowner’s, renter’s and cellphone insurance policies.

To complicate things further, the current proposal by the FTC to amend its Negative Option Rule does not preempt state laws and therefore may add another layer of regulatory complexity for service contract providers subject to the rule.

Because of the service contract industry’s expansion into subscription-based consumer contracts, particularly for vehicle service contracts, consumer electronics service contracts and home service contracts, it is important for service contract providers and administrators to determine whether their contracts that have automatic renewal features must comply with ARC laws and, if so, create required consumer disclosure content and establish procedures required for compliant contract administration.

In addition, private equity investors in this industry should add ARC laws compliance to their legal and regulatory compliance due diligence reviews of target acquisition companies.

Brian T. Casey is a partner at Locke Lord LLP and co-chair of the firm’s regulatory and transactional insurance practice group.

Travis Moore is general counsel at the Service Contract Industry Council.

The opinions expressed are those of the author(s) and do not necessarily reflect the views of their employer, its clients, or Portfolio Media Inc., or any of its or their respective affiliates. This article is for general information purposes and is not intended to be and should not be taken as legal advice.

[1] Federal Trade Commission, Enforcement Policy Statement Regarding Negative Option Marketing (November 4, 20212).

[2] 88Fed. Reg. 24,716 (April 25, 2023) (to be codified at 16 C.F.R. pt. 425).

[3] Consumer Financial Protection Bureau, Circular 2023-01 Unlawful negative option marketing practices (January 19, 2023).

[4] A detailed analysis of these Federal Trade Commission initiatives is beyond the scope of this article.

[5] See, e.g., Ark. Code Ann. § 4-86-106.

[6] See, e.g., Colo. Rev. Stat. Ann. § 6-1-704 and Iowa Code Ann. § 552.8.

[7] See, e.g., 10 M.R.S.A. §§ 1210-C and 1210-D.

[8] See, e.g., Mo. Rev. Stat. § 407.671 to 407.679.

[9] See, e.g., Mont. Admin. R. 38.5.6004(9) and (10).

[10] See, e.g., Conn. Gen. Stat. Ann. § 42-126b,

[11] See, e.g., D.C. Code § 28A—203.

[12] See, e.g., O.G.G.A. §§ 13-12-1 to 13-12-5.

[13] See, e.g., N.C.G.S § 75-41.

[14] See, e.g., Wis. Stat. § 134.49.

[15] N.J.S.A 56:12-95.5, Utah Code § 15-10-201.

[16] While some household electric and gas utilities sell service contracts to their customers, these service contracts are not regulated by a state public service commission or equivalent regulatory authority. In the vast majority of states the state insurance department regulates service contracts.

[17] See, e.g., Cal. Bus. & Prof. Code § 17605(c), Conn. Gen. Stat. Ann. § 42-126b(d); Col. Rev. Stat. 6-1-732(5)(6), DC Stat. § 28A-204(1), Florida Stat. Ann. § 501.165(e)(5), HRS § 481-9.5(j)(2); Idaho Code § 48-603(G), Ken. Rev. Stat. 365.404(3) (effective 1/1/2024), 815 ILCS § 601/20(g), .La. Rev. Stat. § 2716(D(3); N.C.G.S. § 75-41(d), N.D.C.C. § 51-37-03(1); NY Code § 527-a 8(b), Ore. Code § 646A.295 (6)(c); Tenn. Code § 47-18-(e)(6), 9 Vt. Stat. Ann. § 2454a(d)(2), and Va. Cod Ann. § 59.1-207.48(8).

[18] DC Stat. § 28A-204(4), Florida Stat. Ann. § 501.165(e)(5), Ken. Rev. Stat. 365.404(4) (effective 1/1/2024), NY Code § 527-a 8(e), Ore. Code § 646A.295 (6)(e), Tenn. Code § 47-18-(e)(7), and Va. Cod Ann. § 59.1-207.48(6)-(7).

[19] Cal. Code § 1794(c)(3)(A).

[20] Utah Code § 15-10-102(5).

[21] See, e.g., O.G.G.A. §§ 13-12-4.

[22] See, e.g., Colorado where the motor vehicle service contract law is subject to enforcement by the Attorney General, Co. Rev. Stat. 42-11-107.

[23] See, e.g., DC Stat. § 28A-204(b)(1).

[24] See, e.g., Cal. Bus. & Prof. Code § 17602(e), N.Y. Gen Bus. Law § 527-A4, and Va. Cod Ann. § 59.1-207.46C.

[25] Id.

[26] See, e.g., N.C.G.S. § 75-41(e).

[27] See, e.g., HRS § 481-9.5(i).

[28] See, e.g., N.D.C.C. § 51-37-06.

[29] See, e.g., 815 ILCS § 601/10(c).

Reproduced with permission from © 2024, Portfolio Media, Inc.